It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

It is now time for us to look again at the first company covered in this series. General Dynamics recently reported its Q2 2023 results and below we will provide a brief analysis of the contractor’s latest performance.

Key points:

* In Q2 2023, 81.3% of General Dynamics revenue was derived from government contractors (U.S. and international);

* Q2 sales up 10.5% Y/Y. Full year growth outlook increased to +7.7%;

* Q2 EPS down 1.1% Y/Y to $2.70/share. Full year outlook maintained at $12.60-12.65/share, up 3.6% Y/Y;

* Backlog grew 1.8% Q/Q to a record $91.4 billion in Q2, driven by the Combat Systems segment. The book-to-bill ratio was 1.2;

* Margins set to improve in 2024 as new G700 aircraft deliveries begin in Q4 2023 and supply chain issues abate.

General Dynamics Q2 2023 Results Overview

We previously covered General Dynamics's Q1 2023 results in Part 30 of our Top Government Contractors series here. Below we will highlight the progress achieved by the company in Q2 of 2023.

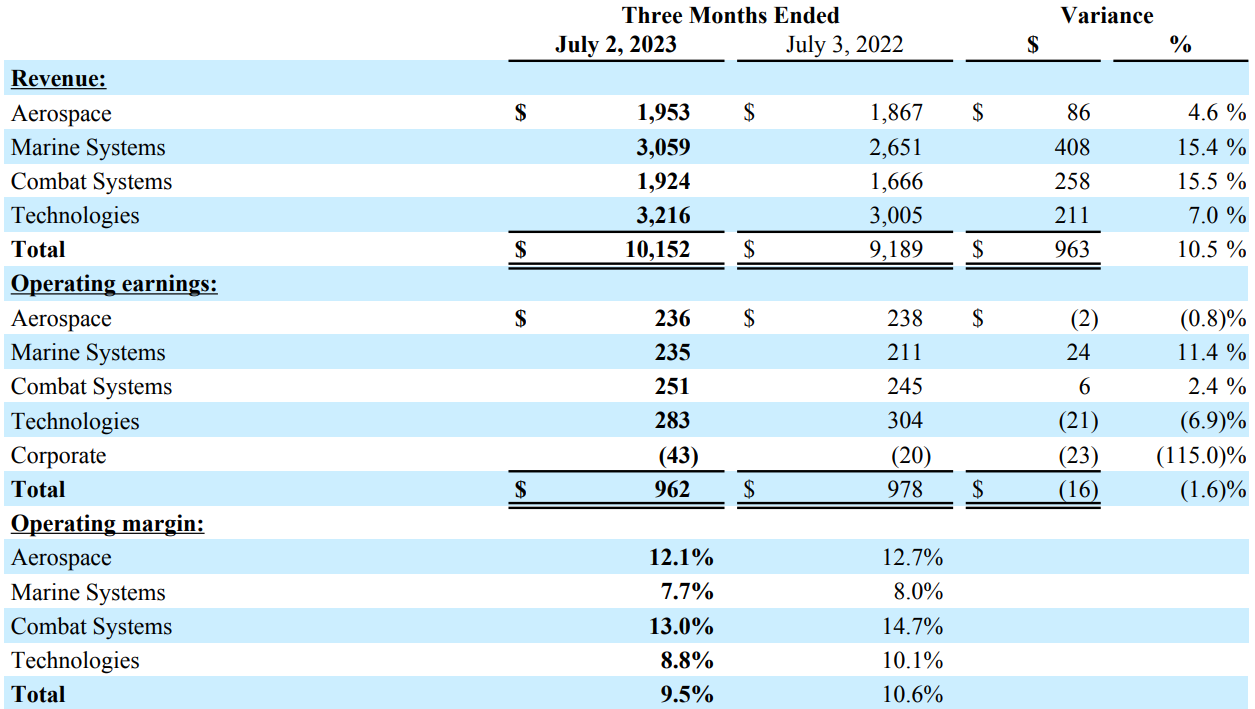

General Dynamics reports results in four main segments, namely Aerospace at 19.2% of Q2 2023 revenues, Marine Systems at 30.1%, Combat Systems at 19% and Technologies at 31.7% of Q2 2023 revenues:

Figure 1: General Dynamics Q2 2023 Results by Segment

Source: General Dynamics Q2 2023 Earnings Release

Operational Overview

Aerospace grew sales 4.6% Y/Y in Q2 (2022 +5.3%) on higher aircraft deliveries. Operating margins were lower, down 0.6% Y/Y to 12.1%, impacted by weakness in Services and higher R&D expenses for the new G700 aircraft, expected to enter into service in Q4 2023. As a result, operating earnings were down 0.8% Y/Y.

Marine Systems was the second-best performing segment in Q2, with revenues up 15.4% Y/Y (2022 +4.9%) on strength in the Columbia-class submarine program. On the other hand, the operating margin was down 0.3% Y/Y to 7.7%, impacted by supply chain issues in the Virginia-class submarine program. Overall, operating earnings were 11.4% higher than the prior-year period.

Combat Systems delivered the best top-line performance in Q2 – sales grew 15.5% Y/Y (2022 -0.6%) on strength in International military vehicles and higher Weapons systems and munitions revenue. The artillery production capacity expansion came with a lower margin, pushing the operating margin down 1.7% Y/Y to 13%. As a result, operating earnings only increased 2.4% Y/Y in Q2.

Technologies saw sales increase 7% Y/Y in Q2 (2022 +0.3%). Growth was broad based and benefited from the acquisition of military communications provider C5ISR Solutions in Q3 2022. As with all segments above, the operating margin was down 1.3% Y/Y to 8.8%, pushing operating earnings 6.9% lower.

On a group level, Q2 sales were up 10.5% Y/Y (2022 +2.4%). The operating margin was 1.1% lower at 9.5%, which pushed EPS down 1.1% Y/Y to $2.70/share. Free cash flow was $519 million in Q2 and $1.8 billion year-to-date (2022 $3.5 billion).

Updated 2023 Outlook

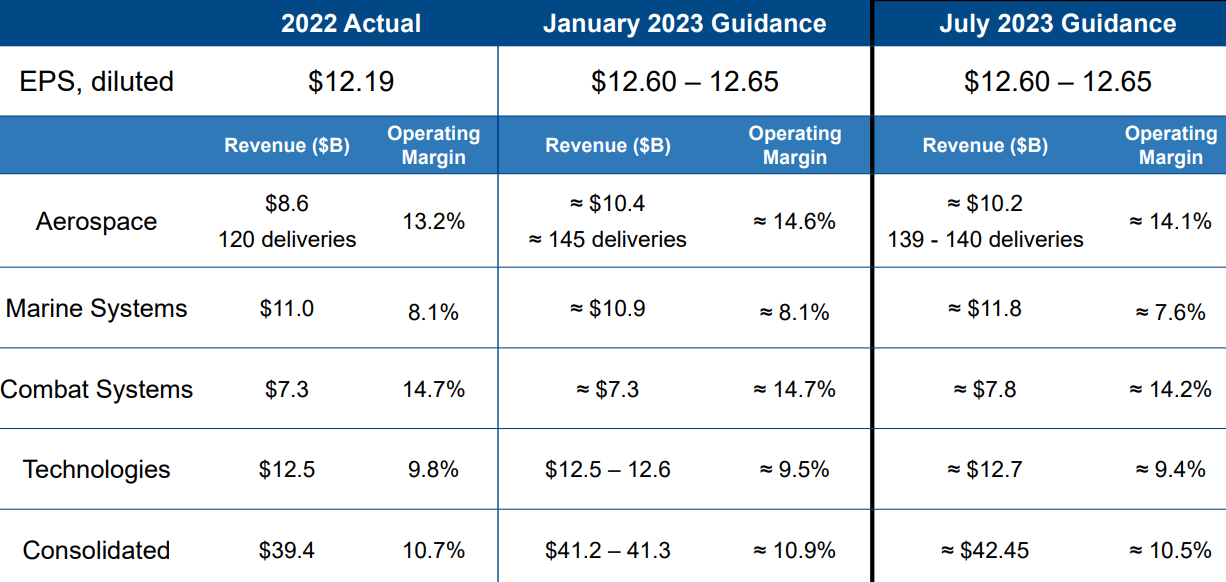

Against the higher-than-expected top-line growth and continuing margin pressure, General Dynamics increased its revenue outlook to +7.7% relative to 2022, but kept its EPS guidance intact (+3.6% Y/Y) on weaker margins (down -0.2% compared to 2022):

Figure 2: General Dynamics July 2023 outlook

Source: General Dynamics Q2 2023 Earnings Presentation

From Figure 2 above we can observe that all segments except Aerospace are delivering higher revenue compared to the initial outlook. At the same time, Aerospace is the only segment to increase its operating margin relative to 2022, although not as much as initially expected.

Backlog

General Dynamics's backlog grew 1.8% Q/Q to a record $91.4 billion in Q2, with a book-to-bill ratio of 1.2. All divisions saw backlog growth, although Combat Systems had the highest increase of 6.9% Q/Q to $15.1 billion, with notable some notable wins being:

- $710 million order for Stryker double-V-hull vehicles;

- $695 million order for next phase of XM30 Mechanized Infantry Combat Vehicle competition;

- $260 million low-rate initial production (LRIP) II order for 26 M10 Booker combat vehicles.

Capital Structure

General Dynamics employs moderate financial leverage when compared with other companies in our Top Government Contractors series, with net debt increasing marginally by $0.1 billion Q/Q to $8.6 billion in Q2 and a market capitalization of $61 billion.

In Q2 the company spent $288 million on stock buybacks and $360 million on dividends.

Conclusion

General Dynamics delivered strong top-line growth but persistent supply chain issues and a later start to G700 aircraft deliveries (expected between November and December 2023) mean sales growth will not translate into robust bottom-line results in 2023. Nevertheless, with a swelling backlog and supply chain issues abating, the company is on track to see margins improve in 2024, as explained on the conference call:

So, Technologies and Combat are simply a question of mix. And I suspect Combat will quickly return to its normal operating leverage. The Marine Group has significant supply chain challenges that have impacted for the Virginia-class in particular. That’s going to take some time to resolve. We’ll talk about that in a little bit more detail. So, as I noted, we expect slow quarter-over-quarter margin growth in the Marine Group, perhaps an occasional perturbation by quarter, but slow and steady improvement over time.

In Q2 2023, 81.3% of General Dynamics revenue was derived from government contractors (U.S. and international). In Q2 of 2022, the figure was 81.4%.

Given the consistent importance of government business for General Dynamics, monitoring the company’s public procurement activity also remains a smart move that can provide key insights into its financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy General Dynamics or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.