It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

It is now time for us to look again at a company we covered previously in this series. Boeing recently reported its Q1 2023 results and below we will provide a brief analysis of the company’s performance in the first 3 months of the year.

To read our other two analyses of Boeing’s quarterly results, please follow the links below:

Part 4: Boeing: Improving Free Cash Flow Generation to Allow Debt Payback (Q4 2022)

Key points:

* 42.7% of Q1 2023 revenues from the U.S. Government (2022 40%);

* Fuselage issue with Boeing 737 affecting 75% of undelivered planes. Inventory build early in Q2 as production normalizes later in the year;

* 28.1% Y/Y revenue growth in Q1; Free cash flow of -$0.8 billion. 2023 target of $3-5 billion confirmed;

* 1.6% Q/Q backlog growth to $411 billion. Net debt at $40.6 billion;

* Global services the only positive operating margin segment as the rest of the company deals with legacy production issues.

Boeing Q1 2023 Results Overview

We originally covered Boeing's Q4 2022 results in Part 4 of our Top Government Contractors series here. Below we will highlight the progress achieved by the company in Q1 of 2023.

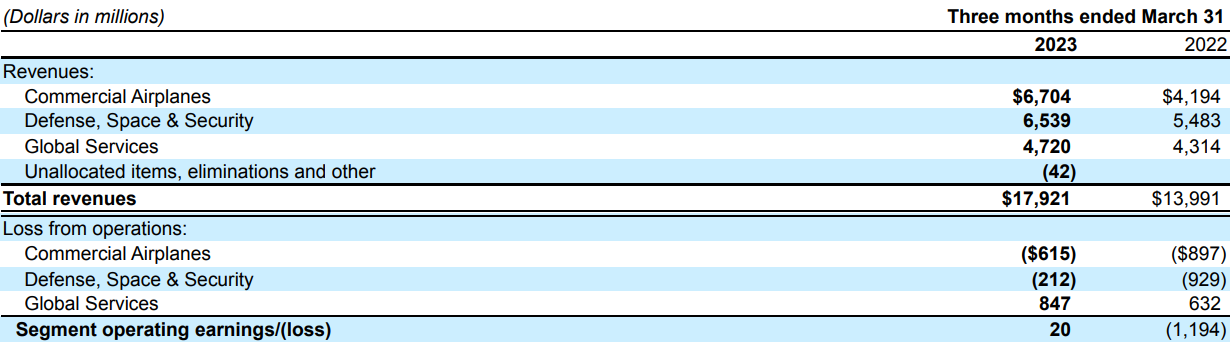

Boeing reports results in three main segments, namely “Commercial Airplanes” (BCA) at 37.4% of Q1 2023 revenues, “Defense, Space & Security” (BDS) at 36.5% and “Global Services” (BGS) at 26.3% of Q1 2023 revenues:

Figure 1: Sales breakdown between segments

Source: Boeing Form 10-Q for Q1 2023

Operational Overview

Commercial Airplanes was the best performing segment in Q1, growing revenues at 60% Y/Y (2022 +32.7%). The operating margin improved by 12.2% Y/Y but remained negative at -9.2%. Hence, the operating loss was reduced by 31.4% Y/Y.

Post quarter end, Boeing highlighted a new issue regarding the 737 program (which accounted for 86.9% of Q1 commercial aircraft deliveries):

Earlier this month (April) the program's fuselage supplier notified Boeing that a non-standard manufacturing process was used on two fittings in the aft fuselage section of certain 737 airplanes. This is not an immediate safety of flight issue and the in-service fleet can continue operating safely. While near-term deliveries and production will be impacted as the program performs necessary inspections and rework, the program still expects to deliver 400-450 airplanes this year. On production, the supplier master schedule remains unchanged including anticipated production rate increases, which will result in higher inventory levels. The company expects final assembly production to recover in the coming months with plans to increase to 38 per month later this year and 50 per month in the 2025/2026 timeframe.

Additional details were revealed on the conference call:

Our team's been working hard over the last week. We've been progressing in our early inspection of affected airplanes. The issue is understood. It's isolated to two specific fittings and we know what we have to do. The work will impact the timing of our deliveries over the next several months. However, we still expect to deliver 450 737 airplanes this year. Unfortunately, the timing of these delivery shortfalls will impact summer capacities for many of our customers, but we feel terrible about that.

Defense, Space & Security grew sales at 19.3% Y/Y (2022 -12.7%). As at BCA, the operating margin improved substantially, by 13.7% Y/Y, to -3.2%. This resulted in a 77% reduction in the operating loss Y/Y.

Global Services was the worst performer in terms of revenue growth, at +9.4% Y/Y (2022 +7.9%). Nevertheless, it was the only segment with a positive operating margin, improving by 3.3% Y/Y to 17.9%. This pushed operating earnings up 34% Y/Y. Boeing expects margins to deteriorate somewhat going forward.

On a consolidated level, sales increased 28.1% Y/Y in Q1 (2022 +6.9%), Core loss per share was $1.27/share (2022 full-year loss of $11.06/share), free cash flow was negative at -$0.8 billion (2022 +$2.3 billion). The operating margin improved substantially (+7.5% Y/Y) but remained negative at -0.8%.

Boeing 2023 Outlook

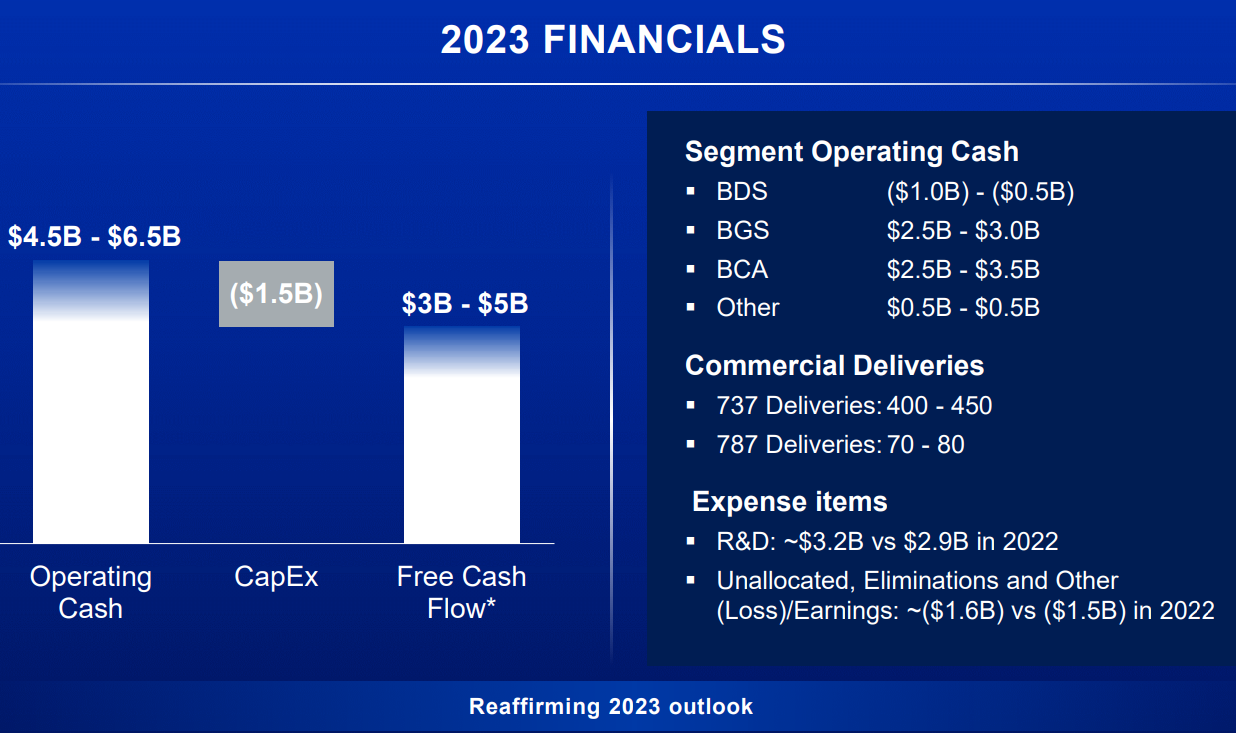

Given the strong start of the year, Boeing confirmed its 2023 free cash flow outlook:

Figure 2: Boeing Cash Flow Outlook for 2023

Source: Boeing Earnings Presentation for Q4 2022

Furthermore, management reaffirmed long-term cash flow targets on the conference call:

There's more to do, but overall, we feel good about the operational and financial outlook shared last November, including cash flow and delivery ranges set for 2023 as well as for the 2025/2026 timeframe where we can see $10 billion in annual free cash flow.

CFO Brian West also shared Q2 expectations on the call:

On 2Q specifically, we expect core EPS will be roughly in line with 1Q 2023 performance absent the Tanker charge, as the 737 delivery impacts would be largely offset by higher wide-body deliveries. We expect free cash flow to be breakeven to slightly negative as we work through the 737 recovery.

Backlog

Total backlog grew 1.6% Q/Q to $411 billion. The bulk of the backlog is in the BCA segment, at 81.3%, or over 4,500 planes. For reference, in Q1 BCA delivered 130 planes.

BDS backlog stood at $58 billion, or 14.1% of total.

Capital Position

The net debt position was $40.6 billion at the end on Q1, which compared with a market capitalization of $122.5 billion reinforces Boeing's position as one of the most levered government contractors in our series.

Conclusion

The 737 issue affects 75% of the planes currently in inventory. While it will impact airplane deliveries in the near term, it should not derail the company's 2023 and medium-term cash flow goals. What is more, Boeing is continuing with its production capacity increase as planned.

For February, Boeing reported passenger traffic at 85% of 2019 levels, with 97% in the U.S. and 78% international.

In Q1 2023, the U.S. Government accounted for 91% of BDS and 36% of BGS revenues. As a result, the combined federal government exposure of Boeing stood at 42.7% of total revenues in Q1 of 2023. For reference, the figure was 40% in 2022.

Given the above figures, monitoring Boeing’s public procurement activity remains a smart move that can provide key insights into the company’s financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy Boeing or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.