After providing in-depth analyses of some individual information technology/services companies in our Top government contractors series (such as IBM in part 46 here) we decided to take a sector approach and observe what trends drove information technology/services company performance in the first half of H1 2023, potentially looking into the second half of the year as well. After covering the Defense sector in our previous sector article, we plan to highlight the healthcare sector next.

Key points:

* Revenue growth in our selection was only 0.8% Y/Y in H1 2023. Across sub-sectors, Hardware IT revenue slumped 10.9% while professional services grew 4.23%.

* Looking into H2 2023, Hardware IT companies anticipate a return to growth, while professional services businesses should see sales grow in-line with or slightly stronger to the H1 2023 pace.

* Net income margins largely held up across the two sub-sectors, notwithstanding individual companies experiencing difficulties.

* Mid-single digit annual recurring revenue growth in software/services divisions of Hardware IT companies and book-to-bill ratios of 1.0x or higher at Professional services businesses point to slightly expanding revenues in the sector looking forward.

* Unlike Defense and Industrial government contractors showing strong topline but mixed net margin results on supply chain issues, IT & Services government suppliers are navigating the weaker revenue environment better, delivering consistent profitability.

Revenue Developments

Information technology/services companies doing significant government business enjoyed a weak first half from a revenue perspective, with two companies reporting double-digit revenue declines in the period:

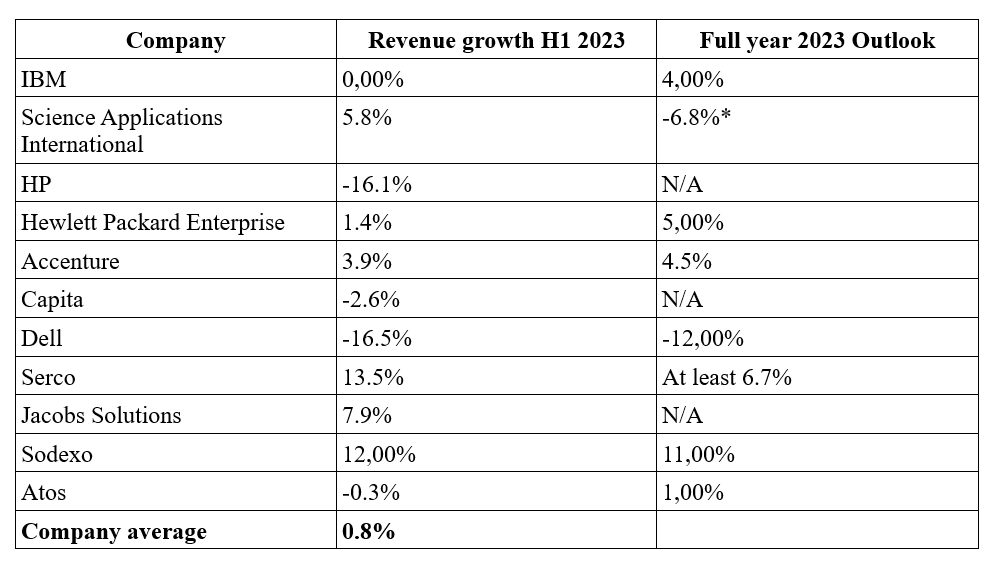

Figure 1: Year-over-year revenue trends at select large government contractors

Source: Company disclosures for H1 2023. *Science Applications International Outlook is for Fiscal 2024 ending in February '24 and is impacted by divestments.

Across the eleven companies in our list, top-line growth came in at 0.8% on average, or 1.4% taking the median growth of Hewlett Packard Enterprise.

From a sub-sector perspective, the weakness was concentrated in the IT companies with a hardware component of the business (IBM, HP, Dell). Hardware IT companies reported a 10.9% decrease in sales in H1.

At the other end of the spectrum, professional services companies delivered 4.23% revenue growth in H1.

Looking into H2, companies are generally optimistic that revenue growth will pick up from the lackluster H1 pace:

- Hardware IT expect revenue to start growing in H2, partially compensating the slump in H1 revenues.

- Professional services companies largely see growth continuing at the H1 pace, or marginally accelerating.

Net Income Developments

Net income margin developments were largely positive, with the majority of companies delivering net income growth in excess of revenue growth:

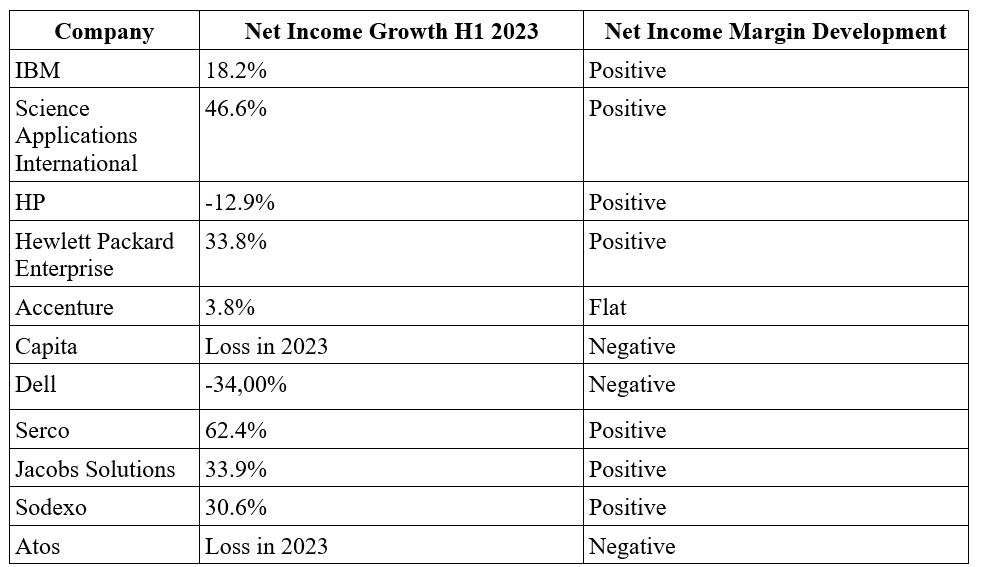

Figure 2: Year-over-year net income trends at select large government contractors

Source: Company disclosures for H1 2023

From a sub-sector perspective, both Hardware IT and Professional services companies had individual businesses experiencing deteriorating margins, but the two sub-groups showed margin improvement nevertheless.

Revenue resilience

We will now highlight backlog, annual recurring revenue (ARR) growth and book-to-bill ratios where reported at the companies in our coverage:

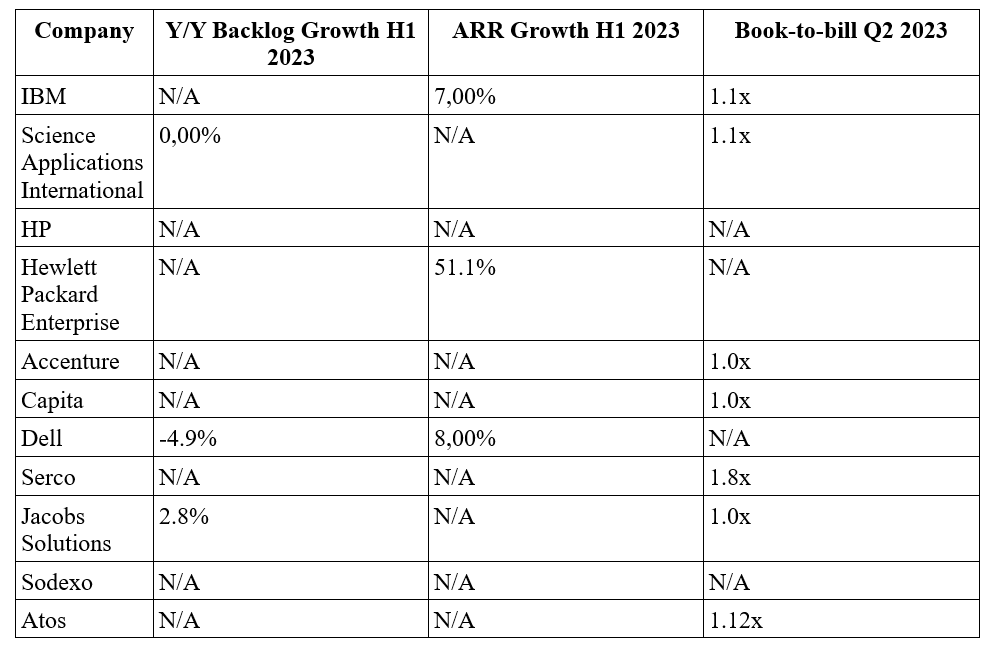

Figure 3: Year-over-year backlog, annual recurring revenue (ARR) and book-to-bill trends at select large government contractors

Source: Company disclosures for H1 2023

Although unification and comparability of business performance indicators in the services sector leaves much to be desired, Hardware IT reported mid-single digit annual recurring revenue growth in their software/services divisions. Professional services companies likewise saw book-to-bill ratios of 1.0x or higher, pointing to a flat/slightly expanding revenue growth rate in the sector looking forward.

Conclusion

Unlike Top Industrial and Defense government contractors which generally saw strong top-line growth but mixed bottom-line performance, information technology/services companies delivered only 0.8% revenue growth in H1 2023, but managed to do so with stable or improving margins.

Hardware IT companies reported a 10.9% decrease in H1 2023 sales, However under the surface, the weakness was largely due to slowing hardware sales, with companies posting annual recurring revenue growth in their software divisions in the high single digits. Hardware IT companies generally expect a return to sales growth in H2 2023.

Professional services companies saw steady 4.23% revenue growth in H1, with improving margins and book-to-bill ratios pointing to revenues increasing at a constant or marginally higher rate.

Given the significant impact government contract wins can have on company financials, monitoring public procurement activity remains a smart, yet lesser-known move that can give an advantage when assessing the impact of new tender awards. This was examined in TenderAlpha's 'Government Receivables as a Stock Market Signal' white paper.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy any stock mentioned within. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.