It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

It is now time for us to look again at the first company covered in this series. Textron recently reported its Q2 2023 results and below we will provide a brief analysis of the contractor’s latest performance.

Key points:

* In Q2 2023, 19.8% of all sales were to the U.S. government. New FLRAA program to contribute $800-900 million in annual sales to the Bell segment, or about 27.5% of 2022 Bell sales;

* 8.6% Y/Y revenue growth in Q2, driven by Aviation and Industrial segments;

* Adjusted Earnings per share grew 31.5% Y/Y in Q2 to $1.46/share. Full year outlook increased to $5.20-5.30/share, +18% Y/Y;

* Backlog grew 8.8% Q/Q to $14.3 billion, driven by a 21.4% increase at Bell;

* Manufacturing cash flow before pension contribution outlook unchanged at $0.9-1 billion, down 19.4% Y/Y. $650 million spent on share buybacks year-to-date.

Textron Q2 2023 Results Overview

We previously covered Textron's Q1 2023 results in part 33 of our Top Government Contractors series here. Below we will highlight the progress achieved by the company in Q2 of 2023.

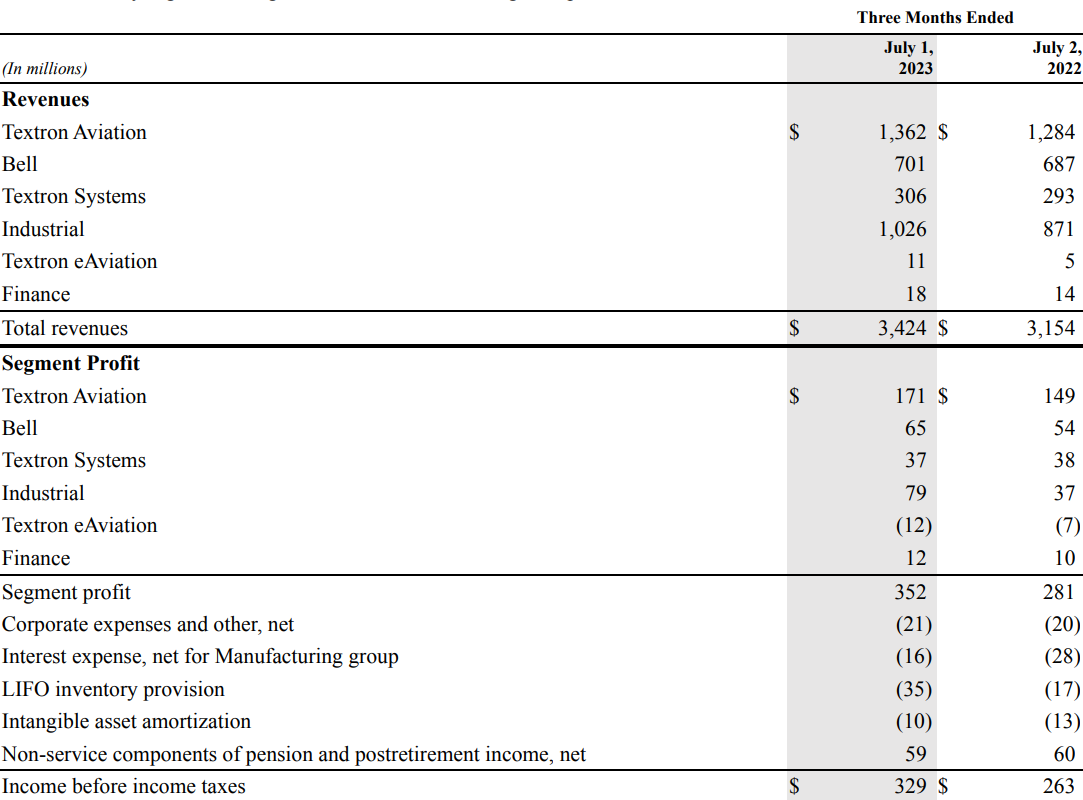

Textron reports results in four main manufacturing segments, namely Textron Aviation (aircraft and aftermarket parts and services) at 39.8% of Q2 2023 revenues, Industrial (fuel systems and functional components; golf cars and specialized vehicles) at 30%, Bell (helicopters, tiltrotor aircraft and related services) at 20.4% and Textron Systems (drones, defense specialty vehicles) at 8.9% of Q2 2023 revenues:

Figure 1: Q2 2023 Textron segment results

Source: Textron Q2 2023 Form 10-Q

Operational Overview

Textron Aviation grew sales 6.1% Y/Y in Q2 (2022 +11.1%). Growth was driven by higher pricing which offset lower volumes. The profit margin increased 1% Y/Y to 12.6%. Overall, segment profit was up 14.8% Y/Y. Management expects further margin improvement going forward.

Bell was the weakest segment in the quarter, with revenue up only 2% Y/Y in Q2 (2022 -8.1%). Strength in commercial sales helped offset weakness in military aircraft. The profit margin was up 1.4% Y/Y to 9.3%, boosting segment profit by 20.4% Y/Y.

Textron Systems grew sales 4.4% Y/Y in Q2 (2022 -7.9%). Revenues were primarily driven by higher volumes. The profit margin was down by 0.9% Y/Y to 12.1%, which resulted in a segment profit 2.6% lower than the prior-year period.

Industrial was the best performing segment in Q2, growing sales by 17.8% Y/Y (2022 +10.7%), driven by both higher volumes and better pricing. The profit margin was substantially higher, +3.5% Y/Y to 7.7%. This pushed segment profit up a stunning 113.5% Y/Y. However, CEO Scott Donnelly highlighted some weakness to be expected in Q3:

Now as you know, there is a certain seasonality of these businesses. In autumn, we do a lot of summer shutdowns and things like that, so second quarter is usually a stronger quarter. Third quarter is usually a little bit lighter in terms of the revenue on those businesses. But look, net of the whole thing, I think the demand environment has been improving, and our teams are doing a nice job of executing on that.

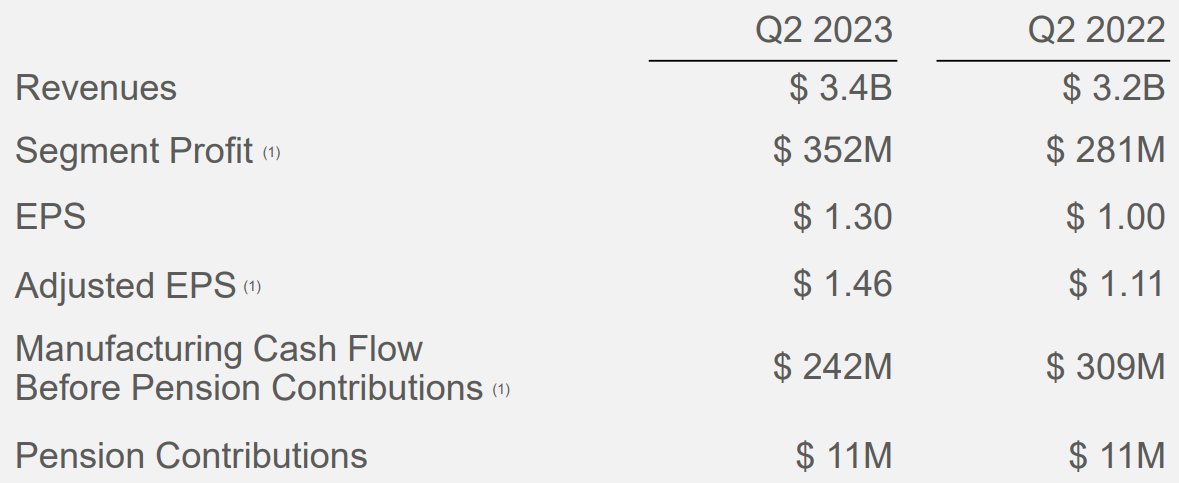

On a group level, revenue was up 8.6% Y/Y in Q2 (2022 +3.9%):

Figure 2: Textron Q2 2023 Results Overview

Source: Textron Q2 2023 Results Presentation

Adjusted Earnings per share grew 31.5% Y/Y in Q2 to $1.46/share. Cash conversion was weaker however, with manufacturing cash flow before pension contribution down 21.7% Y/Y to $242 million in Q2 (2022 $1,178 million).

Updated 2023 Outlook

With top-line performance accelerating relative to Q1, Textron boosted its adjusted EPS outlook but kept its cash flow expectations intact:

- Adjusted EPS should grow 18% Y/Y to $5.20-5.30/share (previous guidance 5.00 to 5.20/share).

- Manufacturing cash flow before pension contribution (of about $50 million) is expected to drop 19.4% to $0.9-1 billion.

- From a segment perspective, Aviation underperformed initial expectations while Industrial beat management's outlook.

Backlog

Total backlog increased 8.8% Q/Q to $14.3 billion, driven by a 21.4% increase at Bell related to the Future Long Range Assault Aircraft Program (FLRAA), as highlighted on the conference call:

Bell began ramping activity on the FLRAA program, including on-boarding engineers, contracting with major suppliers and ordering long lead materials. Bell also added $1.2 billion of backlog related to the FLRAA contract during the quarter. Also in the quarter, Bell received an initial contract authorization for four additional V-22 aircraft.

Capital Structure

Textron ended Q2 2023 with a net debt of $1.79 billion, largely flat Q/Q. With a market capitalization of $15.6 billion, the debt portion is in the low end compared to peers in our Top Government Contractors series.

In the quarter, Textron returned $273 million to shareholders through share repurchases (2022 $867 million), bringing the year-to-date total to $650 million, or 9.4 million shares. In July, Textron approved a new authorization for the repurchase of up to 35 million shares under which the company intends to repurchase shares to offset the impact of dilution from stock-based compensation and benefit plans, as well as for opportunistic capital management purposes.

Conclusion

Bell returned to growth in Q2, with CFO Frank Connor expecting the new FLRAA program to contribute $800 to $900 million in annual revenue in the coming years. For reference, total Bell revenue in 2022 was $3,091 million.

The aviation segment also showed strong performance, driven in part by demand for training aircraft from flight schools. Boeing recently projected demand for 649 000 new commercial pilots worldwide over the next 20 years. Supply chains are also improving in the Aviation segment, albeit slowly.

In Q2 2023, 19.8% of all sales were to the U.S. government, down from the prior-year level of 21.4%.

Given the substantial impact major contract awards can have at niche businesses such as Bell, monitoring the Textron’s public procurement activity also remains a smart move that can provide key insights into its financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy Textron or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.