It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

It is now time for us to look again at a company we covered previously in this series. L3Harris Technologies recently reported its Q2 2023 results and below we will provide a brief analysis of the company’s performance between April and June of this year.

Key points:

* 74% of Q2 revenues from the U.S. government. Closing of Aerojet Rocketdyne acquisition in Q3 set to create new business segment with about 94% U.S. government procurement exposure, boosting L3Harris total exposure to about 76.5%;

* 13.5% Y/Y revenue growth in Q2, with the strongest increase at Communication Systems. Full year growth outlook increased to +6.8%;

* Adjusted EPS of $2.97/share in Q2, down 8% Y/Y. New outlook still envisages a decline of 4.3% to about $12.35/share;

* Book-to-bill ratio of 1.18 in Q2, with the backlog growing 2% Q/Q to $25 billion;

* $652 million in free cash flow year-to-date, with the $2 billion 2023 target intact.

L3Harris Technologies Q2 2023 Results Overview

We previously covered the Q1 2023 results of L3Harris Technologies in part 35 of our Top Government Contractors series here. Below we will highlight the progress achieved by the company in Q2 of 2023.

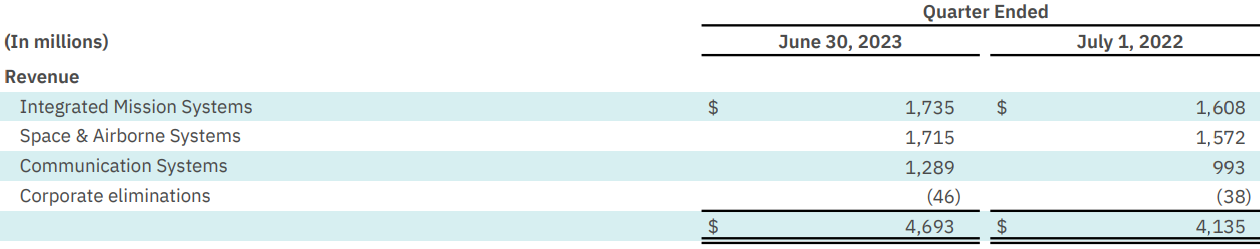

L3Harris Technologies reports results in three main segments, namely Integrated Mission Systems (IMS) at 37% of Q2 2023 revenue, Space & Airborne Systems (SAS) at 36.5% and Communication Systems (CS) at 27.5% of Q2 2023 revenue:

Figure 1: Q2 2023 L3Harris segment revenues

Source: L3Harris Q2 2023 Investor Letter

Post-quarter end, on July 28, L3Harris successfully closed its $4.7 billion acquisition of Aerojet Rocketdyne, creating a fourth business segment at the company. As laid out in the company press release:

The acquisition diversifies the L3Harris portfolio, adding considerable long-cycle backlog and broad expertise that enables opportunities in missile defense systems, hypersonics and advanced rocket engines, among other areas.

96% of Aerojet Rocketdyne's revenue was from the U.S. government in its last public company report (Q1 2023). As a result, monitoring public procurement data will be crucial to assess the health of the new business segment.

With 74% of L3Harris revenues coming from the U.S. government in Q2, we estimate the new combined entity will have a government revenue exposure of about 76.5% in Q3.

Operational Overview

Integrated Mission Systems was the weakest relative performer in Q2, growing revenues 8% Y/Y (2022 -1.8%). Sales increased primarily on higher volumes in Electrco Optical and Commercial Aviation Solutions sub-segments. Margin weakness persisted, with Estimate at Completion (EAC) adjustments and a goodwill impairment driving the operating margin down to 9% from 13% in the prior-year quarter. As a result, operating income dropped 22% Y/Y.

Space & Airborne Systems registered the second-best segment performance, growing revenues 9% Y/Y in Q2 (2022 +1.6%). The increase was driven primarily by the Space Systems sub-segment. As at IMS, margins were weaker, at 10% in the quarter (Q2 2022: 13%), impacted by a non-cash goodwill impairment and higher overhead costs on fixed price contracts. All in all, Q2 operating income was down 17% Y/Y.

Communication Systems was the top performer in the quarter, increasing revenues 30% Y/Y, or 21% excluding the Tactical Data Link acquisition (2022 -1.6%). Growth drivers were unchanged from Q1, with Broadband Communications and Tactical Communications sub-segments recording the strongest performance. CS was the only segment to register margin growth in the quarter, up 1% Y/Y to 25% in Q2, helped by higher volumes and a favorable mix. As a result, operating income shot up 37% Y/Y.

On a consolidated basis, revenue increased 13.5% Y/Y in Q2 (2022 -4.2%), however the segment operating margin of 14.8% was down both Y/Y and relative to 2022 /15.4%/, although improving relative to Q1 2023. Adjusted EPS was $2.97/share, down 8% Y/Y, impacted by lower pension income and higher interest rates (2022 $12.9/share). Free cash flow was $652 million year-to-date (2022 $2 billion).

Updated 2023 Outlook

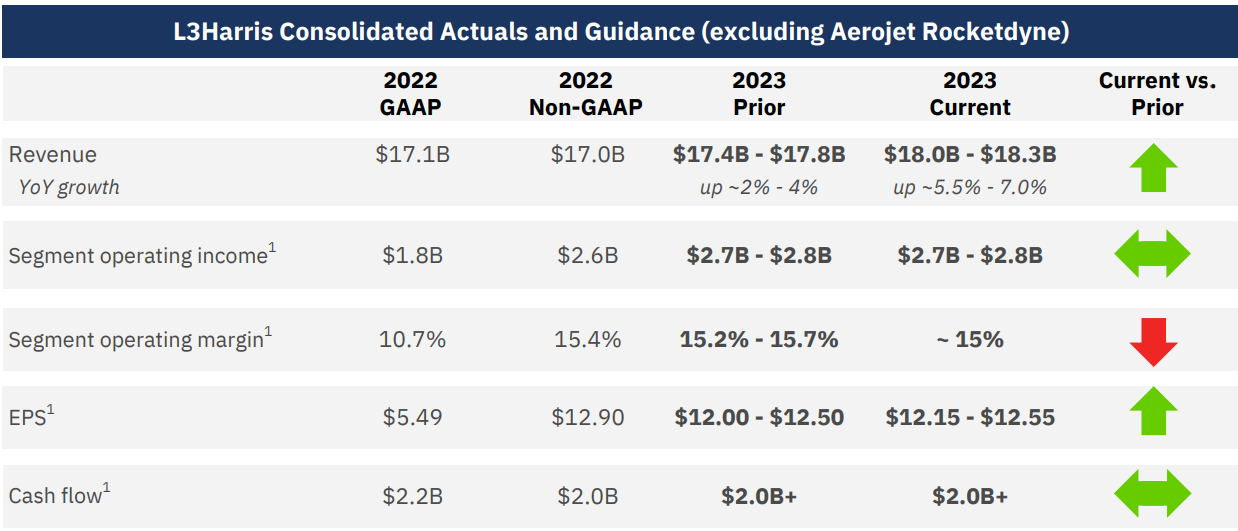

Given the persistent revenue strength, partially offset by continuing margin weakness, L3Harris updated its 2023 outlook, boosting revenue and EPS expectations, but cutting its margin forecast:

Figure 2: L3Harris Updated 2023 Outlook

Source: L3Harris Q2 2023 Investor Letter

- Revenues are now seen up 6.8% Y/Y

- Segment operating margin is seen down 0.4% to about 15%.

- Free cash flow is unchanged at above $2 billion.

- Non-GAAP EPS is expected to decline 4.3% to about $12.35/share.

Backlog

The book-to-bill ratio was 1.18 in Q2 (2022: 1.08). As a result, the total backlog expanded 2% Q/Q to $25 billion and is set to increase to over $30 billion following the successful execution of the Aerojet Rocketdyne acquisition.

Backlog growth was broad based, with CS the top contributor, boasting a book-to-bill ratio of 1.38 in the quarter.

Capital Structure

The company ended Q2 2023 with a net debt of $8.4 billion, while the current market capitalization is around $34.3 billion. With the $4.7 billion acquisition of Aerojet Rocketdyne finalized in Q3, the net debt position should grow to about $12.5 billion, making L3Harris one of the most financially levered companies in our Top Government Contractors series.

Given the rising debt level of the company, the metric L3Harris uses to steer its financial leverage is the net-debt-to-adjusted EBITDA leverage ratio. As of June 31, it stood at 2.5, while the level above which the company will prioritize debt repayments is 3.0. Post-acquisition, CFO Michelle Turner expects the ratio to reach 4.0.

L3Harris is evaluating non-core assets to potentially accelerate near-term focus of debt repayment.

Year-to-date, the company spent $518 on share buybacks and $436 on dividends.

Conclusion

2023 was an extremely active year for L3Harris on the M&A front, closing the Tactical Data Link acquisition in Q1 and Aerojet Rocketdyne in Q3, which is set to be EPS positive in its first full year and free cash flow accretive in its second full year.

Given the strong revenue momentum and swelling backlog, L3Harris should deliver solid top-and-bottom line results in 2024, at the same time focusing on debt repayment to conserve its investment grade credit rating.

In light of the rapidly evolving revenue and backlog profile of L3Harris post-acquisitions (we forecast a 76.5% share of the U.S. government in total Q3 revenue), monitoring the company’s public procurement activity remains a smart move that can provide key insights into its and other companies’ financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy L3Harris or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.