It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

It is now time for us to look again at a company we covered previously in this series. Science Applications International Corporation recently reported its fiscal 2024 Q1 results and below we will provide a brief analysis of the company’s performance.

Key points:

* 98% government contracting exposure. Around 20% of revenues come from the civil space, military space and intel space domain;

* 2% revenue growth Y/Y in Q1. Full year sales seen down 6.8% on the Supply Chain business disposal;

* Adjusted EPS up 14% Y/Y in Q1 to $2.14/share. Full year outlook boosted to $7.1/share, still down 6% Y/Y on deleveraging;

* Backlog flat Q/Q with a book-to-bill of 1.10 in Q1 and 1.00 for the trailing twelve months;

* Net debt of circa $2 billion after business disposal. Free cash flow guidance unchanged at about $470 million.

SAIC Fiscal 2024 Q1 Results Overview

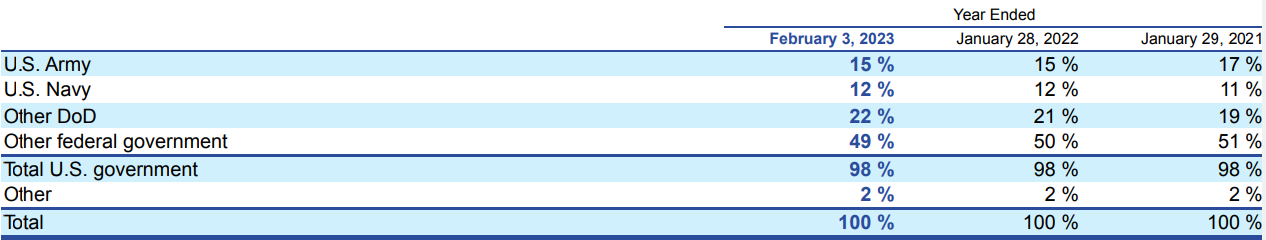

Science Applications International, which we will refer to as SAIC hereafter, provides technical, engineering and enterprise IT services primarily to the U.S. government, which accounts for 98% of SAIC revenues in the last three fiscal years:

Figure 1: Science Applications International customer breakdown, 2021-2023

Source: Science Applications International Q4 2023 Form 10-K

SAIC utilizes a 52/53 week fiscal year ending on the Friday closest to January 31. We originally covered the company's Q4 fiscal 2023 results in part 24 of our Top Government Contractors series here. Below we will highlight how the company started the first quarter of fiscal 2024.

Operational Overview

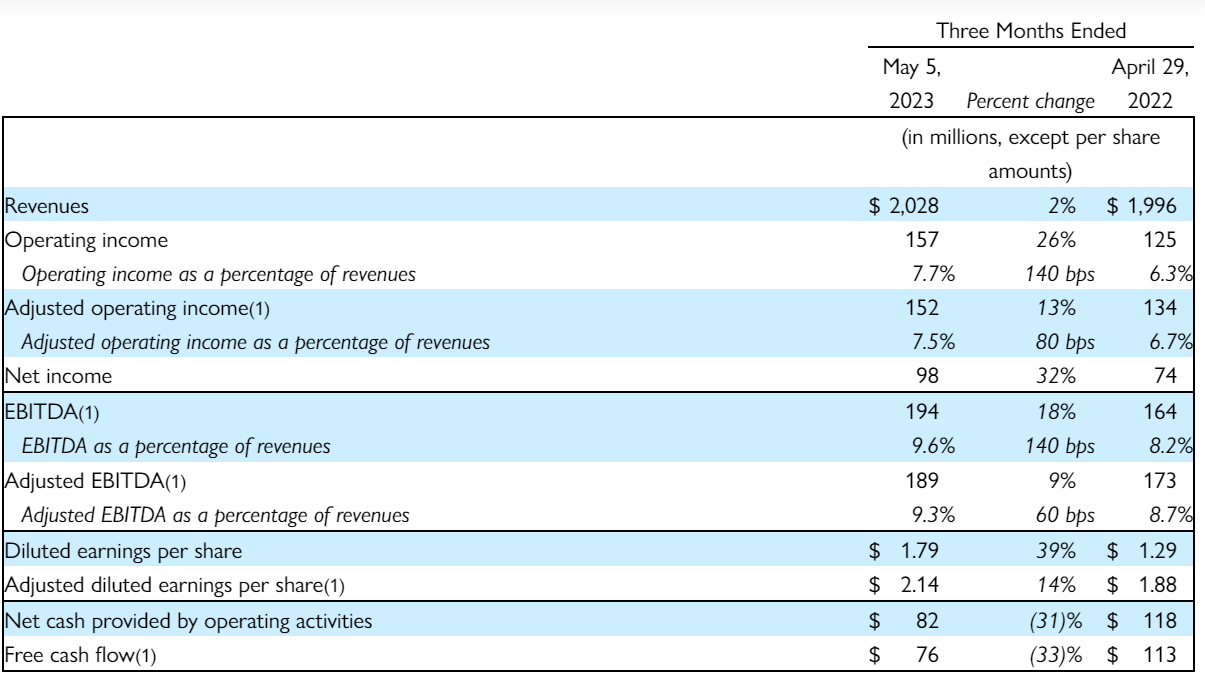

Revenue grew 2% Y/Y in Q1 (2023 +4%), driven by a ramp up on new and existing contracts. Excluding a business divestment that is no longer consolidated but accounted for under the equity method instead, growth would have been 3.5%.

Adjusted EBITDA increased 9% Y/Y in Q1 (2023 -1%), driven by a 0.6% margin improvement to 9.3% on lower indirect costs, as highlighted by CEO Nazzic Keene:

We remain on track to deliver at least 50 basis points of margin improvement in fiscal year '24 through a combination of our portfolio-shaping and our organic initiatives.

Adjusted EPS gained 14% Y/Y in Q1 to $2.14/share (2023 $7.55/share), helped by a 3.2% reduction in share count and a lower tax rate. Free cash flow was down 33% Y/Y to $76 million in Q1 (2023 $457 million) on the timing of payroll payments, as explained by CFO Prabu Natarajan:

...quarterly free cash flow in FY '24 will be impacted by the timing of payroll cycles with one additional payroll cycle in our first quarter, representing a roughly $100 million headwind. We expect this to reverse in our second quarter, be a headwind again in our third quarter, and then the reverse to a tailwind in our fourth quarter.

Figure 2: SAIC Q1 2024 results

Source: SAIC Q1 2024 Earnings Release

Sale of Logistics & Supply Chain Management business

SAIC made progress on the sale of its Supply Chain business, receiving $355 million on March 23 as a cash deposit. The transaction closed subsequent to the end of the quarter. The company is set to pay $82 million in cash taxes and fees related to the sale.

Updated Fiscal 2024 Outlook

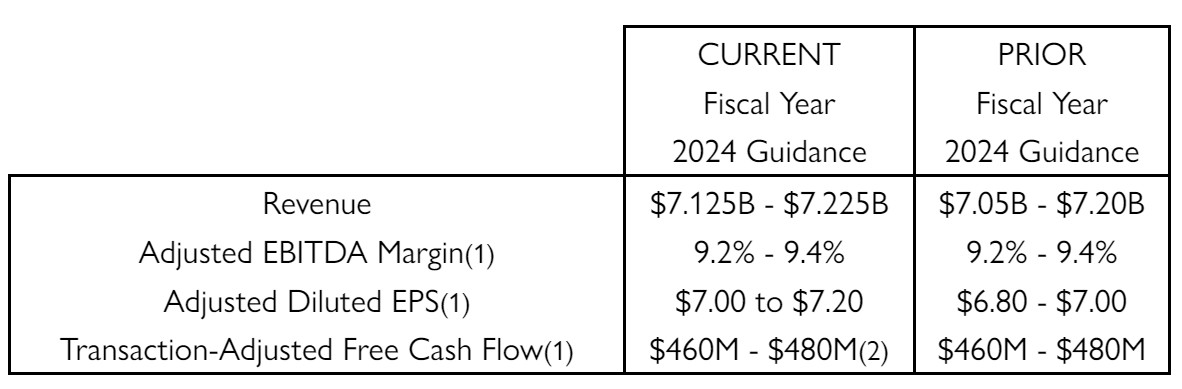

Following a successful start of the year, SAIC raised its revenue and adjusted EPS guidance for fiscal 2024:

Figure 3: Science Applications International Updated 2024 Guidance

Source: Science Applications International Q1 2024 Earnings Release

Revenue is seen at about $7.18 billion, down 6.8% on a reported basis, with underlying business momentum only partially compensating the Logistics & Supply Chain management business exit.

Adjusted diluted EPS is expected at $7.1/share, down 6% Y/Y.

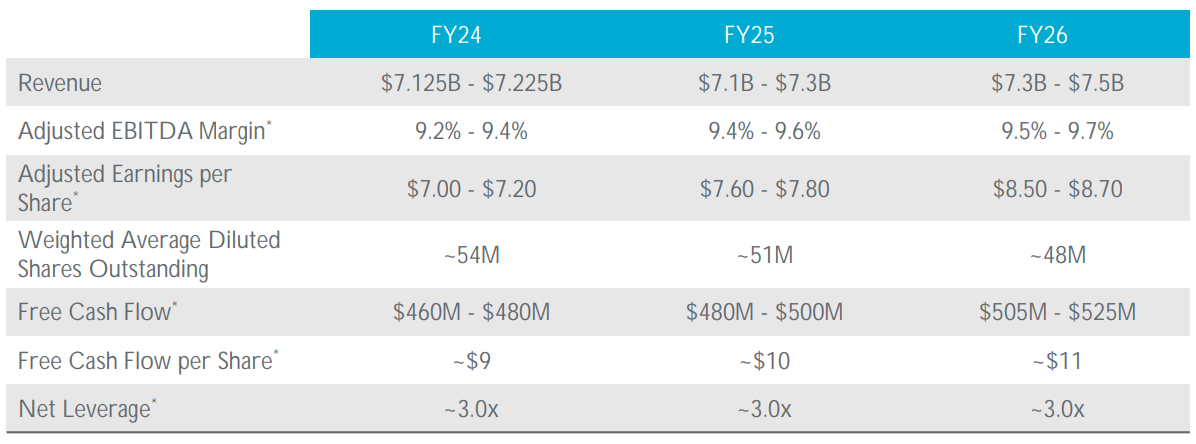

It should be noted that despite the stronger-than-expected performance in fiscal 2024, EPS and revenue guidance for '25-'26 remains unchanged:

Figure 4: Science Applications International 2024-2026 Targets

Source: Science Applications International Q1 2024 Earnings Presentation

The constant outlook for '25-'26 is due to the fact that outperformance in 2024 will be largely due to the Supply Chain business which has been sold as highlighted above.

Backlog

Total backlog was flat Q/Q at $23.8 billion. The book-to-bill ratio was 1.1 in Q1 and 1.00 for the trailing twelve months. CEO Nazzic Keene remained optimistic on progress towards Growth and Technology Accelerants (GTAs):

Looking ahead, our pipeline and backlog of submitted proposals remained strong, with solid growth overall and within our GTAs specifically. At the end of our first quarter, the value of our submitted proposals was $26 billion, an increase of 10% year-over-year, while our total qualified pipeline was up approximately 8% year-over-year. Importantly, our pipeline continues to skew favorably towards the higher-margin areas of our portfolio with approximately 50% of the contract award portion of our qualified pipeline aligning with our GTAs.

Capital Structure

SAIC ended Q1 with a net debt of about $2 billion, retaining the position of one of the most indebted government contractors in our series, in light of its $6 billion market capitalization.

In Q1 SAIC spent $70 million on buybacks, $21 million on dividends and $6 on capex. Full-year allocation to buybacks seen at $350-400 million.

Conclusion

As one of the more financial levered players in the government contracting market, SAIC is in a position to benefit from interest rate cuts expected from the Federal Reserve in '24-'25.

From an operational perspective, the company is on track to deliver its 2-4% organic growth aspiration. A new CEO, Toni Townes-Whitley, will replace outgoing CEO Nazzic Keene on October 2. A focus area for the new CEO may be the space domain, as highlighted by CFO Prabu Natarajan:

...Really a big picture about a fifth of the portfolio has space exposure. And as Nazzic pointed out, that's a combination of civil space, military space and intel space. And the portfolio is pretty well-balanced across the GTA areas as well as sort of the core mission engineering side of the portfolio. There is a fair amount of SETA /Systems Engineering and Technical Assistance/ inside our space business. And so, there is -- that's predominantly into intel space area.

In light of the fact that 98% of SAIC sales were to the U.S. government in each of the last three fiscal years, monitoring the company’s public procurement activity remains a smart move that can provide key insights into its financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy SAIC or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.