It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our Government Receivables as a Stock Market Signal white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

It is now time for us to look again at a company we covered previously in this series. Pfizer recently reported its Q1 2024 results and below we will provide a brief analysis of the company’s recent performance.

Key points:

* The U.S. government contributed 10% to Pfizer’s topline in Q1 2024, well below the record 23% contribution in 2022;

* Revenue and adjusted EPS declined by double digits Y/Y in Q1 2024, impacted by lower COVID-19 sales;

* Non-covid products grew 11% Y/Y in Q1 2024, with the company expecting higher revenues and EPS for the full year.;

* Net debt accounts for 26% of enterprise value, with debt repayment a key priority for the company;

* The company is selling down its Haleon stake, with the remaining 23% worth some $8.8 billion;

Pfizer Q1 2024 Results Overview

We previously covered Pfizer’s Q2 2023 results in part 54 of our Top Government Contractors series here. Below we will highlight the progress achieved by the company in Q1 2024.

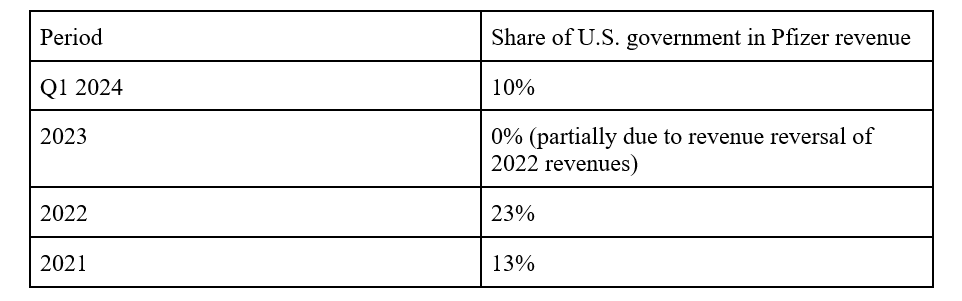

Pfizer reports results in two main segments, namely Biopharma (discovery, development, manufacture, marketing, sale and distribution of biopharmaceutical products worldwide) at 98% of Q1 2024 revenues and Business Innovation (contract development and manufacturing organization, R&D services) at 2% of Q1 2024 revenues:

Figure 1: Pfizer segment revenue developments

Source: Pfizer Q1 2024 Earnings Release

Operational Overview

Sales in Q1 2024 were down 19% Y/Y to $14.9 billion, driven by lower COVID-19-related revenues. Excluding COVID-19, sales were $12.5 billion, up 11% Y/Y. The first quarter also included revenues from Seagen, the acquisition of which closed in Q4 2023. Profitability was affected by sticky operating expenses and elevated interest costs. As a result, adjusted EPS was only $0.82/share in the quarter, down 33.3% Y/Y.

Updated 2024 Outlook

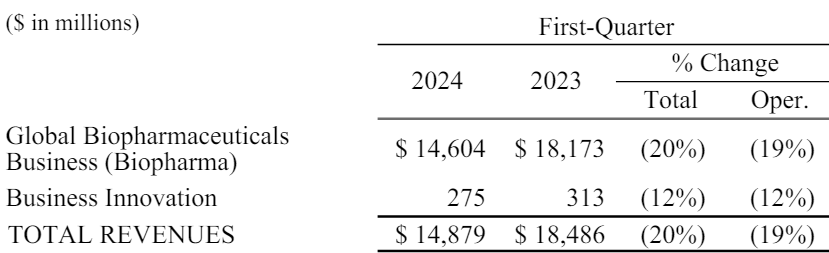

Despite the weak start of the year, confidence in the company’s $4 billion cost reduction target prompted Pfizer to boost its adjusted EPS guidance to $2.15-2.35/share:

Figure 2: Pfizer updated 2024 outlook

Source: Pfizer Q1 2024 Earnings Release

As a result, for 2024 the company now expects:

- Revenues of about $60 billion, up 3% Y/Y.

- Adjusted EPS of $2.25/share, up 22% Y/Y.

- R&D expenses of $11.5 billion, up 7% Y/Y.

Government Revenue Exposure

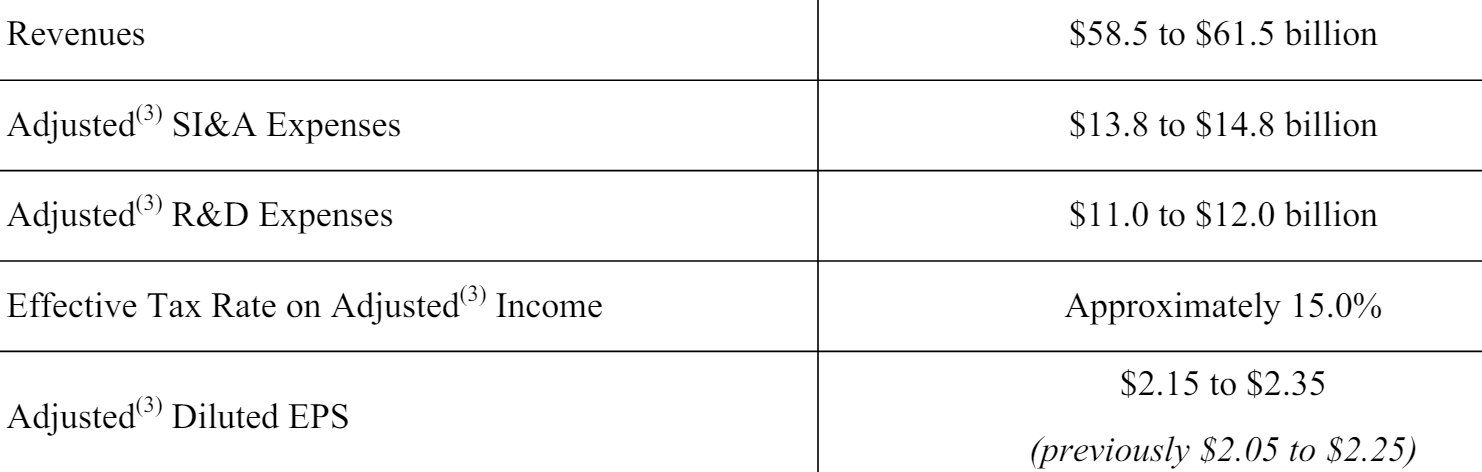

With COVID-19 treatments increasingly moving to commercial channels, the importance of the U.S. government for Pfizer’s revenue has decreased significantly, as shown in the table below:

Figure 3: Pfizer U.S. Government Revenue Exposure

Source: Pfizer Company Filings

Nevertheless, at 10% of Q1 2024 revenues, the U.S. government remains one of Pfizer’s main customers, with the company selected to create, in 2024, a U.S. Strategic National Stockpile of 1 million treatment courses to enable future pandemic preparedness.

Furthermore, considering that sales to the United States represented 64% of Q1 2024 revenues, with the remaining 36% coming from Developed and Emerging Markets overseas, we can reasonably estimate that foreign governments contributed another 6% to Pfizer’s top line, resulting in a cumulative government exposure of 16% in Q1 2024.

Capital Structure

Pfizer ended Q1 2024 with a net debt of $57.6 billion, implying that net debt accounts for 26% of enterprise value. Following the Seagen purchase, reducing the debt burden remains a key priority for management, with $1.3 billion repaid in Q1 2024 and a further $1 billion repayment targeted in Q2. Pfizer also raised $3.5 billion from a partial exit from its equity stake in UK drugmaker Haleon. The remaining 23% stake is currently worth about $8.8 billion.

Conclusion

Despite recording double-digit revenue and EPS declines in Q1 2024, Pfizer remains on track to achieve top-and-bottom-line growth for the full year 2024, driven by strong performance in the second half of 2024. As COVID-19 sales stabilize at a lower level, the 11% growth in non-COVID-19 products will increasingly reach the company’s reported sales.

The 10% share of the U.S. government in the company’s topline is well below the 23% contribution achieved in 2022 - a record for the company in recent years. Nevertheless, Pfizer remains a key supplier of critical medicines for governments around the world. As such, monitoring the company’s public procurement activity appears to be a smart move that can provide key insights into its financial health.

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy Pfizer or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.