It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

It is now time for us to look again at a company we covered previously in this series. CACI International, whose fiscal year ends in June, recently reported its Q3 2023 results and below we will provide a brief analysis of the company’s performance between January and March of this year.

Key points:

* Close to 95% of revenues from the Department of Defense and Federal Civilian Agencies. Q3 DoD revenue up 16.1% Y/Y;

* 10.1% Y/Y revenue growth in Q3. Weaker growth into Q4 to achieve full-year outlook of 8.2% sales increase;

* Q3 EPS up 6% Y/Y. EPS guidance boosted, with full-year growth now seen at 3.3%;

* Backlog down 4.5% Q/Q but up 7.7% Y/Y. Q3 book-to-bill of just 0.6 but 1.4 on a trailing twelve month basis;

* Full-year free cash flow expected at just $280 million, down 60% Y/Y, partially due to a delayed tax refund of $40 million.

CACI International Q3 2023 Results Overview

CACI International has a fiscal year ending in June. We initially covered the company's Q2 2023 results as part 6 of our Top Government Contractors series here. Below we will highlight the progress achieved in Q3 2023.

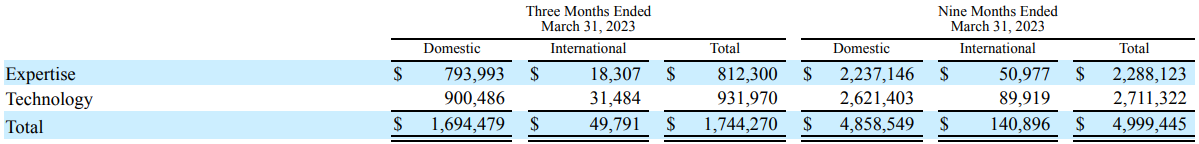

CACI reports results in two main business segments – Expertise (Consulting, Business analysis, Software development and Operations support) at 46.6% of Q3 2023 revenues and Technology (Data platforms, AI, Networks, Cyber security) at 53.4% of Q3 2023 revenues:

Figure 1: CACI Q3 2023 Results by Segment

Source: CACI International Form 10-Q for Q3 2023

Operational Overview

Expertise revenue grew 13.4% Y/Y in Q3, ahead of the year-to-date growth rate of 8.7% in fiscal 2023. For reference, growth was negative in both 2022 (-3.5%) and 2021 (-1%).

Technology sales increased 7.4% Y/Y in Q3, below the year-to-date growth rate of 10.4%. Q3 delivered the weakest growth rate going back to 2022 (8.5%) and 2021 (13%).

On a company level, revenue grew 10.1% Y/Y in Q3, slightly ahead of the year-to-date growth of 9.6% (2022 +3%). The adjusted EBITDA margin was 11% in Q3. an improvement to both the YTD 10.6% and 2022 10.3% margin. Adjusted EPS was $4.92/share in Q3, +6% Y/Y, and $13.55/share year-to-date, +2.1% Y/Y, as margin improvements were offset by higher interest and taxes.

Free cash flow was $180.2 million year-to-date, well below the $578.6 million in the prior year period.

Updated 2023 Outlook

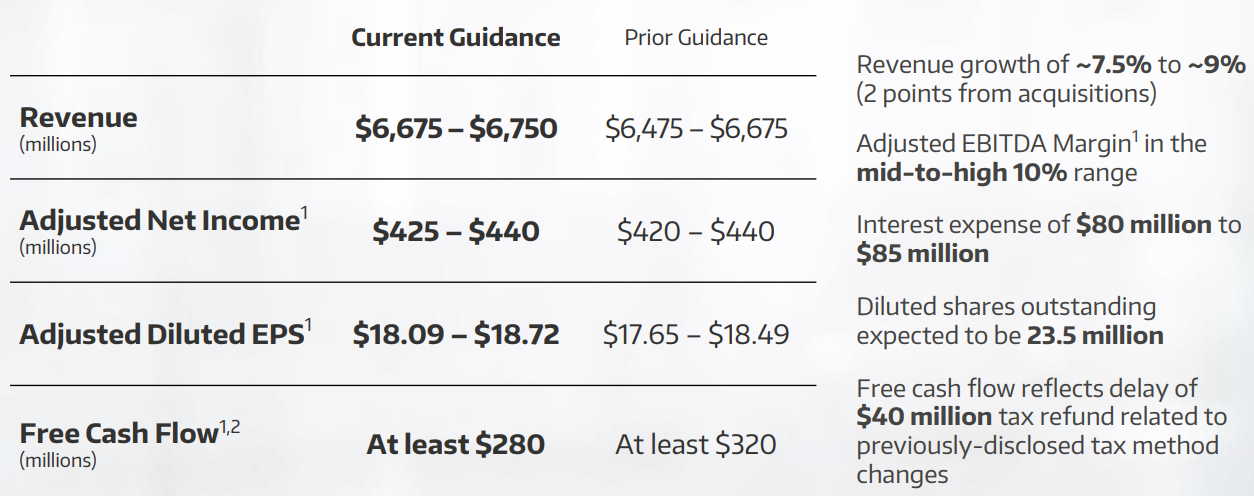

Given the accelerating operating performance in Q3, CACI boosted its 2023 outlook on revenue and EPS but cut its free cash flow outlook due to a delayed tax refund:

Figure 2: Updated CACI 2023 Guidance

Source: CACI Earnings Presentation for Q3 2023

Taking the midpoint of each key performance indicator:

Revenue guidance was increased 2.1% and is now seen up 8.2% on 2022.

EPS guidance was increased 1.9% and is now seen up 3.3% on 2022.

Free cash flow guidance was cut by 12.5% and is expected to be 60% below the $695 achieved in 2022.

Looking into Q4, the revenue deceleration trend observed in Q3 is expected to continue.

Backlog

The backlog declined 4.5% Q/Q but was still up 7.7% Y/Y. The book-to-bill ratio was 0.6 in Q3 and 1.4 on a trailing 12-month basis.

CACI continues to seek new business opportunities, as highlighted on the conference call:

Our pipeline metrics are also very healthy. We have $7.2 billion of submitted bids under evaluation, approximately 65% of which are for new business to CACI. And we expect to submit another $18.7 billion over the next 2 quarters with over 80% of that for new business.

Capital Structure

CACI ended Q3 with a net debt of around $1.7 billion which makes it one of the more financially levered companies in our Top Government Contractors series, in light of the slowdown in free cash flow generation and its market capitalization of $6.95 billion.

CACI Government Contracting Trends

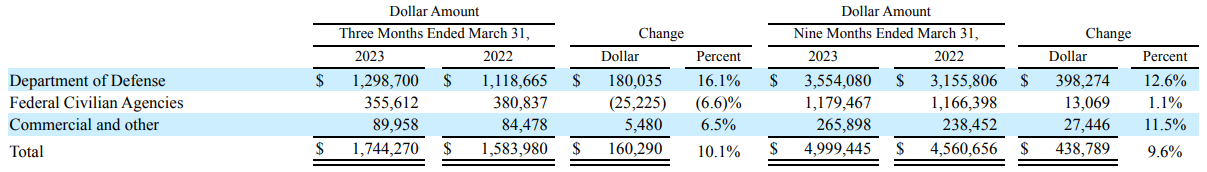

From a customer standpoint, CACI has the greatest exposure to the Department of Defense at 74.5% of Q3 2023 revenues, Federal Civilian Agencies at 20.4% and Commercial and other at just 5.2% of Q3 2023 revenues:

Figure 3: CACI Q3 2023 Customer breakdown

Source: CACI International Form 10-Q for Q3 2023

In Q3 and year-to-date, growth was highest at the Department of Defense, at 16.1% and 12.6% Y/Y respectively, while Federal Civilian Agencies lagged both in Q3 (-6.6% Y/Y) and YTD (+1.1%).

CACI also highlighted the evolving nature of the business on the conference call:

And to John's comments about bidding less and winning more, bidding fewer and winning more, I would add that one of the things that we do keep track of that closely is the length of the awards that we're winning, which over the last couple of years has increased from about 4.5 years on average to 6.5 years. So, we're bidding fewer things. We're winning bigger things, and we're winning longer things.

Conclusion

As expected, CACI sales growth decelerated from the pace achieved in Q2. The company has built enough capacity to start working through its backlog, which now increases below the rate of revenue growth.

Free cash flow generation is expected to accelerate in fiscal 2024, partially helped by the $40 million tax refund initially expected in fiscal 2023.

On the other hand, fiscal 2024 will mark an investment period to set up a new production facility in Orlando, expected to drive sales and profitability in fiscal 2025.

In light of the fact that around 95% of CACI's revenues over the past 3 years have been from the Department of Defense and Federal civilian agencies, monitoring the company’s public procurement activity remains a smart move that can provide key insights into CACI’s financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy CACI or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.