Keeping track of government contract awards is essential to assessing the financial health of companies operating in the defense sector. While current economists’ consensus is that the world economy will avoid a hard landing (the IMF projects 3.2% world GDP growth in 2024, with Euro area growth seen at 0.8%, ahead of UK growth of 0.5%), government contracts could prove to be a lifeline to companies should their commercial business take a hit.

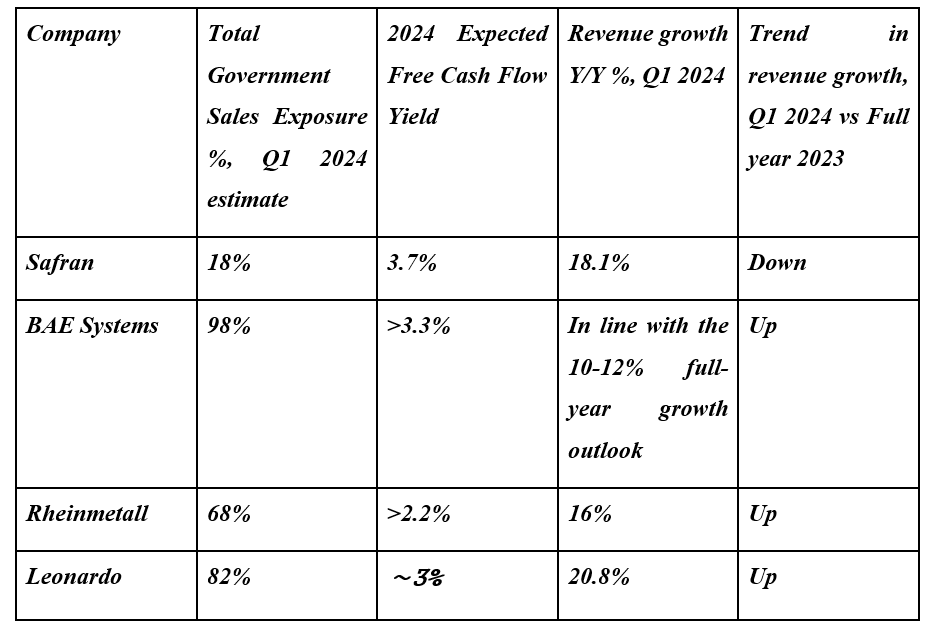

The war in Ukraine has resulted in a meaningful boost to defense spending in Europe, as shown in the figure below which highlights the anticipated spending by NATO countries in 2024:

Figure 1. Defense spending by NATO countries in 2024 as a percentage of GDP

Source: NATO, Defence Expenditure of NATO Countries (2014-2024)

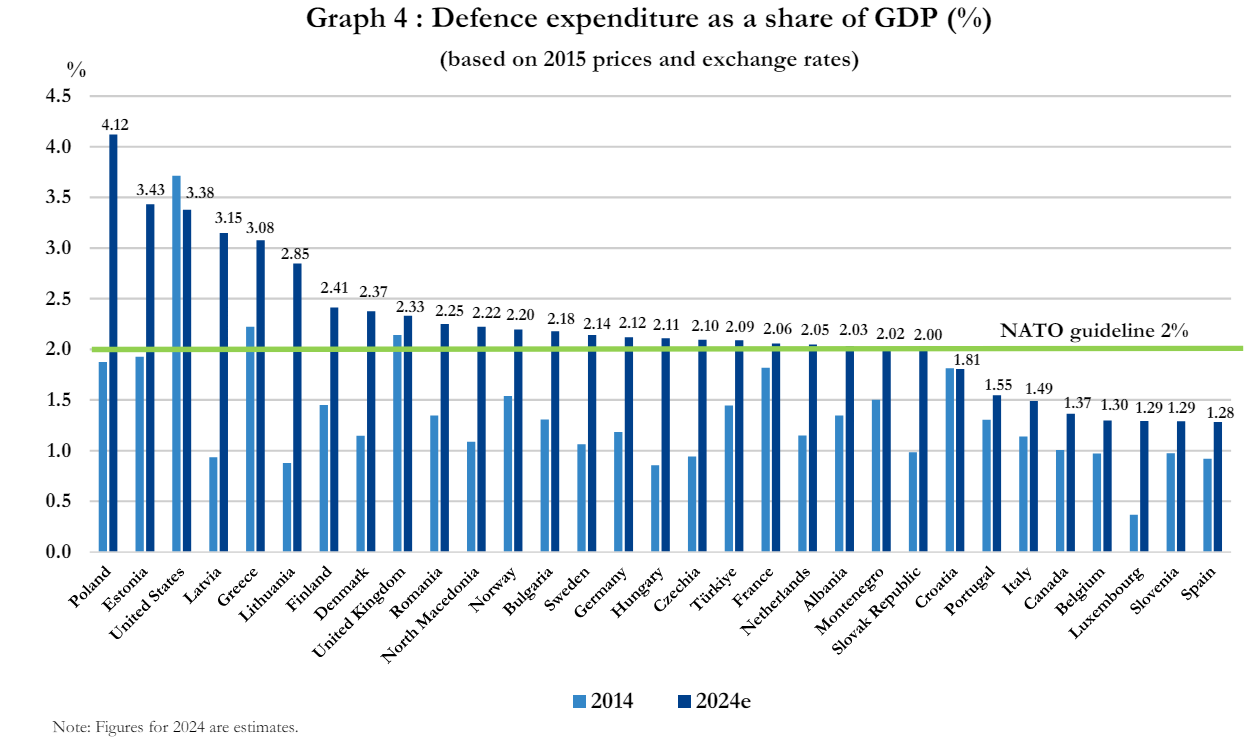

Looking at Figure 1 above, we can observe that in 2024, 23 countries already meet the 2% defense spending goal. This is up from 11 countries meeting the goal in 2023, and significantly higher if compared to only three allies meeting the guideline in 2014. Focusing on Europe and Canada, in the figure below we note that defense spending grew by 9.3% Y/Y in 2023 and is forecast to increase 17.9% in 2024:

Figure 2. Annual evolution of defense spending in Europe and Canada, 2012-2024

Source: NATO, Defence Expenditure of NATO Countries (2014-2024)

To investigate some of the companies benefitting from the increased defense spending, in this article, we analyze four of the largest defense suppliers in Europe - Safran, BAE Systems, Rheinmetall, and Leonardo with respect to their Q1 2024 quarterly results and the significance of government procurement for their revenue.

Safran (Euronext: SAF)

Safran Q1 2024 Results Overview

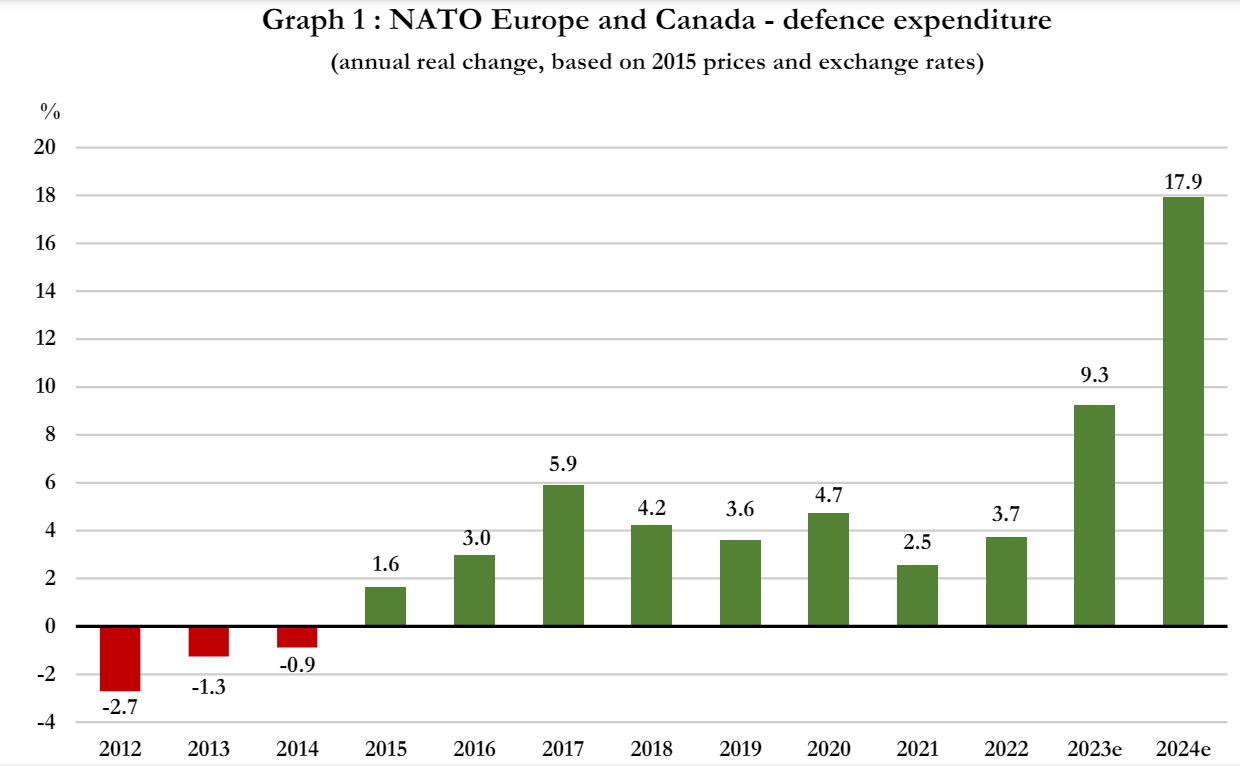

Safran reports results in three key segments, namely Aerospace Propulsion at 50% of Q1 2024 revenues, Equipment & Defense at 39%, and Aircraft Interiors at 11% of Q1 2024 revenue:

Figure 3. Safran Q1 2024 Segment Results

Source: Safran Q1 2024 revenue press release

Safran recorded an 18.1% Y/Y increase in sales in Q1 2024 (2023: 21.9%), with all businesses recording a double-digit increase. No margin or balance sheet information was released with the Q1 2024 revenue results.

Safran boasts an €81 billion market capitalization and runs an extremely conservative debt-free balance sheet, with a net cash position of €0.4 billion at the end of 2023. Free cash flow was €2.9 billion in 2023, up 10% Y/Y.

Together with its Q1 2024 results, Safran reaffirmed its initial 2024 outlook. The company expects 18% higher sales, and a 25% stronger operating income, but only a 3% increase in free cash flow.

Safran Government Revenue Share

Safran has exposure to government contracts primarily through the supply of engines and systems to fighter jets as well as military helicopters. In 2023, military businesses accounted for about 18% of Safran’s revenue, down from the 21% contribution observed in 2022. No precise update on government business was provided with the Q1 2024 results, but we observe that the two government-dependent businesses, Aerospace Propulsion and Equipment & Defense, grew sales by 14.1% and 24.3% Y/Y respectively.

BAE Systems (London Stock Exchange: BA)

BAE Systems Q1 2024 Results Overview

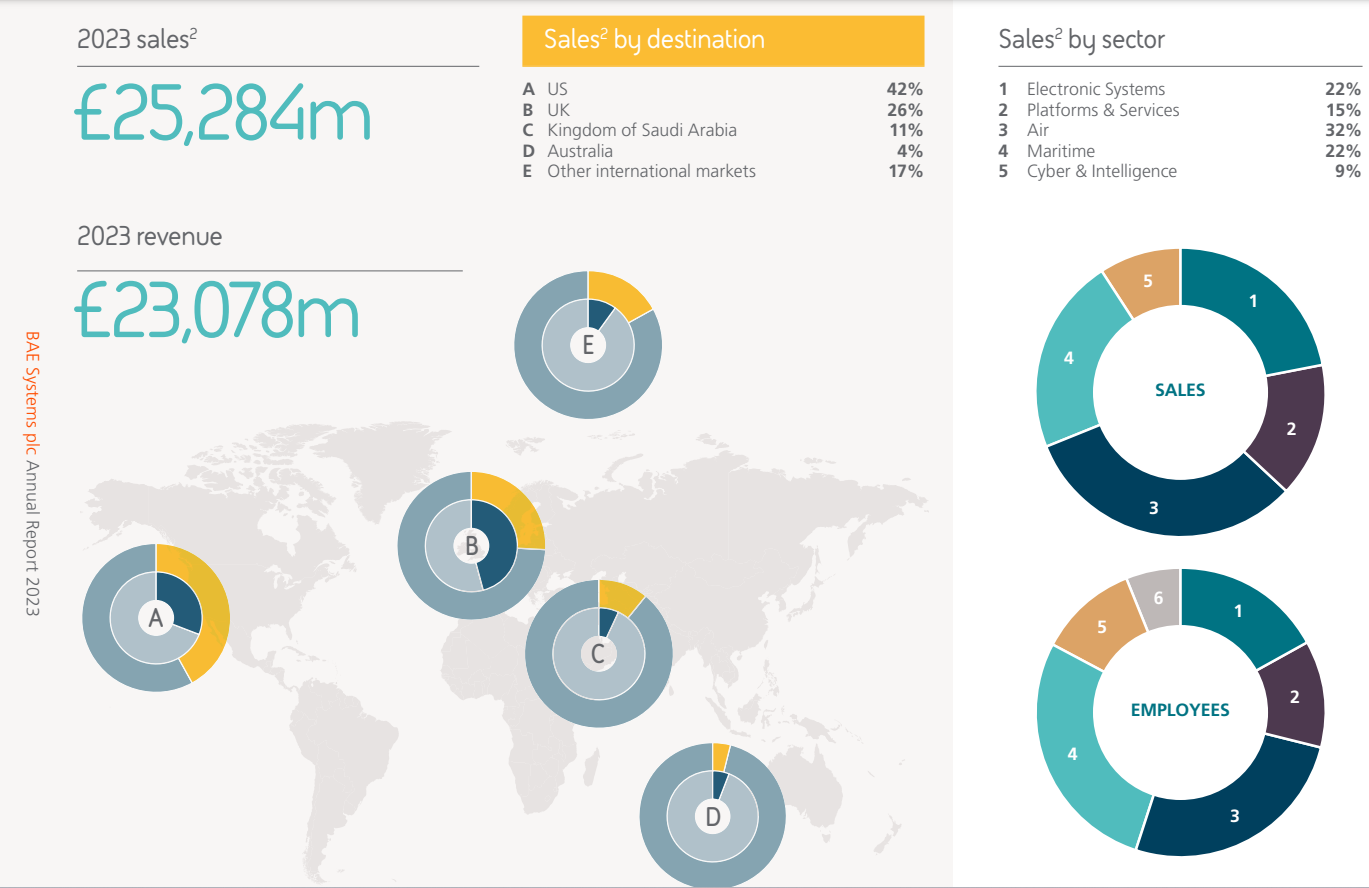

BAE Systems reports results in five main segments, namely Air at 32% of 2023 revenues, Electronic Systems at 23%, Maritime at 23%, Platforms & Services at 15%, and Cyber & Intelligence at 9% of 2023 sales:

Figure 4. BAE revenue breakdown between sectors and regions

Source: BAE Systems 2023 annual report

BAE only provided a limited trading update for Q1 2024. Nevertheless, the company noted that results are in line with its full-year 2024 outlook. Sales are set to increase 10-12% in 2024 (2023:+9%) while underlying EBIT is anticipated to be 12% higher, resulting in a 7% boost to earnings per share. Free cash flow is forecast at above £1.3 billion.

During the quarter BAE Systems finalized the closing of the Ball Aerospace acquisition for $5.6 billion which will form a new Space & Mission Systems business. Net debt accounts for about 13% of BAE Systems’s enterprise value following the Ball Aerospace purchase.

BAE Systems Government Revenue Share

The U.S. government was the single largest customer of BAE systems, accounting for 68% of the company’s 2023 sales. The UK and other governments drove another 30% of sales. As a result, the cumulative government revenue exposure of BAE Systems was 98% in 2023. In Q1 2024 the company noted good progress with its Australia nuclear submarine program, part of the trilateral security pact between the UK, US, and Australia (AUKUS).

Rheinmetall (Deutsche Boerse: RHM)

Rheinmetall Q1 2024 Results Overview

Effective January 1, 2024, Rheinmetall’s civilian business was restructured, combining ‘Sensors and Actuators’ and ‘Materials and Trade’ to form the new Power Systems segment. The new segment accounts for 32% of group revenues, followed by Vehicle Systems at 29%, Weapon and Ammunition at 22%, and Electronic Solutions at 17% of Q1 2024 revenues:

Figure 5. Rheinmetall results breakdown between segments

Source: Rheinmetall Q1 2024 Results Presentation

Rheinmetall delivered 16% Y/Y revenue growth in Q1 2024 (2023: +12%), driven primarily by the Weapon and Ammunition and Electronic Solutions segments. All segments except Vehicle Systems delivered higher margins, with the Group operating margin rising to 8.5% in Q1 2024.

Net debt accounts for about 6% of Rheinmetall’s enterprise value. Company backlog was €40.2 billion at the end of Q1 2024, up 42.6% Y/Y, driven primarily by new air defense orders in the quarter.

The company confirmed its initial 2024 outlook, with the 40% Y/Y sales increase set to be concentrated in H2 2024. Furthermore, the explosive revenue growth will come with continued margin expansion - the operating margin is set to reach 14.5%, improving the cash conversion rate to about 40%.

Rheinmetall Government Revenue Share

Rheinmetall does not disclose the exact amount of revenue derived from government customers. That said, a good approximation can be derived by observing that the new Power Systems division encompassing civilian businesses accounted for 32% of Rheinmetall’s Q1 2024 revenue. As a result, we estimate governments accounted for 68% of Rheinmetall sales in Q1 2024, with the significance of government contracts set to increase dramatically in 2024, since military businesses are forecast to grow 30-65% in 2024, compared to only 5% for the civilian business.

Leonardo (Euronext: LDO)

Leonardo Q1 2024 Results Overview

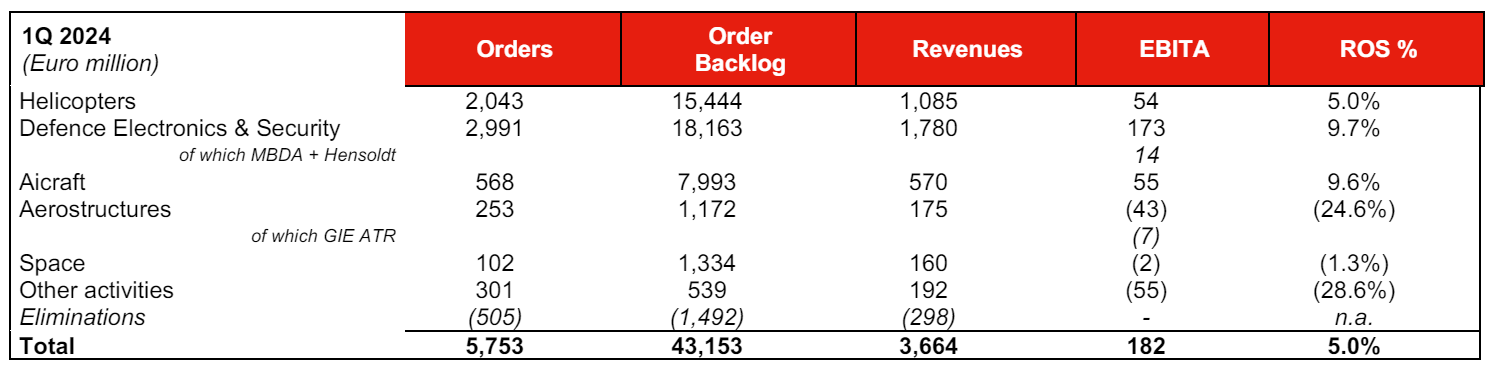

Leonardo reports results in five main segments, namely Defense Electronics & Security at 45% of Q1 2024 revenue, Helicopters at 27%, Aircraft at 14%, Aerostructures at 4%, and Space at 4% of Q1 2024 revenues:

Figure 6. Leonardo segment results

Source: Leonardo Q1 2024 Results Press Release

In Q1 2024 Leonardo recorded a 20.8% Y/Y increase in sales (2023: +3.9%), with double-digit growth in all segments except Aircraft. The margin profile improved as well (return on sales margin of 5%) which pushed EBITA up 73.3% Y/Y. Backlog growth was less impressive, at 10.3% Y/Y, indicating some slowdown in sales growth in the quarters ahead.

Net debt accounts for circa 19% of the company’s enterprise value. In 2024, the company expects 5% topline growth, 8.6% EBITA growth, and an 18.1% increase in operating free cash flow.

During the quarter, the company unveiled ambitious plans for the period up to 2028. Relative to 2023, sales are seen 39% higher, growing at 6% per year. Margins should improve to about 11.5% in 2028, pushing EBITA up 92%. As a result, free operating cash flow is set to double compared to 2023.

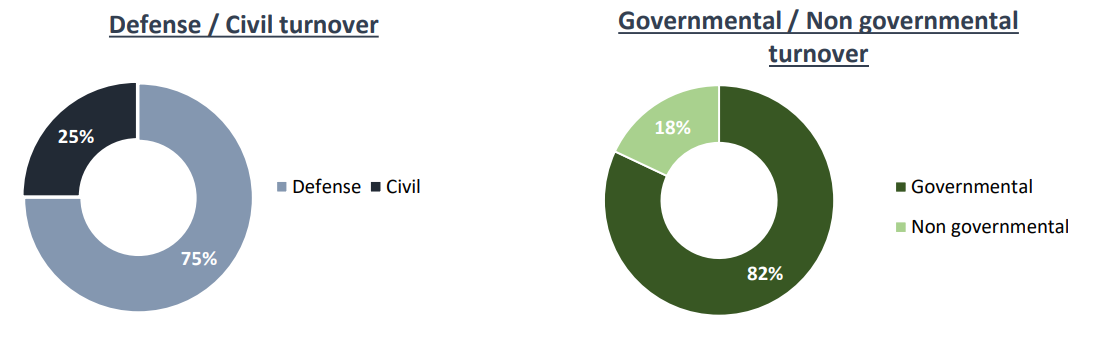

Leonardo Government Revenue Share

No detailed update on government exposure was provided with Leonardo’s Q1 2024 results. Nevertheless, in 2023, Leonardo derived 82% of its revenue from government sources. The company’s government exposure is largely to the defense sector, with 75% of Leonardo’s revenue coming from the defense sector:

Figure 7. Leonardo revenue by customer type

Source: Leonardo 2023 Annual Report

Defense Sector Peer Analysis

After lackluster growth in the previous decade, the defense sector is poised for a comeback in the years to come. Against the backdrop of persistent geopolitical tensions, European governments have meaningfully boosted their spending on defense.

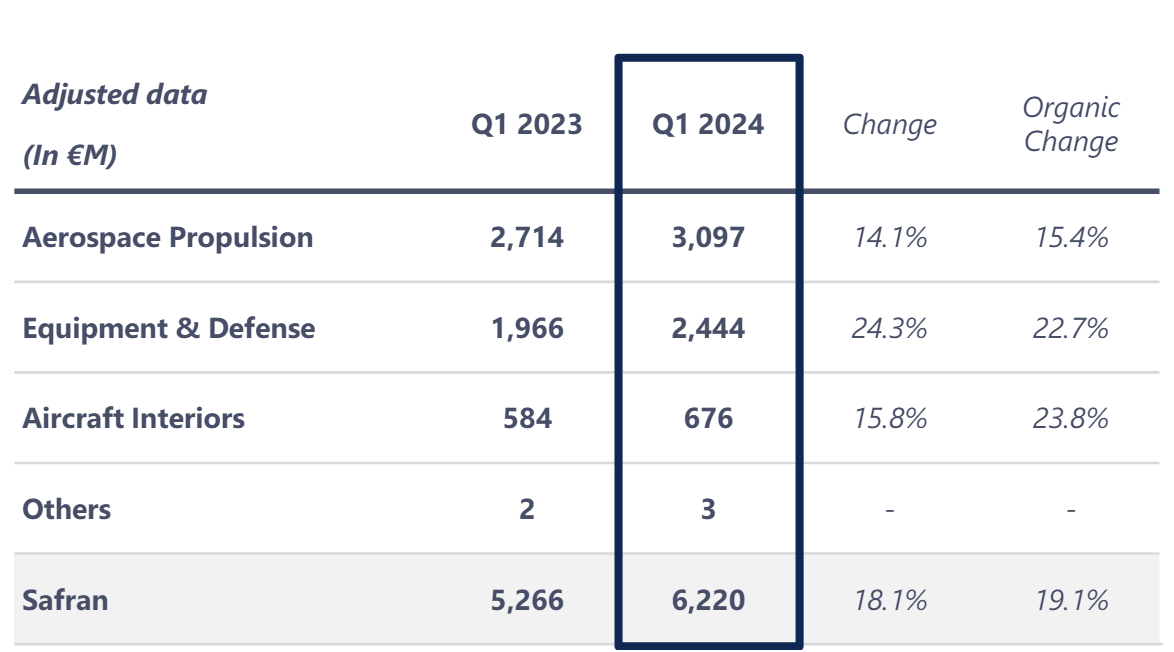

In the table below, we present key figures about the four companies in our analysis:

Figure 8. Defense Suppliers Select Indicators (Q1 2024)

Source: Company filings for Q1 2024 and 2023 Annual Reports

As shown in Figure 8, three companies rely heavily on government sales while Safran is the most exposed to commercial customers, with only 18% of sales coming from government orders. Safran is also the only company to issue a specific free cash flow outlook for 2024, with the remaining three companies offering less precise guidance. Nevertheless, we can observe from the low single-digit free cash flow yields that the market clearly expects further growth for the four companies beyond 2024.

Looking at revenue growth, all four companies are growing revenues at a double-digit rate. That said, we notice a slowdown in sales growth at Safran, indicating that the peak in aviation sales growth was in 2023. At the same time, the other three government-focused companies are seeing sales growth accelerate. This is most visible at Leonardo, which is now growing at the fastest rate among our selection after the weakest sales increase in 2023.

Only two companies reported backlog developments in Q1 2024, with the 42.6% Y/Y increase at Rheinmetall set to translate into strong H2 2024 revenue growth at the company. This rapid growth partly explains Rheinmetall’s lowest free cash flow yield among the four companies.

The ever-growing increase in defense spending across Europe will inevitably result in higher government spending on military contracts. To be the first to know about the latest defense contracts awarded in Europe, check out our daily-updated Government Contracts Awards Feed.