It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

It is now time for us to look again at a company we covered previously in this series. McKesson recently reported its Q4 2023 results and below we will provide a brief analysis of the company’s performance in the first 3 months of 2023.

Key points:

* COVID-19 vaccine procurement contract to expire in July, impacting EPS by 4.3%;

* 5% revenue increase in fiscal 2023, with 6.5% growth expected in 2024;

* Adjusted EPS up 9.3% in 2023 to $25.94/share. 2.1% increase expected in 2024 to a range of $26.1-26.9/share;

* Net debt of just $0.9 billion. Free cash flow of $4.6 billion in 2023, with $3.9 billion expected in 2024, down 15% Y/Y;

* Operating profit growth targets increased by 1% in each division on higher utilization, biosimilars, the health systems business, the retail pharmacy network and the oncology platform, now the biggest in the U.S.

McKesson Q4 2023 Results Overview

We initially covered McKesson Corporation's Q3 2023 results (the company has a fiscal year ending in March) in part 14 of our Top Government contractors series here. Below we will highlight the progress achieved in Q4 and what management expects in 2024.

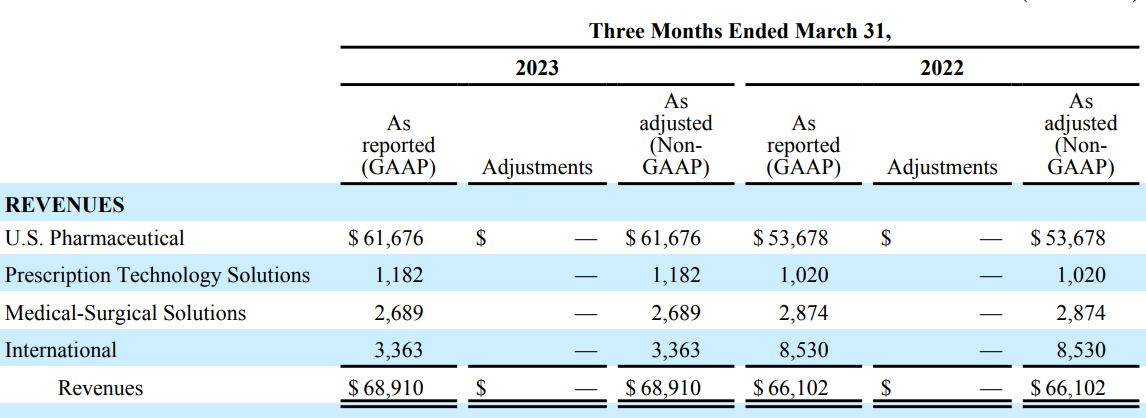

McKesson reports results in four main segments, namely U.S. Pharmaceutical at 89.5% of Q4 2023 revenues, Prescription Technology Solutions at 1.7%, Medical-Surgical Solutions at 3.9%, and International at 4.9% of Q4 2023 revenues:

Figure 1: Q4 2023 McKesson segment revenues

Source: McKesson Q4 2023 Earnings Release

U.S. Pharmaceutical was the second-best performing segment in Q4, growing revenues 15% Y/Y, while the full-year increase came in at 13%. The strong performance was due to higher volumes from retail national account customers and general market expansion. The adjusted segment operating margin was down both in Q4 and the full year, reaching 1.4% and 1.29% of sales respectively. As a result, operating profit growth was lighter, at 10% in Q4 and 6% for 2023.

Prescription Technology Solutions was the top performer in Q4, delivering a 16% sales growth. 2023 revenue increase was 14%. Margin performance was equally robust, at 18.44% in Q4 and 15.48% in the full year, with operating profit up 35% in Q4 and 15% in 2023.

Medical-Surgical Solutions revenues were down 6% Y/Y in Q4 and 4% in the full year, impacted by lower COVID-19 related sales. The margin picture was nuanced, down in Q4 to 9.22% but up for the full year to 10.43%, hence operating profit was down 17% in Q4 but only decreased 4% in 2023, in line with sales.

International was the weakest performer in Q4, impacted by divestitures. Revenue was down 58% Y/Y in Q4 (2023 -38%), while operating profit decreased 40% Y/Y in Q4 (2023 -22%). The segment showed margin improvement both in Q4 and the full year, at 2.38% and 2.42% respectively. Norway remains the only European business for sale.

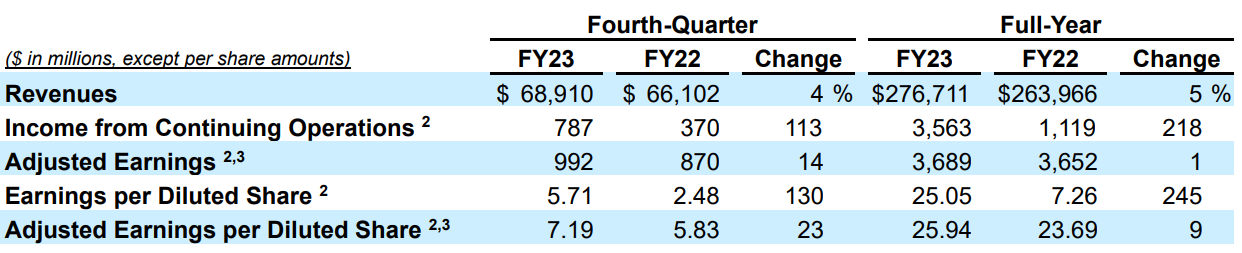

On a consolidated basis, revenues were up 4% in Q4 and 5% in full year 2023. Adjusted earnings per diluted share was up 23% in Q4 to $7.19/share and 9% in 2023 to $25.94/share. Free cash flow came in at $4.6 billion for the full year, up 18% Y/Y:

Figure 2: McKesson Q4 and 2023 results overview

Source: McKesson Q4 2023 Earnings Release

2024 Outlook

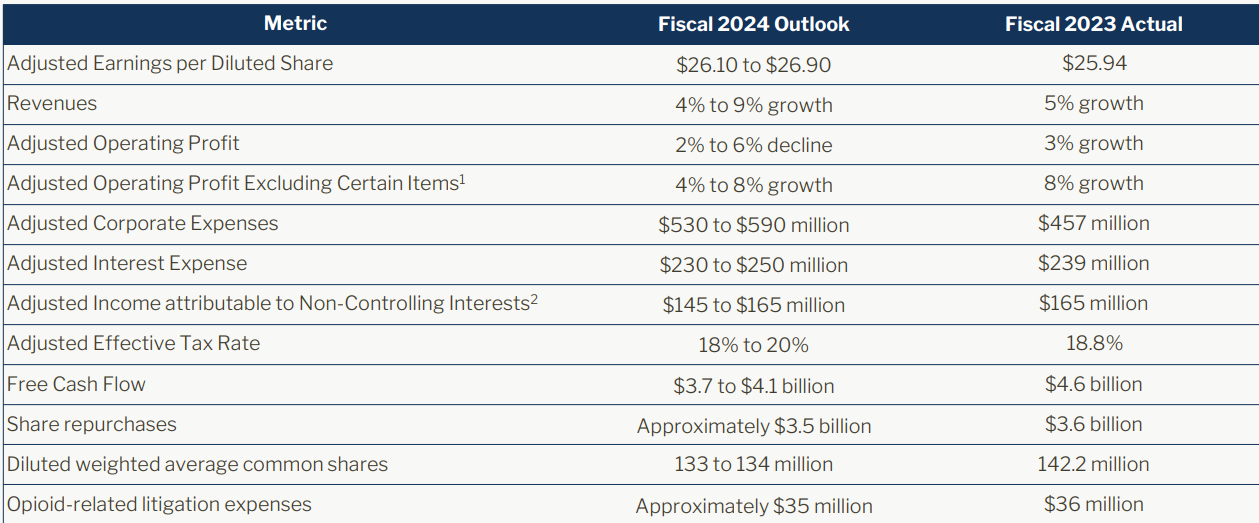

McKesson expects operating momentum to carry into the new fiscal year, with adjusted EPS seen 2.1% higher to a range of $26.1-26.9/share.

Figure 3: McKesson 2024 outlook

Source: McKesson Q4 2023 Earnings Presentation

As the COVID-19 contract with the U.S. government ends in July (2023 EPS contribution of 4.3%), EPS growth will lag top-line growth of around 6.5%. Free cash flow is also set to disappoint, at $3.9 billion or 15% lower Y/Y.

With the end of the government supply contract, McKesson sees the COVID-19 contribution to earnings as immaterial in 2024.

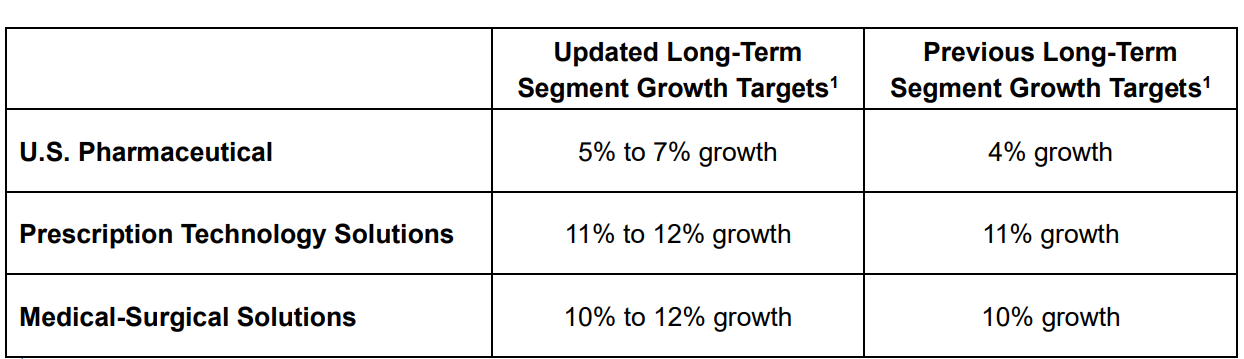

Nevertheless, EPS should return to robust growth in 2025 as the company raised its long-term adjusted segment operating profit targets:

Figure 4: McKesson updated segment profit growth targets

Source: McKesson Q4 2023 Earnings Release

On the conference call, CFO Britt Vitalone pointed out that the profit outlook increase was due to higher utilization, biosimilars, the health systems business, the retail pharmacy network and the oncology platform, which is now the biggest in the U.S.

Capital Structure

McKesson ended fiscal 2023 with a net debt of just $0.9 billion, a negligible amount against a market capitalization of $55 billion. It should be noted the company has $7.2 billion in litigation liabilities under a 2022 settlement regarding the distribution of opioids, $0.55 billion of which is set to be paid in fiscal 2024.

The main use of free cash flow is forecast to be share repurchases, at about $3.5 billion in 2024, in line with 2023.

Conclusion

McKesson runs a very conservative balance sheet and is enjoying strong operating momentum in its reporting segments. While bottom-line growth will lag revenue growth in 2024 on the end of the COVID-19 vaccine supply contract and Europe divestitures, EPS growth is expected to pick up pace in 2025.

The company is also undergoing a headcount and real estate optimization initiative, with $60 million of the $125 million total cost incurred in Q4 2023.

In light of McKesson’s boosted segment profitability targets, monitoring the company’s public procurement activity remains a smart move that can provide key insights into the company's financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy McKesson or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.