It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

It is now time for us to look again at the first company covered in this series. Boeing recently reported its Q2 2023 results and below we will provide a brief analysis of the contractor’s latest performance. To read our analyses of Boeing's results in the previous two quarters, please follow the links below:

Part 4: Boeing: Improving Free Cash Flow Generation to Allow Debt Payback (Q4 2022)

Key points:

* 38.2% of Q2 revenues from government contractors (2022 40%);

* 18.4% revenue growth in Q2, driven by Commercial Airplanes (+41.3%), with operating margins at the division seen turning positive as early as Q1 2024;

* Defense, Space and Security segment performance hampered by charges on fixed price programs;

* 7.1% Q/Q backlog growth to $440 billion, with Commercial Airplanes now accounting for 82.5% of all backlog;

* $3-5 billion 2023 free cash flow target confirmed as net debt cut by $2.1 billion Q/Q to $38.5 billion.

Boeing Q2 2023 Results Overview

We previously covered Boeing's Q1 2023 results in part 29 of our Top Government Contractors series here. Below we will highlight the progress achieved by the company in Q2 of 2023.

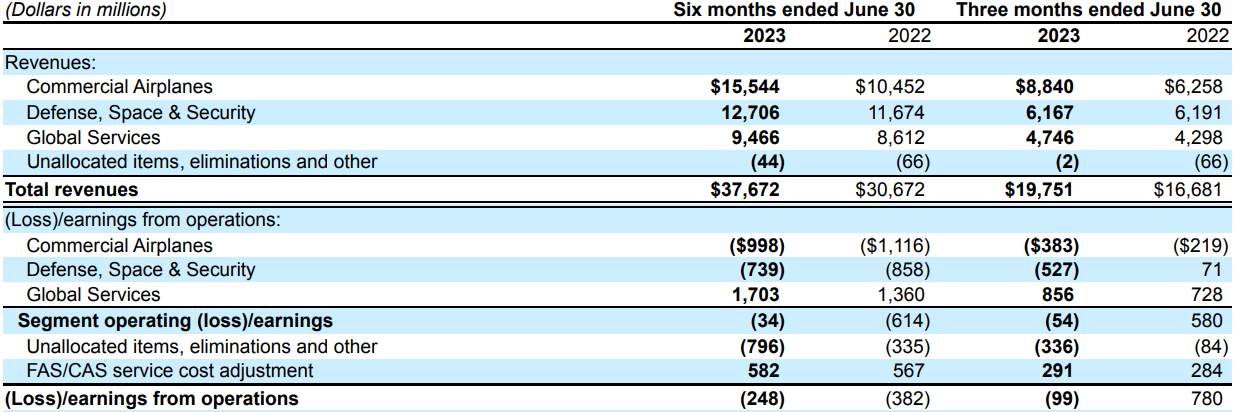

Boeing reports results in three main segments, namely “Commercial Airplanes” (BCA) at 44.8% of Q2 2023 revenues, “Defense, Space & Security” (BDS) at 31.2% and “Global Services” (BGS) at 24% of Q2 2023 revenues:

Figure 1: Sales breakdown between segments

Source: Boeing Form 10-Q for Q2 2023

Operational Overview

Commercial Airplanes was the best performing segment in Q2, growing revenues at 41.3% Y/Y (2022 +32.7%). The operating margin deteriorated by 0.8% Y/Y and remains negative at -4.3%. As a result, the operating loss increased by 75% Y/Y, impacted by higher R&D spending and abnormal production costs.

The fitting issue concerning 737 airplanes (highlighted in our previous article) was resolved in May.

Defense, Space & Security was the only segment to register a 0.4% Y/Y revenue drop in Q2 (2022 -12.7%). Despite the flat top-line results, operating margins were significantly weaker, down 9.6% Y/Y to negative 8.5%, pushing the division to an operating loss from a prior-year positive result. The weak performance was the result of unfavourable cumulative contract catch-up adjustments and losses on development programs, as highlighted on the conference call:

Given the fixed-price nature of some of our contracts, we're very transparent about these financial impacts and we're working to stabilize, to derisk and mature them through development. Quarterly charges have declined significantly over the last 18-months. Demand side of BDS is strong. We see solid order activity. In the quarter we booked orders valued at $6 billion including key contracts from the US Army for 19 Chinooks, and Germany also shared its plans to purchase 60 Chinooks. We remain confident in our Defense business. Demand is strong and we will continue to improve operational performance to more normalized levels.

Global Services grew sales at +10.4% Y/Y in Q2(2022 +7.9%). It remains the only segment with a positive operating margin, improving by 1.1% Y/Y to 18%. This pushed operating earnings up 17.6% Y/Y. The strong performance was driven by gains in both commercial and government services revenue.

On a consolidated level, sales increased 18.4% Y/Y in Q2 (2022 +6.9%), Core loss per share was $0.82/share (2022 full-year loss of $11.06/share), free cash flow was $1.8 billion year-to-date (2022 +$2.3 billion). The core operating margin deteriorated by 5% Y/Y and was negative at -2%.

2023 Outlook

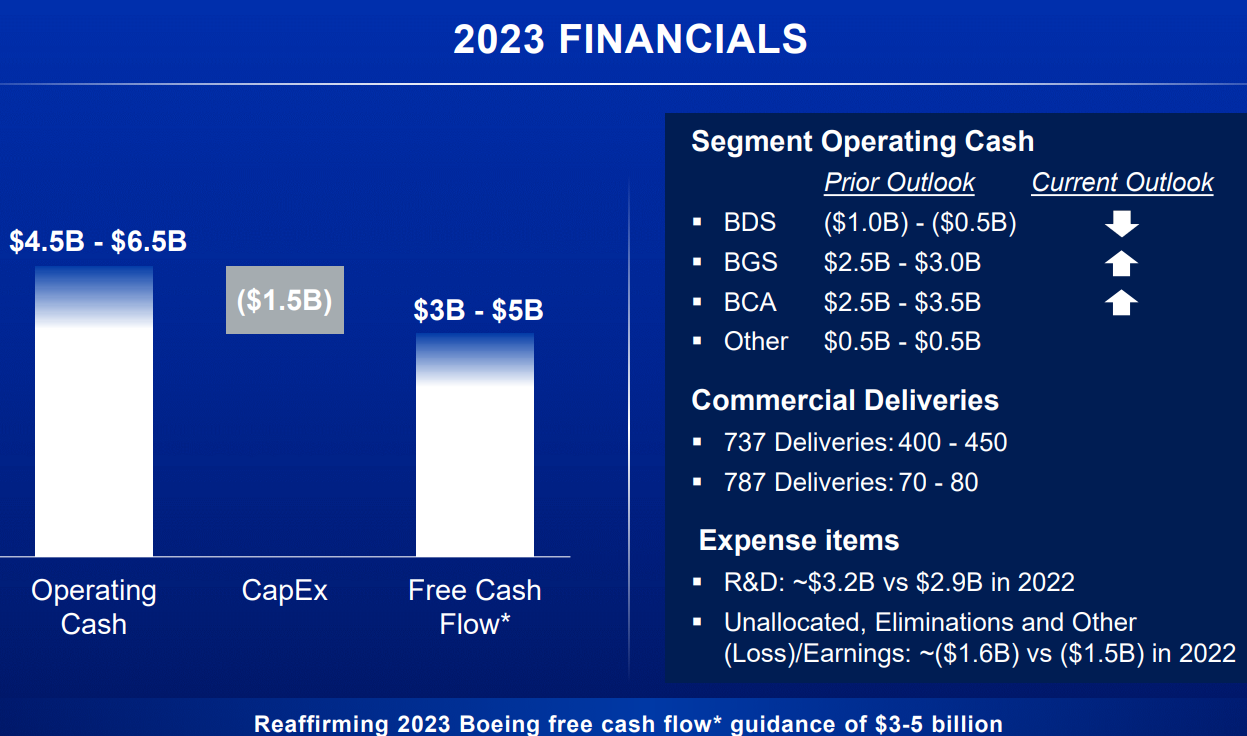

With most of 2023 in the rear-view mirror, Boeing confirmed its top-line free cash flow outlook, with weakness at BDS offset by strength in BCA and BGS:

Figure 2: Boeing Cash Flow Outlook for 2023

Source: Boeing Earnings Presentation for Q2 2023

The underperformance at BDS is set to fade only gradually, as explained on the conference call by CFO Brian West:

Looking at BDS in aggregate, it will take time to return to normalized levels of performance. We're confident and we're focused on the path to high single-digit margins in 2025-2026. A strong demand across the customer base, the portfolio is well positioned, and we're focused on execution.

Looking into the second half of the year, Brian West added:

Relative to the first half of 2023, we continue to expect operating and financial performance to improve in the second half. On the third quarter specifically, we expect BCA margins to improve sequentially, but remain negative and we're not anticipating much in terms of BDS profitability.

Backlog

Total backlog grew 7.1% Q/Q to $440 billion. The bulk of the backlog is in the BCA segment, at 82.5%, or over 4,800 planes. BDS backlog was flat Q/Q and stood at $58 billion, or 13.2% of total.

Capital Position

Strong cash conversion helped Boeing cut its net debt by $2.1 billion Q/Q to $38.5 billion at the end on Q2. Nevertheless, with a market capitalization of $144 billion Boeing remains one of the most levered companies in our Top Government Contractors series.

Conclusion

For May, Boeing reported passenger traffic at 96% of 2019 levels, with 105% in the U.S. and 91% international. The swift recovery in air traffic and the swelling backlog bode well for the company's revenues and its $10 billion free cash flow aspiration in '25-'26, with positive operating margins in BCA as early as Q1 2024.

Fixed-price contracts negatively impacted margins at BDS, with operational performance set to improve going into next year.

In Q2 2023, the U.S. government accounted for 90% of BDS and 41.9% of BGS revenues. As a result, the combined federal government exposure of Boeing stood at 38.2% of total revenues in Q2 of 2023. For reference, the figure was 40% in 2022.

Given Boeing’s active participation in government contracting, monitoring the company’s public procurement activity also remains a smart move that can provide key insights into its financial health.

To learn more about the ways in which TenderAlpha can provide you with rare and valuable public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy Boeing or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.