It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

It is now time for us to look again at a company we covered previously in this series. Northrop Grumman recently reported its Q2 2023 results and below we will provide a brief analysis of the company’s recent performance.

Key points:

* 86% of Northrop Grumman sales were to the U.S. government in Q2 2023, with the impact of legacy fixed-price contracts on margins set to diminish;

* 9% Y/Y revenue increase in Q2, driven by the largest Space Systems segment. Full year growth outlook increased to +5.5%;

* Adjusted EPS of $5.34/share in Q2, down 12% Y/Y. Full year outlook increased but still seen down 11.3%;

* Total backlog grew 1.7% Q/Q to $78.8 billion, with a book-to-bill ratio of 1.14 in Q2;

* Operating margin set to expand from the current 10.9% in H1 to 11.5% in H2 2023, and potentially 12% in the medium term.

Northrop Grumman Q2 2023 Results Overview

We previously covered Northrop Grumman's Q1 2023 results in part 36 of our Top Government Contractors series here. Below we will highlight the progress achieved by the company in Q2 of 2023.

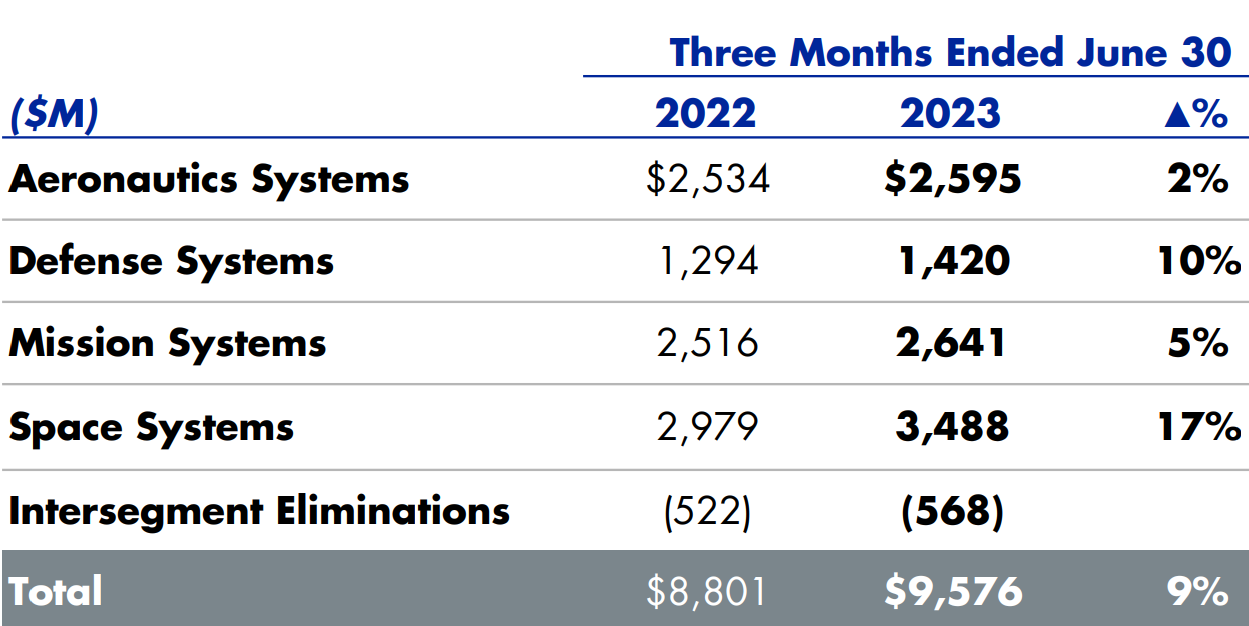

Northrop Grumman reports results in four main operating segments, namely Aeronautics Systems at 25.3% of Q2 2023 revenues, Defense Systems at 13.9%, Mission Systems (cyber, radar, sensors, communications and networks) at 25.8% of and Space Systems at 34.1% of Q2 2023 revenues:

Figure 1: Q2 2023 Northrop Grumman segment revenues

Source: Northrop Grumman Q2 2023 Results Presentation

Operational Overview

Aeronautics Systems was the weakest segment in Q2 from a revenue perspective, growing sales 2% Y/Y (2022 -6.3%). The segment operating margin (OM) was 10.7%, stronger Y/Y and relative to 2022 (10.6%). As a result, Q2 operating income grew 8% Y/Y. The improvement in margins was due to Estimate at Completion (EAC) adjustments on restricted programs, which were also the main sales driver in the quarter.

Defense Systems was the second best performing segment, with sales up 10% Y/Y in Q2 (2022 -3.4%). The Q2 OM was 11.7%, down Y/Y and relative to 2022 /11.9%/. All in all, the Q1 operating income decreased 1% Y/Y. EAC adjustments weighed on margins whiles sales grew on strong ammunition demand.

Mission Systems revenues were up 5% Y/Y in Q2(2022 +2.6%). The OM was down to 15.2%, weaker Y/Y and relative to the 15.6% in 2022. The combined effect drove operating income down 3% Y/Y. Margin weakness was due to shifting mix towards cost-type contracts, while sales grew on restricted revenues and Marine systems.

Space Systems was the best performing segment in the quarter, with sales up 17% Y/Y in Q2 (2022 +15.7%). The OM margin was substantially weaker, down 2.3% Y/Y to 8.1% in Q2 (full-year 2022 9.4%). As a result, despite strong top-line growth, operating income fell 9% Y/Y. Sales grew on the start of development programs while margins were impacted by negative EAC adjustments.

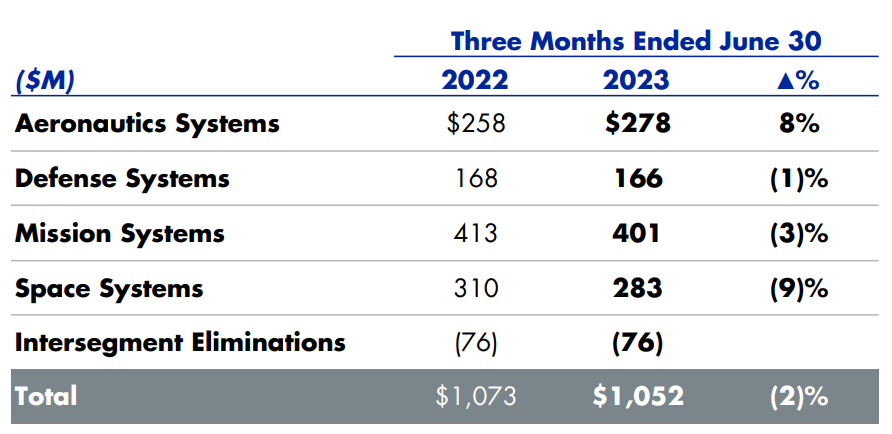

On a consolidated basis, revenues increased 9% Y/Y in Q2 (2022 +2.6%), the segment operating margin slipped 1.2% Y/Y to 11% (2022: 11.6%), driving segment operating income down 2% Y/Y:

Figure 2: Q2 2023 Northrop Grumman segment operating income

Source: Northrop Grumman Q2 2023 Results Presentation

Free cash flow was -$0.4 billion year-to-date. Adjusted EPS was $5.34/share, down 12% Y/Y (2022: $25.54/share), mainly impacted by a smaller net pension benefit.

Updated 2023 Outlook

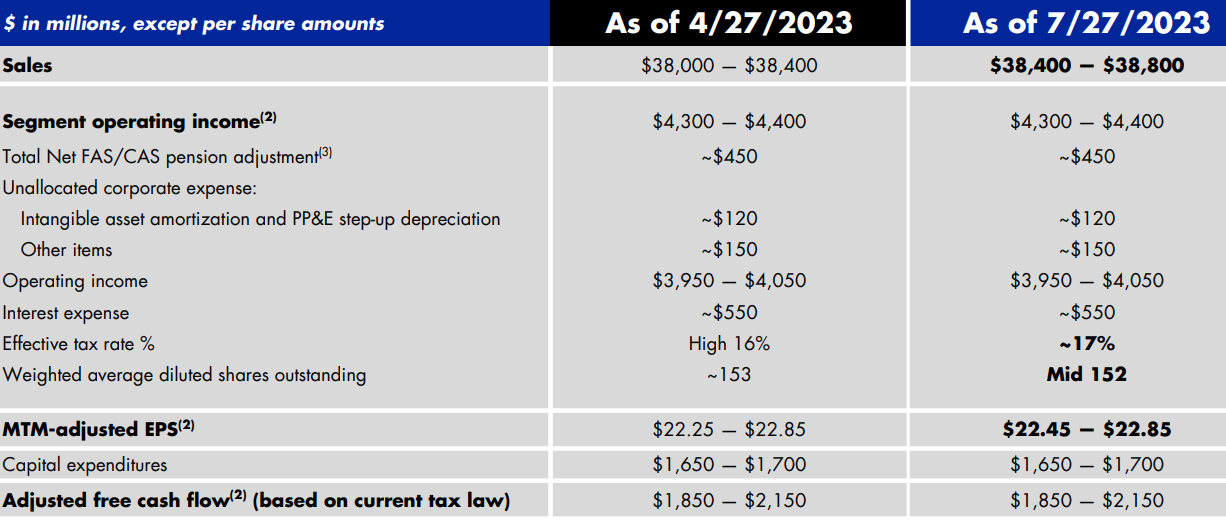

Against the backdrop of strong top-line growth and fading margin pressures, Northrop Grumman boosted its revenue and adjusted EPS guidance:

Figure 3: Northrop Grumman Updated 2023 Outlook

Source: Northrop Grumman Q2 2023 Results Presentation

- Revenues is expected to increase by 5.5% to 38.6 billion;

- Adjusted EPS is seen at about $22.65/share, down 11.3% Y/Y;

- Adjusted free cash flow is still forecast at around $2 billion.

From a segment perspective, sales are seen higher in Defense Systems and Space Systems, with the latter showing some persistent margin weakness as well.

Backlog

Total backlog grew 1.7% Q/Q to $78.8 billion, with a book-to-bill ratio of 1.14 in Q2. On a year-to-date basis, the backlog is largely unchanged, with growth in Mission and Space systems offsetting declines in Aeronautics and Defense systems.

By the end of 2023, Northrop Grumman will have worked through roughly 70% of its 2021 fixed-price backlog, prices of which were set before inflation accelerated in 2022. For new contracts, the company is factoring higher inflation expectations, which will gradually improve the margin profile of the backlog in 2024 and beyond.

Capital Structure

Northrop Grumman ended Q2 with a net debt of about $11.5 billion against a market capitalization of $65 billion currently. The company plans to return 100% of free cash flow to shareholders, mainly through a $1.5 billion buyback program in 2023.

Conclusion

Northrop Grumman delivered solid revenue growth in the first half but margin pressures kept profits subdued. Looking ahead, CEO Kathy Warden outlined three factors which will boost operating margins from the current 10.9% in H1 to 11.5% in H2 2023, and potentially 12% in the medium term:

- Stabilization of temporal macroeconomic factors that have driven higher costs and impacted Northrop Grumman's supply chain and labor efficiency;

- Ongoing implementation of cost management programs across the company that help drive affordability, competitiveness and performance;

- Shift to international demand and maturity of current development programs.

As a result, the company should deliver strong profit growth in 2024 against the backdrop of persistent revenue tailwinds.

In light of the fact that 86% of Northrop Grumman sales were to the U.S. government in Q2 2023, monitoring the company’s public procurement activity remains a smart move that can provide key insights into its financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy Northrop Grumman or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.