It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

In the fourth article of our new blog series, we will present you the Q4 results of Boeing – a renowned government supplier, which had 49% of its revenue in 2021 coming from government sales.

To read our other two analyses of Boeing’s quarterly results, please follow the links below:

Key points:

* Boeing generated $2.3 billion in free cash flow in 2022; the company expects to generate $3-5 billion in 2023;

* 40% of Boeing's 2022 revenue was derived from U.S. government contracts. Revenue grew by 6.9% in 2022, driven by a 33% increase in the Commercial Airplanes segment;

* Backlog grew 7.1% to $404.4 billion, driven by Commercial Airplanes which now make up 81.5% of total;

* In 2023 capex is set to increase 25% relative to 2022; R&D spending seen up 10.3%;

* Q1 2023 earnings and free cash flow seen negative but improving; main drag this year will continue to be the Defense, Space & Security segment.

Boeing Q4 Overview

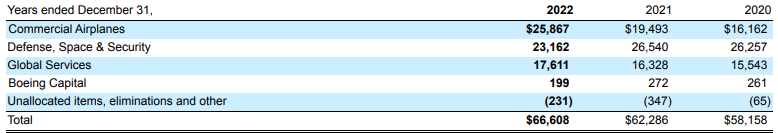

Boeing reports results in three main segments, namely “Commercial Airplanes” (BCA) at 38.8% of 2022 revenues, “Defense, Space & Security” (BDS) at 34.8% and “Global Services” (BGS) at 26.4%:

Figure 1: Sales breakdown between segments

Source: Boeing 10-K Form for Q4 2022

Operational Overview

Commercial Airplanes saw the strongest growth in the quarter, with revenues up a stunning 94% Y/Y, well above the 33% growth recorded in 2022. The operating margin was -6.8%, above the -9.2% in 2022.

Defense, Space & Security recorded a 5% Y/Y revenue growth rate in Q4, an improvement to the 13% drop recorded in 2022. The operating margin was 1.8%, better than the negative -15.3% in 2022 but less than the 5.8% recorded in 2021.

Global Services delivered 6% Y/Y revenue growth in Q4. However, this was a deceleration to the 8% growth recorded in 2022. The operating margin was 13.9% in Q4, up 4.6% Y/Y but below the 15.5% recorded in 2022.

On a group level, Boeing recorded 6.9% revenue growth to $66.6 billion. The core operating margin was -7%, a slight deterioration to the -6.5% in 2021. The positive standout was clearly free cash flow which ended the year at $2.3 billion, above the negative $4.4 billion in 2021.

The Core Loss Per Share in 2022 was $11.06, worse than the $9.44/share loss in 2021.

Backlog

The company's backlog grew slightly stronger than sales, at 7.1% to $404.4 billion. The strongest growth of 11.1% was recorded at BCA, while BDS actually saw a contraction of 9.1%. The BGS backlog was marginally down by 5.6%.

Overall, the share of Commercial Airplanes backlog increased to 81.5% of total, up from 78.6% in 2021.

Boeing 2023 Outlook

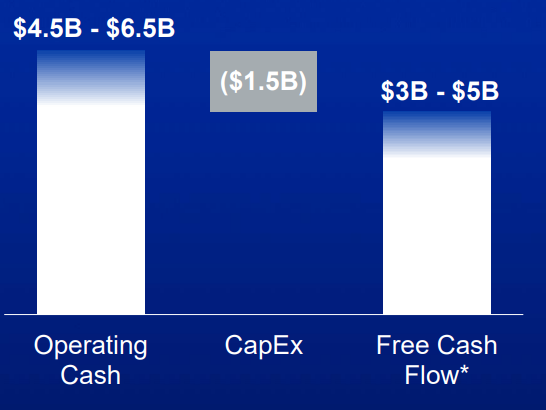

The company expects further improvement in its free cash flow to $3-5 billion in 2023:

Figure 2: Boeing Cash Flow Outlook for 2023

Source: Boeing Earnings Presentation for Q4 2022

The main drivers will be BCA and BGS, while BDS is still seen with a negative free cash flow. The free cash flow outlook is even more encouraging in light of the $1.5 billion capital expenditures, up 25% from 2022. R&D Expenses are also seen up 10.3% to $3.2 billion.

The company reiterated its 10 billion free cash flow aspiration for 2025-2026, which encompasses $2 billion in capital expenditures and $3.5 billion in R&D spending:

"And it is important to note that margins and EPS are important, but they will be uneven over the next two years, as we unwind the BCA inventory, we put the BCA abnormal cost behind us, and we get the BDS margins back on track to its normal trajectory."

Source: Boeng Q4 2022 Earnings Call Transcript

Looking into Q1 of 2023, management expects earnings to improve relative to Q4 of 2022 (negative $1.75/share). Free cash flow is also seen ahead of Q1 2022, yet both shall remain negative in Q1 2023 before improving later in the year.

Capital Position

Thanks to a return to free cash flow generation, Boeing is slowly making progress on cutting its net debt position. Over the course of 2022, it improved by $0.6 billion to $39.8 billion. Nevertheless, relative to the $127.5 billion market capitalization it remains relatively elevated and will continue to be a focus area for management in the coming years.

Conclusion

Boeing is seeing strong momentum in its BCA and BGS divisions, all the while facing the headwind of persistent weakness in its BDS segment. While Q1 2023 is expected to be a weak start to the year, momentum should pick up into Q2 which positions the company well to execute on its medium-term objectives.

Given the elevated but stabilizing net debt position, free cash flow generation and movement towards BA's $10 billion 2025-2026 free cash flow aspiration remain key for the company.

In 2022, 40% of Boeing's revenue was earned pursuant to U.S. Government contracts. Within the BDS segment, the federal government share is even higher at 89%.

Owing to Boeing’s in-depth government business, monitoring public procurement activity remains a smart move that can provide key insights into the company’s financial health. To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

Disclaimer: This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy Boeing or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.