It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

It is now time for us to look again at a company we covered previously in this series. Oshkosh recently reported its Q2 2023 results and below we will provide a brief analysis of the company’s performance between April and June of this year.

Key points:

* Defense segment accounting for 20.6% of Q2 revenues, with Oshkosh losing appeal for the JLTV program.

* Q2 revenue up 16.8% Y/Y. Full-year 2023 outlook increased to +14.5%.

* Adjusted EPS of $2.69/share. 2023 expectations raised to $8/share, 131% growth relative to 2022.

* $800 million AeroTech business purchase from JBT Corporation set to swell net debt position to about $1 billion in Q3, with higher interest expense weighing on EPS in the remainder of 2023.

* All three segments should see improved margins in 2024, especially Defense and Vocational segments.

Oshkosh Q2 2023 Results Overview

We previously covered Oshkosh's Q1 2023 results in part 34 of our Top Government Contractors series here. Below we will highlight the progress achieved by the company in Q2 of this year.

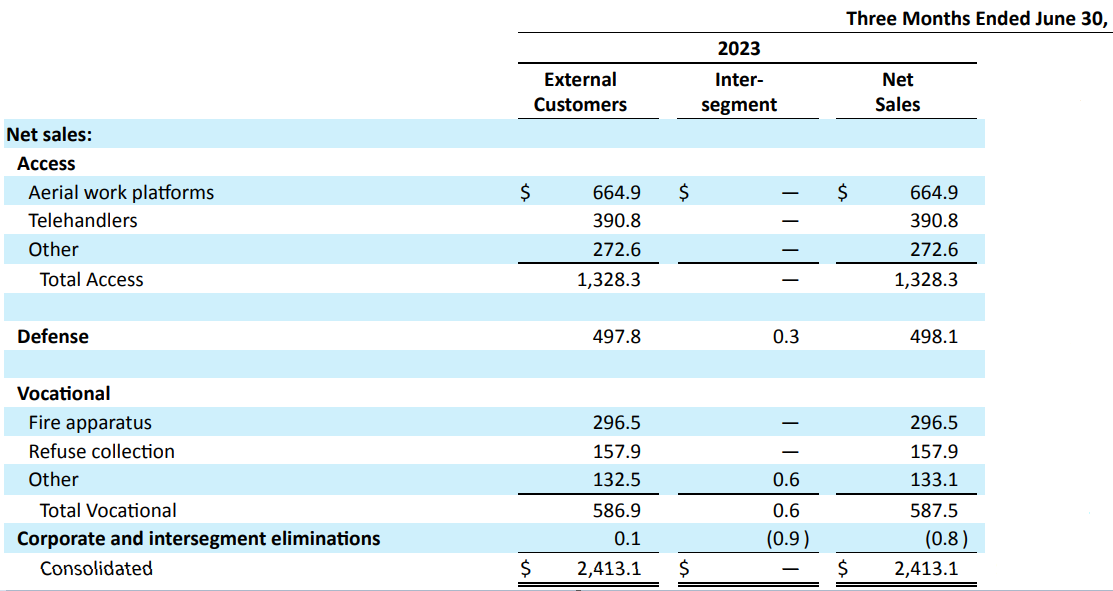

Oshkosh reports results in three main segments, namely Access Equipment at 55% of Q2 2023 revenues, Defense at 20.6% and Vocational (combined the former Fire & Emergency and Commercial segments) at 24.3% of Q2 2023 revenues:

Figure 1: Q2 2023 Oshkosh segment revenues

Source: Oshkosh Q2 2023 Form 10-Q

Operational Overview

Access Equipment was the best performer in Q2, with net sales up 35.9% Y/Y (2022 +18.9%). The operating income margin was 15.9% (2022 8%). The strong numbers were the result of both increased volumes, improved pricing and a favourable product mix.

Oshkosh is repurposing some Defense production facilities to serve the Access Equipment market in light of consistent demand.

Defense was the only segment to register a revenue decline in the quarter, -7.6% Y/Y (2022 -14.6%). The weakness was driven by lower volumes on the Joint Light Tactical Vehicle, JLTV, program. In June, Oshkosh lost its JLTV appeal for the next stage of the program, with CEO John Pfeifer outlining plans for the division:

...we are still building JLTVs and will continue to do so through the end of 2024 under the current contract. Beyond 2024, we will continue to build JLTVs for international customers as well as JLTV specialty applications. These, of course, are smaller quantities. From 2025 onward, we will continue to deliver on many solid programs of record in the Defense segment, including FMTV, FHTV, Stryker MCWS and multiple trailer programs as well as international contracts that extend well into the future. Long term, we expect that these programs will provide $1 billion-plus revenue base at mid- to high single-digit operating margin.

The operating income margin was only 1.3% (2022 2.4%) on materials cost inflation.

Vocational saw sales increase by 6.5% Y/Y. The operating income margin was 10.6% (2022 7.2%). The positive developments were driven by higher prices and volumes, as well as an improved product mix.

On a consolidated basis, revenues increased 16.8% Y/Y in Q2 (2022 +4.1%). The adjusted operating income margin was 9.8% (2022 4.6%). Adjusted EPS was $2.69/share (full year 2022 $3.46/share), driven by higher volumes, stronger pricing and a favorable mix.

Updated 2023 Outlook

Given the stronger-than-expected performance in both Access equipment and Vocational segments, Oshkosh boosted its 2023 outlook for both revenue and EPS, but cut its free cash flow outlook:

- Revenue of 9.5 billion, + 14.5% Y/Y.

- Adjusted EPS of $8/share, +131% Y/Y.

- Free cash flow of $200 million

The cash flow outlook was reduced by $100 million on higher receivables at year end, as well as start-up investments related to the Next Generation Delivery Vehicle (NGDV) program.

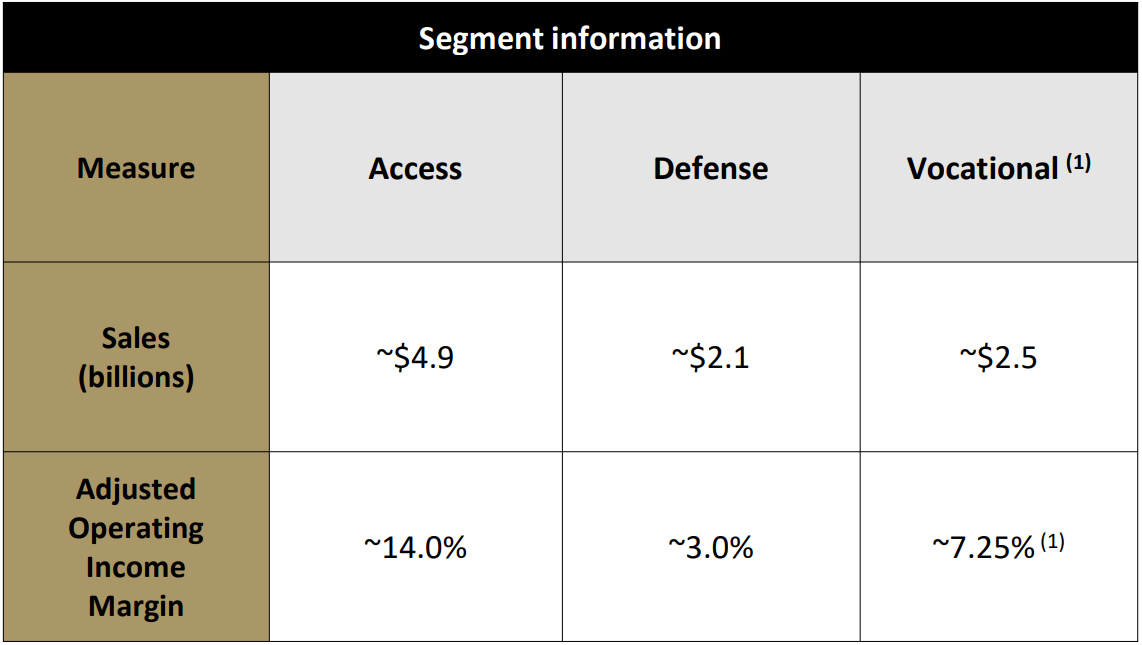

From a profitability perspective, the Defense and Vocational segments continue to underperform, while Access equipment shines:

Figure 2: Oshkosh updated segment outlook for 2023

Source: Oshkosh Q2 2023 Results Presentation

Q3 revenues should be modestly higher Q/Q while adjusted EPS will be lower, at about $2.15/share, with interest expenses weighing on profitability.

AeroTech acquisition

Post quarter end, on August 1, 2023, Oshkosh purchased the AeroTech businesss of JBT Corporation in a $800 million deal. AeroTech is a leading provider of aviation ground support products, gate equipment and airport services to commercial airlines, airports, air-freight carriers, ground handling and military customers.

AeroTech will be part of the Vocational business, with the company expecting technology and R&D synnergies. Furthermore, due to the strong aftermarket and services component of the business, the deal should enhance Oshkosh's resilience through market downturns.

Also in Q3, Oshkosh closed on smaller business disposals which will bring in $20 million.

Backlog

Total backlog grew 0.8% Q/Q to $15 billion, driven by the Vocational segment, with the other two segments registering marginal declines.

Capital Structure

The company ended Q2 with a net debt position of $242 million, which is set to increase to close to a billion following the AeroTech business acquisition. As a result, Oshkosh will lose its position as one of the most conservatively financed companies in our Top government contractors series, in light of its $6.6 billion market capitalization.

Conclusion

Oshkosh delivered strong performance in Q2, with further improvement expected, as explained by CEO John Pfeifer:

Over our longer-term planning horizon, we expect further growth in both sales and margins driven by numerous positive factors, which include improving supply chains, benefits from price cost, especially in the vocational segment, bringing new capacity online, introducing new products and innovations, ramping up production of the United States Postal Services next-generation delivery vehicles and realizing benefits from acquisitions.

The AeroTech acquisition will further strengthen the Vocational segment, with high single-digit growth expected for global passenger traffic over the coming years. That said, initial purchase accounting and deal amortization will negatively affect Vocational segment margins in the remainder of 2023, before becoming accretive in 2024.

Supply chain conditions at Access equipment have improved but are not yet back to normal (75% current on-time deliveries from suppliers versus benchmark of 90%). The defense segment should see meaningful margin improvement in 2024 and especially in 2025, with deliveries of NGDV for the U.S. postal service ramping up significantly.

Considering the huge importance government tender wins, as well as losses, can have on stock performance, monitoring the company’s public procurement activity remains a smart move that can provide key insights into Oshkosh’s and other companies’ financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy Oshkosh or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.