It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

It is now time for us to look again at the first company covered in this series. Raytheon Technologies recently reported its Q2 2023 results and below we will provide a brief analysis of the defense contractor’s latest performance.

Key points:

* 12.3% Y/Y revenue growth in Q2, full-year growth now seen at 9.5%.

* EPS increased 11% Y/Y to $1.29/share; 2023 outlook boosted to $4.95 - $5.05, +4.6% relative to 2022.

* Free cash flow outlook cut to $4.3 billion in 2023, down 12.2% Y/Y, impacted by elevated engine inspections at Pratt & Whitney. 2025 target of $9 billion.

* Backlog up 2.7% Q/Q to $185 billion, a new record. Book-to-bill ratio of 1.34 in Q2.

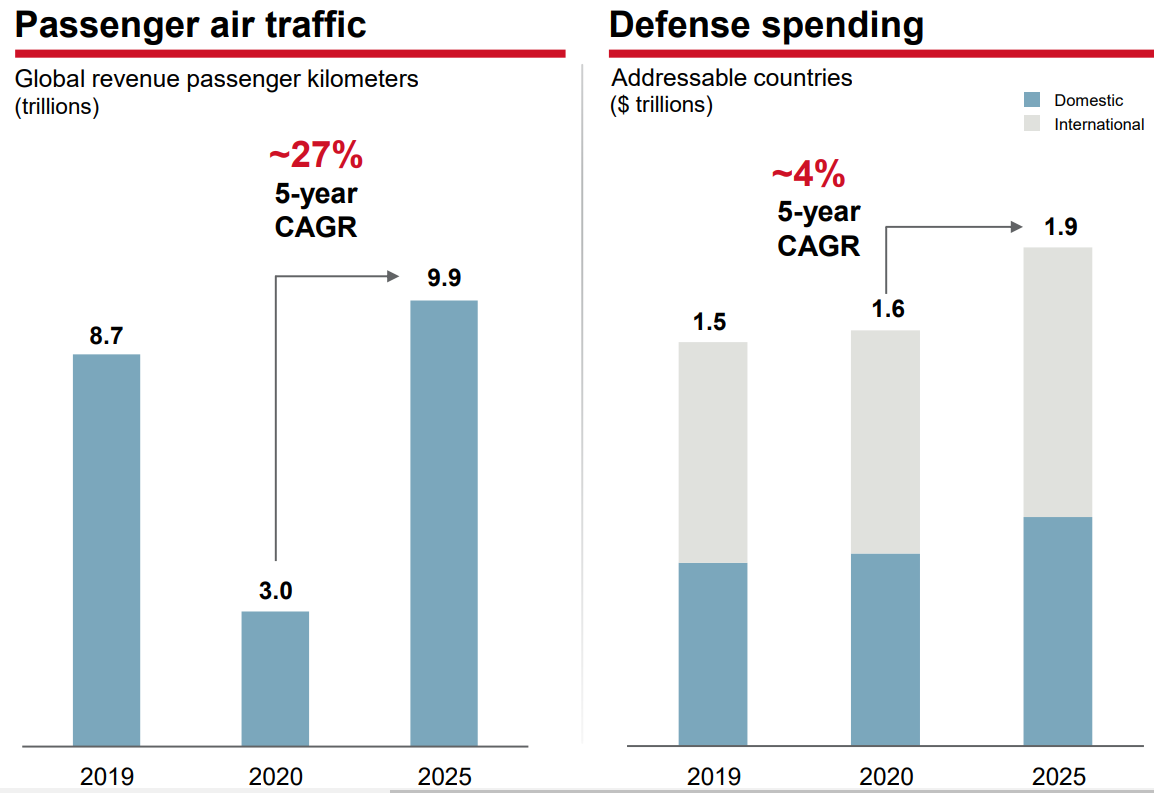

* Global revenue kilometers currently at 95% of 2019 levels; expected to reach 114% by 2025. Defense budgets seen 27% higher in 2025 relative to 2019.

Raytheon Technologies Q2 2023 Results Overview

We previously covered Raytheon's Q1 2023 results in part 27 of our Top Government Contractors series here. Below we will highlight the progress achieved by the company's in Q2 2023.

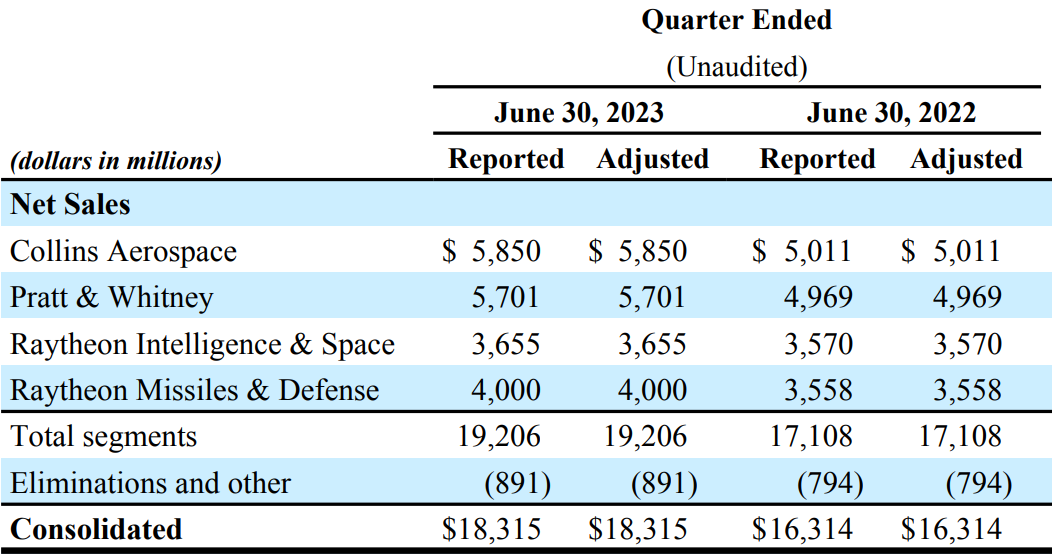

While Raytheon is set to reorganize its segment reporting structure in starting in Q3, the company still splits operations in four segments, namely Collins Aerospace at 30.4% of Q2 2023 net sales, Pratt & Whitney at 29.7%, Raytheon Intelligence & Space (RIS) at 19% and Raytheon Missiles & Defense (RMD) at 20.8% of Q2 2023 net sales:

Figure 1: Sales breakdown between segments

Source: Raytheon Technologies Form 8-K for Q2 2023

Operational Overview

Collins Aerospace delivered the best segment performance in Q2, with revenue up16.7% Y/Y (2022 +11.6%). Sales were primarily driven by strength in the commercial market. Adjusted margin performance, as measured by return on sales (ROS), was equally robust, with ROS rising 2% Y/Y to 14.3% in Q2. As a result, operating profit was 36% above the prior-year level, as Raytheon benefited from increased sales volume and a favourable mix.

Pratt & Whitney was the second-best performing segment - top-line growth was 14.7% Y/Y in Q2 (2022 +13.1%). Growth was entirely driven by the commercial market, with defense sales marginally down. Adjusted ROS was 1.5% higher Y/Y to 7.6% in Q2, driving operating profit 44% above 2022 levels, excluding the impact of a customer insolvency which would have pushed operating profit down 24% Y/Y.

Segment performance at Pratt & Whitney will be negatively impacted in the coming quarters due to a rare condition in powdered metal used to manufacture certain engine parts, requiring early inspection of aircraft engines.

Current production of parts and engines is not affected, with the issue limited to some components produced in 2015 to 2021.

Raytheon Intelligence & Space (RIS) grew sales 2.4% Y/Y in Q2 (2022 -5.7%), with growth coming from Sensing and Effects, as well as Cyber and Services programs. Adjusted ROS was weaker on higher expenses and an unfavourable mix, down 0.7% Y/Y to 8.1%. As a result, operating profit dropped 6% relative to the prior year period.

Raytheon Missiles & Defense (RMD) delivered 12.4% Y/Y revenue growth in Q2 (2022 -4.4%), driven by Air Power, Advanced Technology and Land Warfare & Air Defense segments. Program efficiencies and higher volume pushed adjusted ROS 0.9% higher to 10.7%, resulting in a 23% increase in operating profit.

On a company level, sales increased 12.3% Y/Y in Q2 (2022 +4.2%). Adjusted EPS grew 11% Y/Y to $1.29/share (2022 $4.78/share). Free cash flow was $0.2 billion.

Updated 2023 Outlook

In light of the continuing strong performance Raytheon boosted its 2023 outlook for sales, organic sales growth and adjusted EPS but cut its free cash flow expectations:

- Sales of $73.0 - $74.0 billion, +9.5% Y/Y (2022 $67.1 billion)

- Adjusted EPS of $4.95 - $5.05, +4.6% Y/Y (2022 $4.78/share)

- Free cash flow of $4.3 billion, -12.2% Y/Y (2022 $4.9 billion)

- Organic sales growth of 9-10% in 2023, up from 7-9% in previous outlook.

Crucially the reduced free cash flow outlook is not the result of higher capital expenditures, which are still seen at $2.5 billion, up 9.3% Y/Y. Instead, the lower cash conversion is the result from elevated costs related to the engine issue at Pratt & Whitney.

Capital Structure

Raytheon ended Q2 with a net debt of $30 billion, making it one of the most levered companies in our Top Government Contractors series, in light of its market capitalization of $127 billion.

Year-to-date, the company spent $1.2 billion on share buybacks and confirmed its 2023 target of $3 billion in share repurchases.

Backlog

Despite strong sales growth, the book-to-bill ratio was 1.34 in the quarter, bringing the backlog up 2.7% Q/Q to $185 billion, a new all-time-record for Raytheon. From a customer perspective, 60.5% of the backlog were commercial orders, while defense accounted for the remaining 39.5%, as highlighted on the conference call:

On the defense side, across the RTX businesses, we captured $13 billion in new bookings in the quarter, driving a strong book-to-bill of 1.22, and this takes our defense backlog to $73 billion. Contributing to the backlog in the second quarter were a number of significant awards, including $2 billion at Pratt & Whitney for the Lot 17 of the F135 engines and $1.5 billion for 117 sustainment. The Raytheon segment was awarded its largest-ever AMRAAM contract for $1.2 billion from the U.S. Air Force and international partners, including Ukraine.

2023 Investor Day

On June 19, Raytheon held its investor day. Across its three businesses (starting in Q3, RIS & RMD will merge to form a new division called Raytheon, as highlighted with the Q1 results), the company expects:

- 6-7% adjusted sales growth at Collins Aerospace

- 9-10% adjusted sales growth at Pratt & Whitney

- 3.5-4.5% adjusted sales growth at Raytheon

The company targets free cash flow of $9 billion in 2025, up 84% relative to 2022. The main positive driver will be higher operating profit ($5 billion impact as a result of growing sales and expanding margins) and a smaller R&D tax impact, offset by higher pension contributions and elevated capital expenditures.

Conclusion

Raytheon continues to benefit from the air traffic recovery, with global revenue passenger kilometers now tracking at about 95% of 2019 levels. The company estimates the metric to reach 114% of 2019 levels as soon as 2025, implying further growth for the commercial businesses:

Figure 2: Total addressable market growth

Source: Raytheon Technologies 2023 Investor Day Presentation

As highlighted in Figure 2, the defense business is also set to benefit from expanding military spending around the world, with 2025 defense budgets seen at 127% of 2019 levels.

As a result, despite the near-term negative impact on free cash flow from the engine issue at Pratt & Whitney, Raytheon is on track to achieve significant top-and-bottom line growth in the years ahead.

In light of the fact that defence orders account for about 39.5% of Raytheon Technologies’ backlog, monitoring the company’s public procurement activity also remains a smart move that can provide key insights into its financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy Raytheon Technologies or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.