It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our Government Receivables as a Stock Market Signal white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

It is now time for us to look again at a company we covered previously in this series. L3Harris recently reported its Q1 2024 results and below we will provide a brief analysis of the company’s recent performance.

Key points:

* U.S. government exposure reached 77% in Q1 2024, the highest since 2020;

* Revenue is expected to grow by circa 6% in the 2024-2026 period;

* Reported results were impacted by restructuring expenses and Aerojet Rocketdyne purchase amortization;

* Free cash flow is seen 10% higher in 2024, with debt repayment a key near-term priority;

* Total backlog of $32.1 billion, down 2% Q/Q, with 50% set to be recognized in revenue over the next 12 months.

L3Harris Q1 2024 Results Overview

We previously covered L3Harris Technologies's Q2 2023 results in part 52 of our Top Government Contractors series here. Below we will highlight the progress achieved by the company in Q1 of 2024.

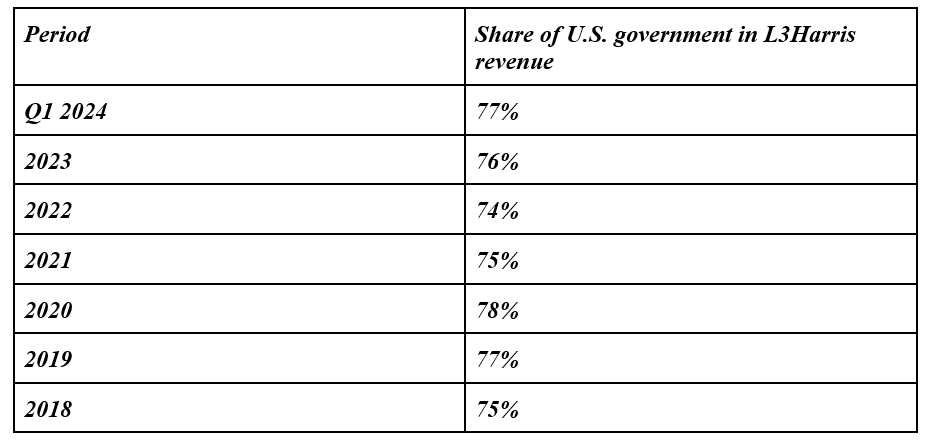

We will start with an L3Harris revenue breakdown. The company reports results in four main segments, namely Space & Airborne Systems (SAS) at 33% of Q1 2024 revenue, Integrated Mission Systems (IMS) at 32%, Communication Systems (CS) at 25%, and Aerojet Rocketdyne (AR) at 10% of Q1 2024 revenue:

Figure 1: L3Harris Q1 2024 Results Overview

Source: L3Harris Q1 2024 Results Press Release

Operational Overview

Space & Airborne Systems delivered 6% Y/Y growth in Q1 2024 (2023: +7%), driven by Space Systems and a classified program contribution in Intel and Cyber. Margins were stronger, at 12.3% (2023: 11%), boosted by progress on development programs and higher volumes.

Integrated Mission Systems was the only segment to record a revenue decline, down 2% Y/Y (2023: flat Y/Y), hampered by lower aircraft procurement activity in Intelligence, Surveillance, and Reconnaissance. Margins were a bright spot, at 11.4% in the quarter (2023: 6.9%), benefitting from fewer negative Estimate as Completion adjustments.

Communication Systems was again the fastest growing segment, at 11% Y/Y (2023: +20%), boosted by higher volumes in Tactical Communications, Integrated Vision Systems, and Broadband Communications. Margins were robust as well, at 24% in Q1 2024 (2023: 24.2%), driven by higher volumes and improved operating performance in Integrated Vision Systems.

Aerojet Rocketdyne segment results were the result of program execution across Missile Solutions and Space Propulsion and Power Systems, with no prior year comparison provided by L3Harris. The operating margin stood at 13.3% in Q1 2024.

On a consolidated level, Q1 2024 sales were 17% higher (2023: +14%), driven in large part by the Aerojet Rocketdyne acquisition in 2023. Organic revenue growth was 5%. Reported operating margins were lower, at 7.3% (2023: 11%), due to amortization of AR purchasing costs and restructuring expenses under the LHX NeXt efficiency plan. Adjusted for these effects, the operating margin stood at 15.1%. Likewise, adjusted EPS was $3.06/share, up 7% Y/Y, while free cash flow was negative $156 million.

2024 Outlook

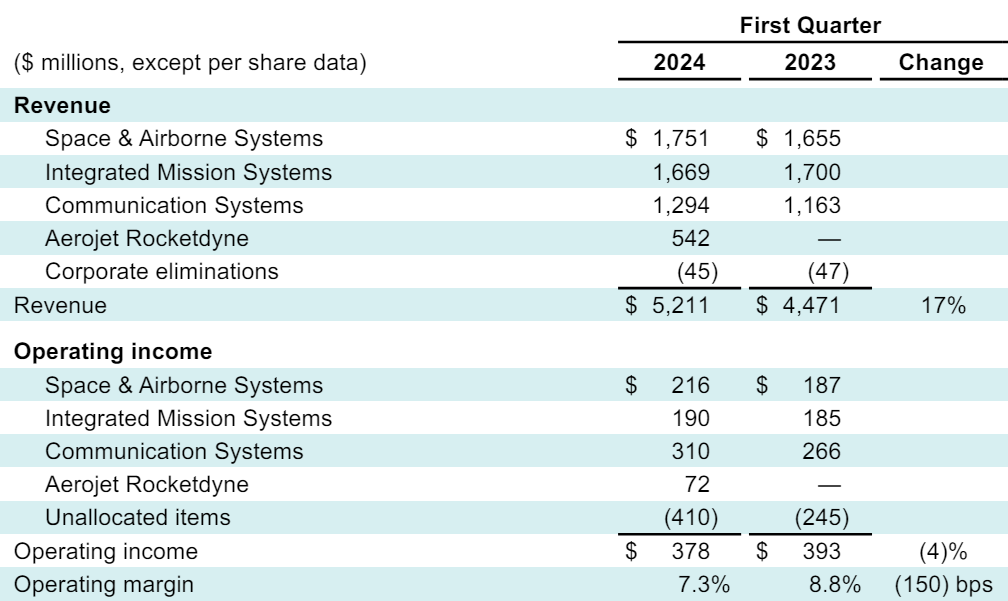

In light of the stronger-than-anticipated start of the year, especially in Space & Airborne Systems, L3Harris boosted its revenue, adjusted operating margin, and adjusted EPS outlook:

Figure 2: L3Harris Updated 2024 Outlook

Source: L3Harris Q1 2024 Results Presentation

- Revenue is now expected at about $20.5 billion, up 6% Y/Y.

- The adjusted segment operating margin is now seen above 15%.

- Adjusted EPS is forecast at $12.88/share, up 4% Y/Y.

- Free cash flow is forecast at $2.2 billion, up 10% Y/Y.

Backlog

Backlog developments were more nuanced, with the total company backlog falling 2% Q/Q to $32.1 billion, despite a book-to-bill ratio of 1.06 during Q1 2024. It should be noted that L3Harris’s backlog is relatively short-term, with 50% expected to be realized over the next 12 months, and 25% over the following twelve months. Compared to the end of 2023, the proportion of near-term backlog (12 months) has increased from 40% to 50%, potentially indicating a slowdown in the company’s rate of contract awards, or alternatively, improved manufacturing processes allowing it to deliver goods and services to customers faster.

Capital Position

L3Harris ended Q1 2024 with a net debt of $13.2 billion, implying that net debt accounts for 24% of the company’s enterprise value. While manageable, debt is elevated following the 2023 acquisitions, and the company aims to bring net debt to adjusted EBITDA to below 3.00, from the current ratio of 3.5.

L3Harris Government Contracts Exposure

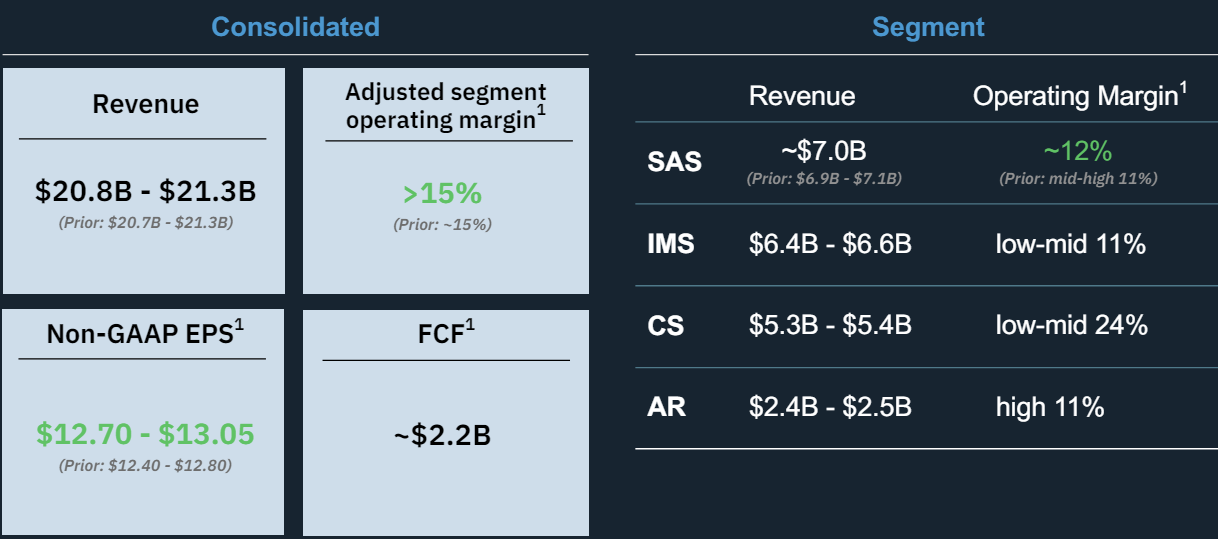

Following the Aerojet Rocketdyne acquisition, the U.S. government gained an even greater significance in L3Harris’s topline. As of Q1 2024, the U.S. government alone accounted for 77% of the company’s revenue:

Figure 3: Evolution of L3Harris U.S. Government Revenue Exposure

Source: Company filings

From the table above we can observe that the only period during which government contracts played a greater role for L3Harris’s revenue was during the 2020 COVID-19 pandemic, when the U.S. government had a 78% contribution to the company’s topline.

Conclusion

L3Harris had a strong start to 2024, although reported performance was impacted by restructuring expenses. Revenue growth is forecast at 6% in 2024, with similar increases anticipated until 2026, with the company aiming to reach $23 billion in topline sales.

Deleveraging remains the top priority for L3Harris in the near term while improving margins should accelerate the growth in free cash flow from 10% in 2024 to about 13% over the 2025-2026 period, ultimately reaching a free cash flow of $2.8 billion.

Following the Aerojet Rocketdyne purchase, the share of the U.S. government in the company’s revenue reached 77%. Given the short-term nature of the company’s backlog (50% is set to be realized over the next 12 months), monitoring the company’s public procurement activity appears to be a smart move that can provide key insights into its financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!