It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

It is now time for us to look again at the first company covered in this series. Lockheed Martin recently reported its Q1 2023 results and in this article, we offer you a brief analysis of the defense contractor’s performance in the first 3 months of the year.

To read our other two analyses of Lockheed Martin’s quarterly results, please follow the links below:

Part 1: Lockheed Martin: Soft 2023 Expected Before Growth Resumes in 2024

Key points:

* Fiscal year 2024 Department of defense budget request up 3% Y/Y to $842 billion.

* Sales up 1.1% Y/Y in Q1 (2022 –1.6%). 2023 revenue outlook of -0.8% unchanged as all segments except Space registering Y/Y sales declines.

* Adjusted EPS of $6.43/share in Q1, flat Y/Y (2022 $27.23/share). 2023 outlook of $26.6-26.90/share intact.

* 101% of $1.3 billion free cash flow returned to shareholders in Q1 2023 outlook of >$6.2 billion intact.

* 3.3% Q/Q drop in backlog to $145.1 billion. Book-to-bill of just 0.7.

Lockheed Martin Q1 2023 Results Overview

We originally covered Lockheed Martin's Q4 2022 results in the first installment of our government contractors series here. Below we will provide an update on how the company is doing after the Q1 2023 results were released.

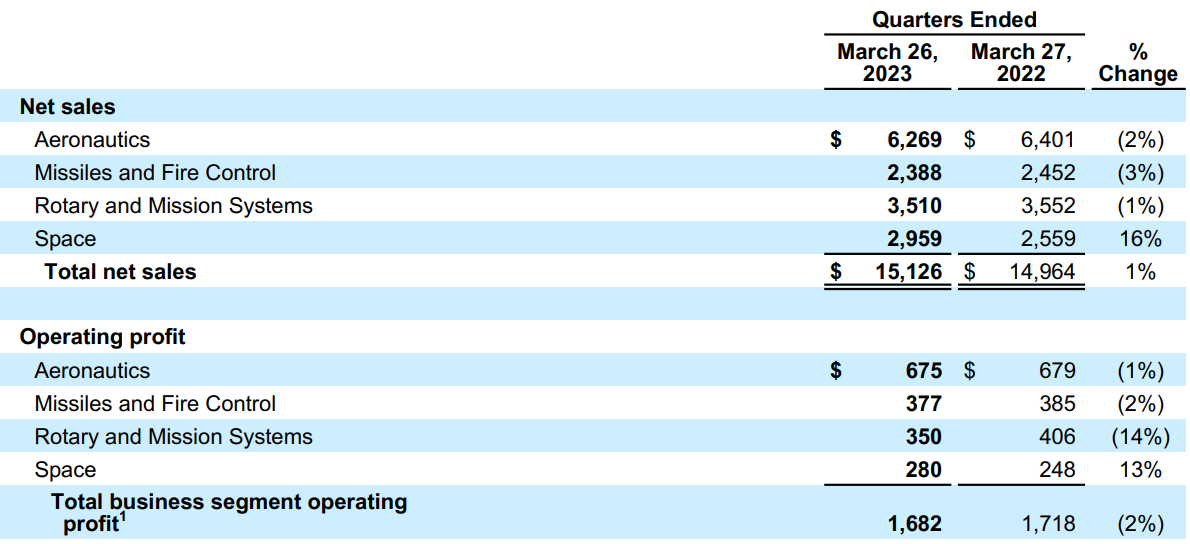

Lockheed Martin reports results in four key segments, namely Aeronautics at 41.4% of Q1 2023 net sales, Missiles and Fire Control at 15.8%, Rotary and Mission Systems at 23.2% and Space at 19.6% of Q1 2023 net sales:

Figure 1: Sales breakdown between segments

Source: Lockheed Martin Q1 2023 News Release

Operational Overview

Aeronautics saw sales decline 2.1% Y/Y in Q1 2023 (2022 +0.9%), with higher classified programs volume only partially offsetting weakness in F-35 production. The operating margin improved by 0.2% to 10.8%, helping limit operating profit decline to 0.6%.

Missiles and Fire Control was the worst performing revenue segment in the quarter, recording a 2.6% Y/Y sales decline (2022 -3.2%). Here again margins held up, +0.1% Y/Y to 15.8%, resulting in a 2.1% operating profit drop.

Rotary and Mission Systems recorded the largest operating profit decline – not only did sales shed 1.2% Y/Y (2022 -3.8%), but the operating margin dropped 1.4% to 10% as well. Hence, the operating profit ended Q1 13.8% lower Y/Y. Results were primarily impacted by low volumes and profitability for Sikorsky helicopter programs.

Space delivered the strongest performance in the quarter, with net sales up 15.6% Y/Y in Q1 (2022 -2.4%). The operating margin was down 0.2% to 9.5%, bringing the operating profit up 12.9% Y/Y. The main positive contributors were higher development volumes on classified programs, as well as the Next Generation Interceptor. LMT expects performance at the Space segment to decelerate in the remainder of the year.

On a company level, revenues were up 1.1% Y/Y (2022 -1.6%). Adjusted EPS was $6.43/share in Q1, flat Y/Y (2022 $27.23/share), with higher sales and a reduced share count offset by margin pressures, higher interest expense and pension expenses. Free cash flow was $1.3 billion in the quarter (2022 $6.1 billion)

Overall, it is fair to say that while Q1 results outperformed 2022 performance, they were below the growth rates achieved in Q4.

Lockheed Martin 2023 Outlook

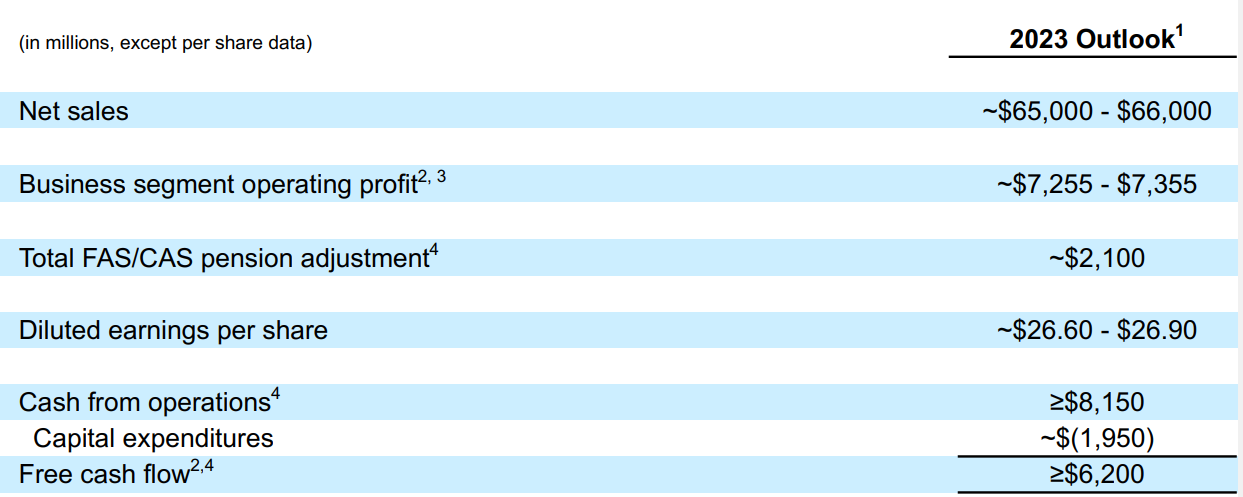

Despite the strong start of the year relative to expectations, LMT did not upgrade its 2023 guidance:

Figure 2: Lockheed Martin 2023 Outlook

Source: Lockheed Martin Q1 2023 News Release

As management had previously communicated, Q1 would be the weakest quarter of the year, we reckon LMT is on track to beat its 2023 outlook, here is why:

Sales are still forecast down 0.8% in 2023 despite being up 1.1% Y/Y in the first quarter.

Adjusted EPS is expected to be down 1.8% in 2023 despite a flat Y/Y performance in Q1.

Should performance accelerate from the pace of Q1, LMT will easily beat its guidance outlined in January. However, as the growth was driven primarily by the Space segment, the other divisions would have to step up their contributions.

Looking into 2024, Lockheed Martin reaffirmed guidance for a return to sales growth and free cash flow per share growth.

Capital Structure

In line with previously communicated policy, 101% of free cash flow was returned to investors in Q1. As a result, net debt was little changed at $13.2 billion, a relatively conservative amount against the market capitalization of $122.2 billion.

For 2023, 110% of free cash flow is set to be returned to shareholders.

Backlog

The book-to-bill ratio of just 0.7 drove total backlog down 3.3% Q/Q to $145.1 billion. While some reduction of the backlog is to be expected as LMT builds production capacity, the company expects backlog growth in Q2 driven by the Aeronautics segment.

Commenting on supply chains over the conference call, Lockheed Martin saw no major improvement relative to trends in H2 2022.

Conclusion

Lockheed Martin started 2023 on a better footing that initially expected, and the already anticipated pickup in growth in 2024 is set to accelerate, judging by preliminary 2024 budget proposals discussed on the Q1 conference call:

Turning to the budget. The administration released preliminary details of the FY ‘24 President's Budget Request or PBR in early March. This budget proposal reflects a heightened emphasis on defense and security cooperation with allies. The FY ‘24 DoD budget request is $842 billion an increase of $25 billion or 3% over the FY ‘23 enacted funding. The near peer threats posed by China and the Russian invasion of Ukraine is driving the national defense strategy and has created added demand for Lockheed Martin's advanced effective solutions.

In light of the fact that government orders account for about 99% of Lockheed Martin's revenue, monitoring the company’s public procurement activity also remains a smart move that can provide key insights into its financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy Lockheed Martin or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.