It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

It is now time for us to look again at a company we covered previously in this series. Raytheon Technologies recently reported its Q1 2023 results and below we will provide a brief analysis of the defense contractor’s performance in the first 3 months of the year.

Key points:

* US revenue passenger miles back to 2019 levels; International at 80% with a 2019 level run-rate expected by the end of 2023.

* Revenue up 9.5% Y/Y in Q1, driven by commercial customers. Outlook for 2023 unchanged at +8%.

* Adjusted EPS +6% Y/Y in Q1 to $1.22/share (2022 $4.78/share). Outlook for 2023 unchanged at $4.90 - $5.05, +4.1% Y/Y.

* Backlog up 2.9% Q/Q to a record $180 billion. Q1 book-to-bill of 1.25.

* Free cash flow negative at $1.4 billion in Q1. Outlook of $4.8 billion in 2023 unchanged (2022 $4.9 billion).

Raytheon Technologies Q1 2023 Results Overview

We originally covered Raytheon's Q4 2022 results in part 2 of our Top Government Contractors series here. Below we will highlight the company's Q1 2023 results.

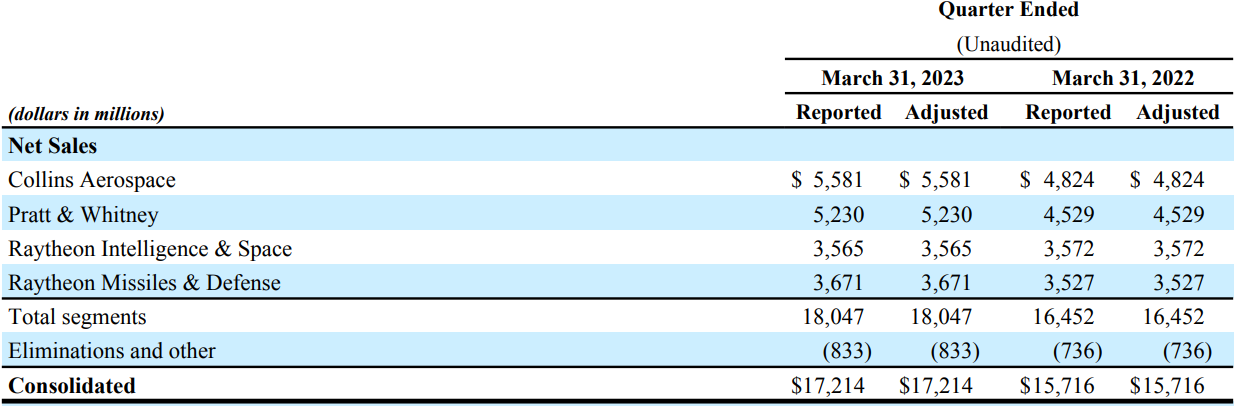

While Raytheon is set to reorganize its segment reporting structure in July 2023, the company still splits operations in four segments, namely Collins Aerospace at 30.9% of Q1 2023 net sales, Pratt & Whitney at 29%, Raytheon Intelligence & Space (RIS) at 19.8% and Raytheon Missiles & Defense (RMD) at 20.3% of Q1 2023 net sales:

Figure 1: Sales breakdown between segments

Source: Raytheon Technologies Form 8-K for Q1 2023

The company also unveiled the outlines of the new Raytheon segment, which will largely combine RIS & RMD:

Figure 2: Business movements across reporting segments

Source: Raytheon Technologies Results Presentation for Q1 2023

Further details will be unveiled at the company's Investor Day at the Paris Air Show on June 19th.

Raytheon Technologies Operational Overview

Collins Aerospace delivered the best segment performance in Q1, with revenue up15.7% Y/Y (2022 +11.6%). Sales were driven by commercial customers benefiting from the air traffic recovery, while military revenues increased 9%. Adjusted operating profit was up 37% Y/Y helped by better margins (operating margin, also referred to as return on sales (ROS), increased by 2.2% Y/Y to 14.3%).

Pratt & Whitney top-line growth was 15.5% Y/Y in Q1 (2022 +13.1%). Growth drivers mirrored Collins Aerospace, albeit with a stronger military sales growth of 13% Y/Y. Adjusted operating profit grew 41% Y/Y, buoyed by ROS increasing 1.5% to 8.3% in Q1.

Raytheon Intelligence & Space (RIS) was the only segment to register a 0.2% sales decline Y/Y (2022 -5.7%). Despite flat sales, operating profit was down 14% Y/Y, with ROS down 1.5% to 9.1%.

Raytheon Missiles & Defense revenues grew 4.1% Y/Y in Q1 (2022 -4.4%). Adjusted operating profit was disappointing given the top-line growth, as it recorded a 13% decrease, again weighed by ROS dropping 1.9% to 9.1% in the quarter.

On a company level, sales increased 9.5% Y/Y in Q1 (2022 +4.2%). Adjusted EPS grew 6% Y/Y to $1.22/share (2022 $4.78/share). Operating profit growth of 15% was partially offset by lower pension income and a higher tax rate. Free cash flow was off to a slow start at negative $1.4 billion. The company is confident in boosting cash flow conversion in the remainder of the year.

2023 Outlook

Despite a strong start of 2023, Raytheon did not increase its full year outlook:

Sales of $72.0 - $73.0 billion, +8% Y/Y (2022 $67.1 billion)

Adjusted EPS of $4.90 - $5.05, +4.1% Y/Y (2022 $4.78/share)

Free cash flow of $4.8 billion, -2% Y/Y (2022 $4.9 billion)

Share repurchase of $3.0 billion, +7% Y/Y (2022 $2.8 billion)

Nevertheless, both sales (+9.5% Y/Y) and Adjusted EPS (+6% Y/Y) are running in the top range of the outlook. Hence, we reckon a guidance update is on the cards if momentum carries into the rest of the year.

Capital Structure

In light of the slow cash conversion at the beginning of the year and ongoing share repurchases ($560 million spent on buybacks in Q1), net debt ended Q1 at $28.6 billion, relatively elevated against the market capitalization of $149.5 billion.

Nevertheless, given the ambitious $9-10 billion free cash flow aspiration for 2025 the debt position is not a major concern.

Backlog

Despite strong sales growth, the book-to-bill ratio was 1.25 in the quarter, bringing the backlog up 2.9% Q/Q to $180 billion, an all-time-high for Raytheon. From a customer perspective, 60.5% of the backlog were commercial orders, while defense accounted for the remaining 39.5%

Conclusion

Raytheon continues to benefit from the commercial air traffic recovery. US revenue passenger miles (RPMs), an aviation industry metric tracking miles travelled by passengers, are back to pre-pandemic levels. On the other hand, international RPMs stand at around 80% of 2019 levels. The company expects international RPMs to reach a 2019 run-rate as we exit 2023.

On the defense side, Raytheon benefits from the 3% increase in the 2024 defense budget proposal, which is on top of the 10% growth achieved in this fiscal year.

In light of the fact that defence orders account for about 39.5% of Raytheon Technologies's backlog, monitoring the company’s public procurement activity also remains a smart move that can provide key insights into its financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy Raytheon Technologies or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.