It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

It is now time for us to look again at a company we covered previously in this series. Pfizer recently reported its Q2 2023 results and below we will provide a brief analysis of the company’s performance between April and June of this year.

Key points:

* Revenue down 54% Y/Y in Q2 on slump in COVID-19 product sales. Full year outlook marginally reduced to about -31.7% Y/Y;

* Adjusted Diluted EPS of $0.67/share in Q2 , 67% lower Y/Y. Full year outlook unchanged at $3.25 – 3.45/share, down 49.1% Y/Y;

* Revenue growth excluding COVID-19 products seen at 7% for the full year, 1% lower than previous estimate;

* Q2 expenses were unusually elevated due to a high amount of product launches which are set to boost sales in H2 2023 and 2024;

* Pfizer raised $31 billion of debt to fund its $43 billion cash acquisition of Seagen, with an average yield of 4.93% and maturity of 16.3 years.

Pfizer Q2 2023 Results Overview

We previously covered Pfizer's Q1 2023 results in part 38 of our Top Government Contractors series here. Below we will highlight the progress achieved by the company in Q2 2023.

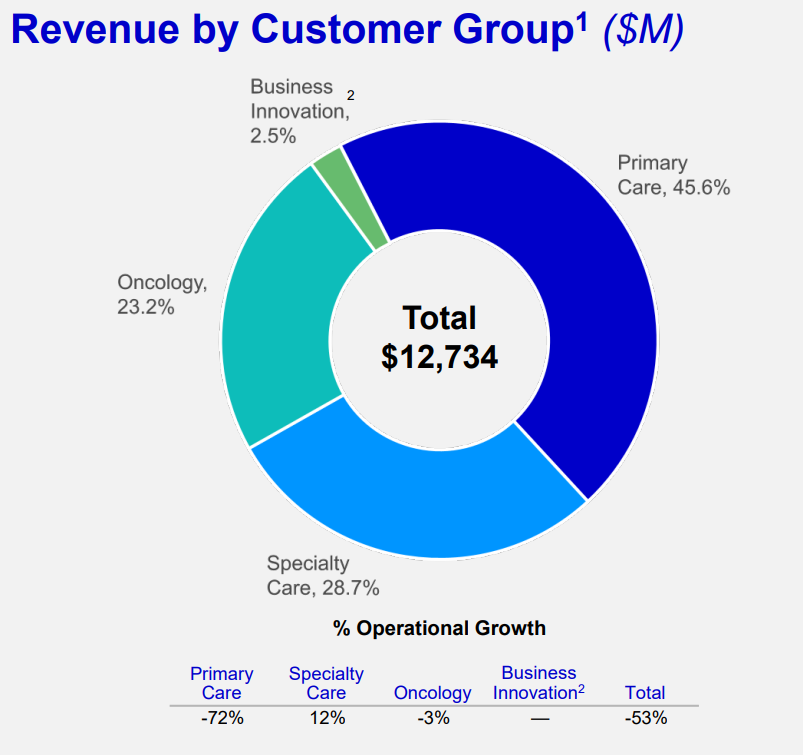

Pfizer reports results in three customer groups, namely Primary Care (Internal Medicine and Vaccines, COVID-19 treatments) at 45.6% of Q2 2023 revenues, Specialty Care (Inflammation & Immunology, Rare Disease and Hospital) at 28.7% revenues and Oncology at 23.2% at of Q2 2023 revenues:

Figure 1: Q2 2023 Pfizer segment revenues

Source: Pfizer Q2 2023 Earnings Presentation

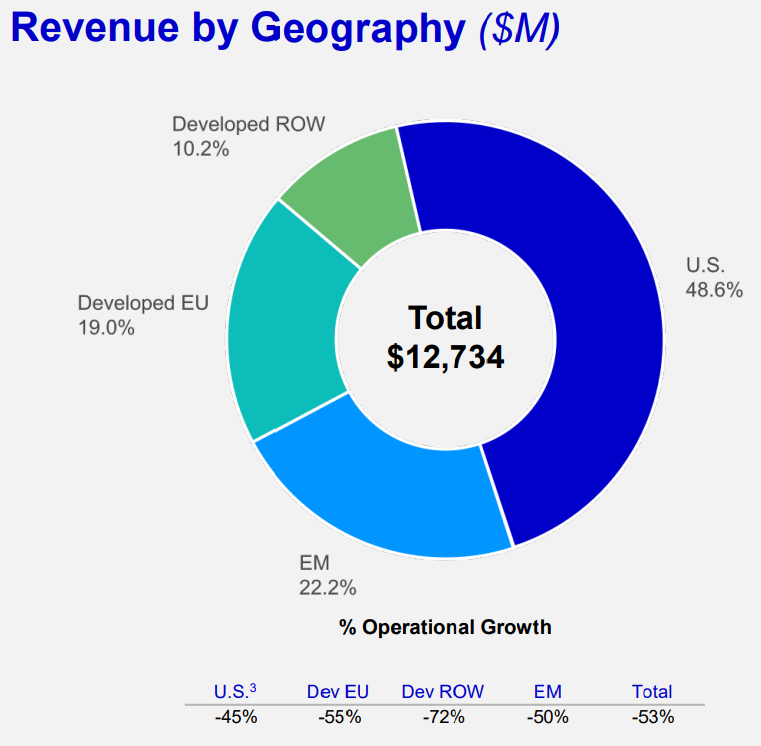

From a geographical perspective, the U.S. is the largest market at 48.6% of Q2 2023 revenues, followed by emerging markets at 22.2%:

Figure 2: Q2 2023 Pfizer revenue by region

Source: Pfizer Q2 2023 Earnings Presentation

Operational Overview

Primary Care was the weakest segment in the quarter, with sales crashing 72.3% Y/Y (2022 +40.4%). The slump was due to weakness in COVID-19 treatments, with the vaccine Comirnaty down 82% while the Paxlovid pill lost 98% of sales Y/Y, with the latter suffering from a transition to traditional commercial markets in the U.S.

Specialty Care was the top performing segment in Q2, growing revenues 8.8% Y/Y (2022 -9%).

Oncology sales were down 4.3% Y/Y in Q2 (2022 -1.6%).

On a consolidated basis, revenue decreased 54% Y/Y (2022 +23.4%). Adjusted Diluted EPS was $0.67/share in Q2 , down 67% Y/Y (full year 2022: $6.58/share). The EPS weakness was the result of both lower COVID-19 product sales as well as higher expenses (+20%) on new product launches.

Excluding COVID-19 products, revenue growth came in at 5% Y/Y, with the company expecting an acceleration going into H2 2023.

Updated 2023 Outlook

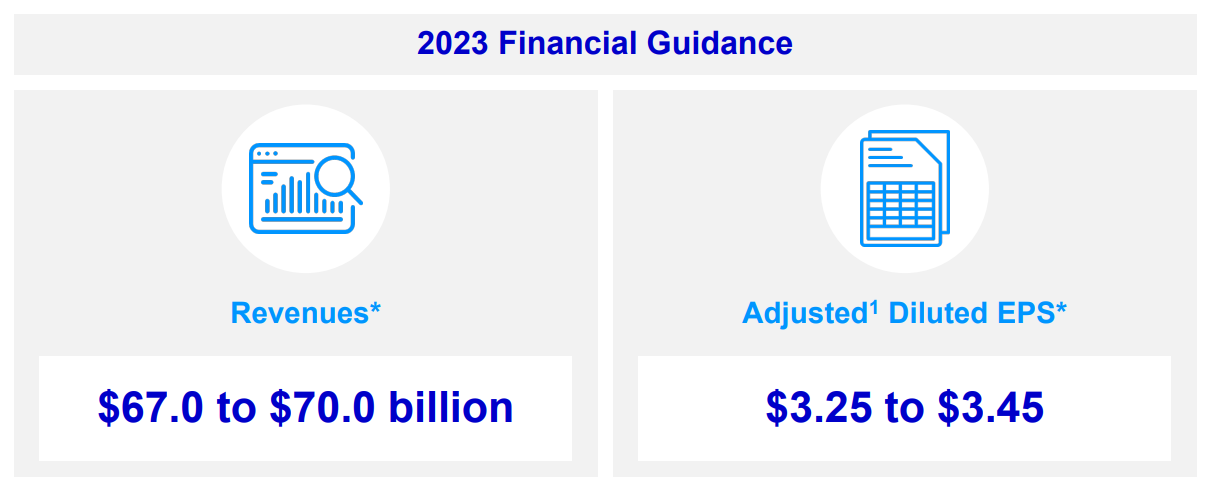

Given the significant declines in COVID-19 revenue, Pfizer marginally lowered its 2023 revenue outlook, with revenue expected to drop around 31.7%:

Figure 3: Pfizer 2023 Updated Outlook

Source: Pfizer Q2 2023 Results Presentation

Despite cutting the top range of its revenue estimate, the outlook for Adjusted diluted EPS was unchanged at $3.25 – 3.45/share, down 49.1% relative to 2022.

Excluding COVID-19 products, revenue growth is now expected at 7% for the full year, down 1% relative to previous assumptions.

As for the high uncertainty surrounding COVID-19 revenues, CEO Albert Bourla expects a good run-rate estimate to be available once Q3 and Q4 have passed:

The good news is we will have much more clarity and certainty regarding how our COVID-19 products will perform in the commercial market by the time we report our third quarter financial results. And we expect the uncertainties to be largely eliminated by the end of the year. This is because we expect the vaccination and treatment rates from the upcoming respiratory disease season to be a reliable predictor of trends in subsequent years, with some potential upside, of course, if a combination flu and COVID-19 vaccine is brought to market in the future.

Capital Structure

During the quarter, Pfizer raised $31 billion on the debt markets to fund its upcoming $43 billion cash acquisition of Seagen (which is still expected to close in late 2023 or early 2024). The new debt carried a weighted average yield of 4.93% and a weighted average maturity of 16.3 years. As a result, the company ended Q2 with a net debt of $20.5 billion against a market capitalization of $190 billion.

Current financial guidance anticipates no incremental share buybacks in 2023 as the company seeks to preserve liquidity.

Conclusion

Pfizer performance likely had a trough in Q2, with weak COVID-19 product sales weighing on results. For the rest of the year, the company should deliver improvement both in COVID-19 sales as well as non-COVID-19 products.

Expenses during the quarter were also elevated (+20% Y/Y) as a result of new product launches, as highlighted by CEO Albert Bourla:

We continue to make progress towards our goal of executing an unprecedented number of launches of new products or indications. In fact, Pfizer is more than halfway of its goal of launching 19 new products or indications in 18 months' time. In addition to the 6 approvals and 5 launches that occurred prior to 2023, we have 6 approvals and 4 launches in the first 6 months of 2023. For the second half of 2023, we expect 6 additional approvals and 6 additional launches, including the 2 launches that occurred in July.

As a result, Pfizer should see both higher sales and margins into the latter part of 2023. The effect will carry into 2024 as well, given the small contribution new product launches had to H1 results this year.

In light of the rapidly evolving revenue outlook for Pfizer, monitoring the company’s public procurement activity remains a smart move that can provide key insights into its financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy Pfizer or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.