It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

It is now time for us to look again at a company we covered previously in this series. Lockheed Martin recently reported its Q2 2023 results and below we will provide a brief analysis of the company’s performance between January and March of this year. The highlight of the period was Lockheed Martin's record backlog reaching $158bn.

To read our analyses of Lockheed Martin's results in the previous two quarters, please follow the links below:

Part 1: Lockheed Martin: Soft 2023 Expected Before Growth Resumes in 2024

Part 26: Lockheed Martin: Strong Start to 2023 Driven by the Space Segment

Key points:

* Sales up 8.1% Y/Y in Q2 on strength in Aeronautics and Space segments. Full year outlook seen at +2.3%;

* Adjusted EPS of $6.73/share in Q2, up 6.5% Y/Y. 2023 range expected at $27.00-27.20/share, still down 0.5% Y/Y;

* Book-to-bill ratio stood at 1.70 in Q2, driving the backlog to a record $158 billion, up 8.9% Q/Q;

* All segments saw year-to-date backlog increases, the top performer being the Missiles and Fire Control segment (+18.4%);

* Capex seen at $1.9 billion to $1.95 billion (+15.3% Y/Y), with a free cash flow target of $6.2 billion.

Lockheed Martin Q2 2023 Results Overview

We previously covered Lockheed Martin's Q1 2023 results in part 26 of our Top Government Contractors series here. Below we will provide an update on how the company is doing after the Q2 2023 results were released.

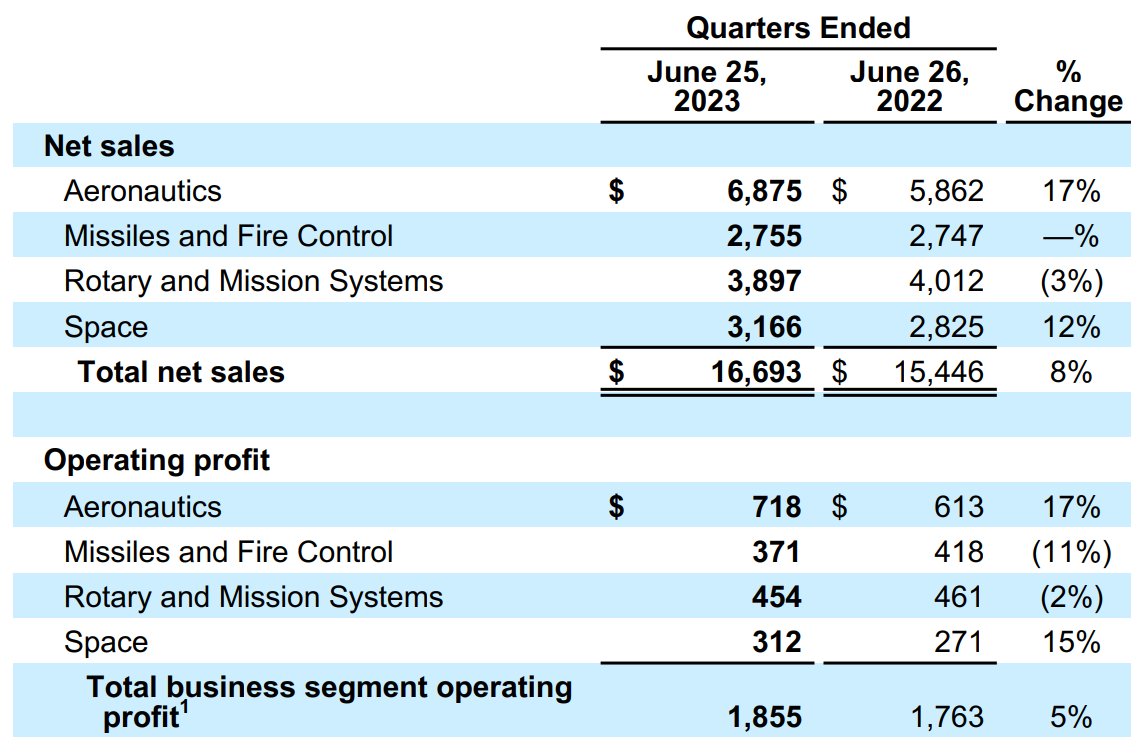

Lockheed Martin reports results in four key segments, namely Aeronautics at 41.2% of Q2 2023 net sales, Missiles and Fire Control at 16.5%, Rotary and Mission Systems at 23.3% and Space at 19% of Q2 2023 net sales:

Figure 1: Sales breakdown between segments

Source: Lockheed Martin Q2 2023 News Release

Operational Overview

Aeronautics was the best performing segment in Q2 2023 as sales grew 17% Y/Y (2022 +0.9%), primarily due to higher revenue in the F-35 program compared to a weak prior-year quarter. The operating margin deteriorated by 0.1% to 10.4%, bringing operating profit up 17% Y/Y, in line with sales.

Missiles and Fire Control sales were largely flat Y/Y in Q2 2023 (2022 -3.2%). Margins were considerably weaker, down 1.7% Y/Y to 13.5%, impacted by lower net favorable profit adjustments across the board (excerpt explanation below from the company's 2022 Annual report):

Increases in the profit booking rates, typically referred to as favorable profit adjustments, usually relate to revisions in the estimated total costs to fulfill the performance obligations that reflect improved conditions on a particular contract. Conversely, conditions on a particular contract may deteriorate, resulting in an increase in the estimated total costs to fulfill the performance obligations and a reduction in the profit booking rate and are typically referred to as unfavorable profit adjustments. Increases or decreases in profit booking rates are recognized in the current period they are determined and reflect the inception-to-date effect of such changes.

The lower margins drove operating profit down 11.2% Y/Y in Q2.

Rotary and Mission Systems was the worst performing segment in Q2 2023 as revenues declined 3% Y/Y (2022 -3.8%) on lower Black Hawk production. Margins were up 0.1% Y/Y to 11.6%, helping limit operating profit decline to 2%.

Space sales grew 12% Y/Y in Q2 (2022 -2.4%) on higher revenues in the Next Generation Interceptor program, classified programs and the Orion capsule in civil space. The operating margin was up 0.3% to 9.9% on strength in civil space, bringing the operating profit up 15.1% Y/Y.

On a company level, revenues were up 8.1% Y/Y (2022 -1.6%). Adjusted EPS was $6.73/share in Q2, up 6.5% Y/Y (2022 $27.23/share), boosted by higher volumes and lower pension expense. Free cash flow was $0.7 billion in the quarter and $2 billion year-to-date (2022 $6.1 billion)

2023 Updated Outlook

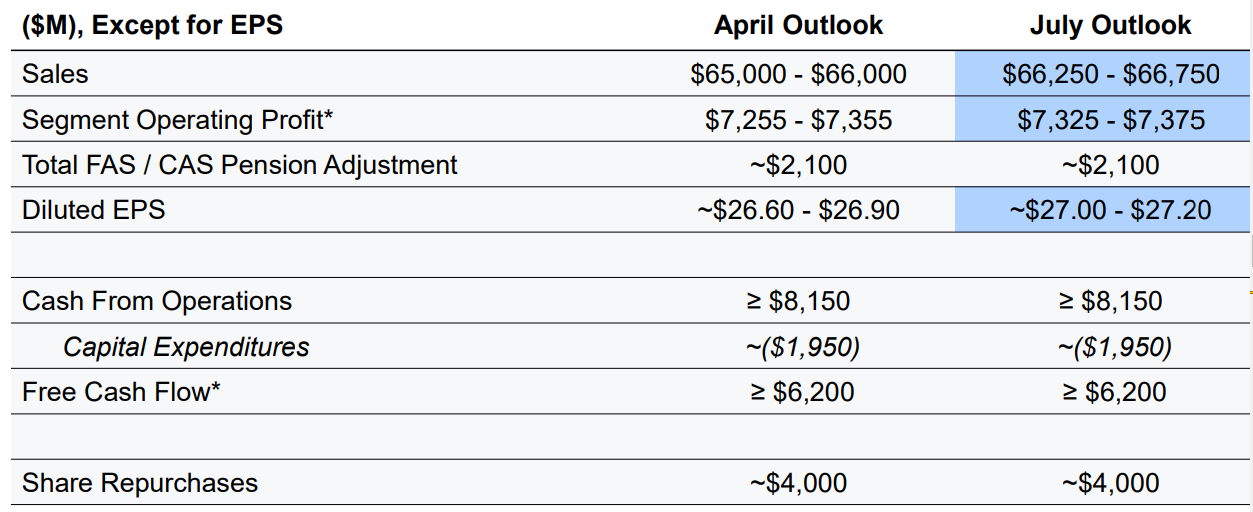

Considering that the positive operating momentum from Q1 carried into the second quarter, Lockheed Martin boosted its full-year outlook for sales, segment profit and EPS:

Figure 2: Lockheed Martin 2023 Outlook

Source: Lockheed Martin Q2 2023 Earnings Presentation

- Sales are set to grow 2.3% in 2023.

- Segment profit is expected to be 1.8% higher.

- Adjusted EPS is seen 0.5% lower in 2023.

Here is the rationale behind the increase as discussed on the conference call:

At the business area level, we've increased aero's outlook for sales by $250 million, with profit up $25 million, based on higher volume on F-35 sustainment and classified work at Skunk Works. As we've mentioned previously, we expect minimal impact to our cost throughput in 2023 as a result of the lower F-35 aircraft deliveries. And while we expect there to be some pressure on cash collections, we are driving offset opportunities to make up any shortfalls. At space, we're raising the sales midpoint by $750 million on higher development volume and the profit midpoint by $20 million as the benefit from higher sales is partially offset by a lower ULA earning outlook -- earnings outlook.

Capital Structure

In line with previously communicated policy, 137% of free cash flow was returned to investors year-to-date. As a result, net debt was marginally up at $13.9 billion, a relatively conservative amount against the market capitalization of $117.5 billion.

For 2023, over 100% of free cash flow is set to be returned to shareholders, with $2.7 billion in buybacks planned for H2 2023.

Backlog

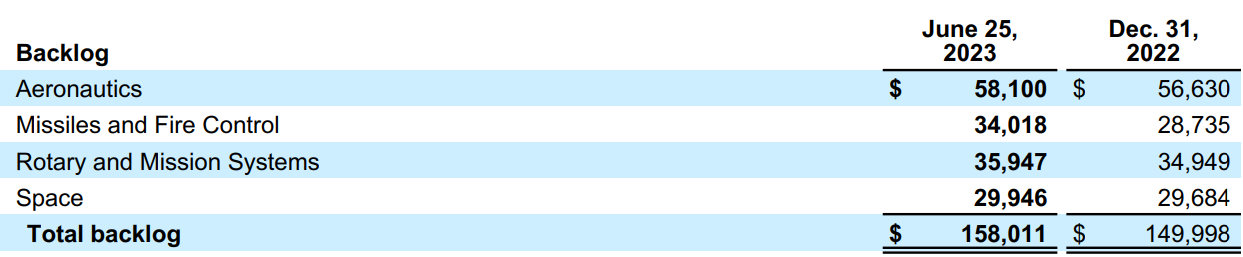

The book-to-bill ratio recovered to 1.7 in Q2, driving the backlog to a record $158 billion, up 8.9% Q/Q. On a year-to-date basis, all segments registered backlog growth, with the strongest increase in the Missiles and Fire Control segment (+18.4%):

Figure 3: Lockheed Martin Backlog

Source: Lockheed Martin Q2 2023 Earnings Release

On an absolute basis, Aeronautics still accounts for the largest share of the backlog, at 36.8%.

Conclusion

Lockheed Martin saw an exceptional second quarter, with the record backlog laying a foundation for strong sales growth in 2024. The challenge for the company now is to overcome supply chain issues and reach a higher rate of production. To do so, LMT expects capex spending to accelerate, as highlighted on the conference call:

And on capex side, we definitely expect it to increase in the back half of the year. We're still holding our forecast of $1.9 billion to $1.95 billion (+15.3% Y/Y) for the year, and we're going to -- that's going to essentially stay elevated for the next few years. So, a lot of that is investment in capacity and production capability, as Jim mentioned in his prepared remarks.

In light of the fact that government orders account for about 99% of Lockheed Martin's revenue, monitoring the company’s public procurement activity remains a smart move that can provide key insights into its financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy Lockheed Martin or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.