Today marks the first article of our new series that will cover the financial performance of some of the largest global government contractors.

It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the results these major government contractors achieve.

The first company we will cover, is Lockheed Martin – one of the most prominent government suppliers, which makes 99% of its sales to government customers.

To read our other two analyses of Lockheed Martin’s quarterly results, please follow the links below:

Part 26: Lockheed Martin: Strong Start to 2023 Driven by the Space Segment

Key points:

* Sales grew 7% in Q4. 2022 total sales were down 1.5% to $66 billion. A similar decline is expected in 2023;

* Backlog grew 10.8% to $150 billion with a book-to-bill ratio of 1.2. LMT is increasing capex by 16.8% to allow for sales growth in 2024 and beyond;

* $10.9 billion returned to shareholders in 2022, of which $7.9 billion in buybacks. 2023 buyback seen at $4 billion, or 50% lower;

* LMT increased the share of debt in its capital structure, with net debt at around $12.9 billion in 2022;

* Dividend and buyback in 2023 (combined circa $7 billion) will likely surpass free cash flow ($6.2 billion).

Lockheed Martin Q4 Results Overview

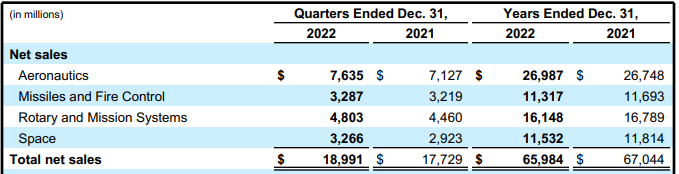

Lockheed Martin reports results in four key segments, namely Aeronautics at 40.2% of Q4 2022 net sales, Rotary and Mission Systems at 25.3%, Missiles and Fire Control at 17.3%, and Space at 17.2%:

Figure 1: Sales breakdown between segments

Source: Lockheed Martin Q4 2022 News Release

Operational Overview

Aeronautics saw 7% Y/Y sales growth in Q4, mainly due to higher production volume of the F-35 program. The operating margin was down by 0.8% Y/Y to 10.7% due to lower net favorable profit booking rate adjustments, with strength in the F-35 program offset by weakness in classified contracts. Nevertheless, the operating margin of 10.7% was above the 10.6% achieved in 2022 and the 10.5% in 2021.

Missiles and Fire Control recorded 2% Y/Y sales growth in Q4. Growth was driven by higher volumes in tactical and strike missile programs, offset by weakness in integrated air and missile defense programs. Despite lower sales growth than the Aeronautics segment, the operating margin was up both in Q4 and for the full year, finishing at 13.7% in Q4 and 14.4% in 2022. (2021, 14.1%).

Rotary and Mission Systems delivered 8% Y/Y sales growth in Q4. Two thirds of the effect was driven by higher volumes in integrated warfare systems and sensors, and one third by higher helicopter production volume. The operating margin was up in Q4 2022 to 10.6%, topping the 10.4% achieved for the full year. However this fell short of the 10.7% achieved in 2021.

Space remains the smallest segment for LMT, albeit only marginally behind Missiles and Fire Control. Nevertheless, the Space segment achieved the highest Y/Y sales growth of 12% in Q4. Growth was primarily driven by classified programs. The operating margin performance was markedly lower in Q4, dropping to 7.1% from 10.5% a year earlier. The performance for the full year was better at 9.1%, albeit below the 9.6% achieved in 2021.

On a company level, sales were down 1.6% in 2022 due to weakness early in the year (Q4 Y/Y growth was 7%), while the operating margin was little changed (-0.1%) to 10.9% in 2022. Adjusted EPS was up 1.8% to $27.23/share with a 4.6% drop in average diluted shares to 264.6 million offsetting sales and margin weakness.

Lockheed Martin 2023 Outlook

Naturally the main point of attention after the Q4 results was the new 2023 outlook:

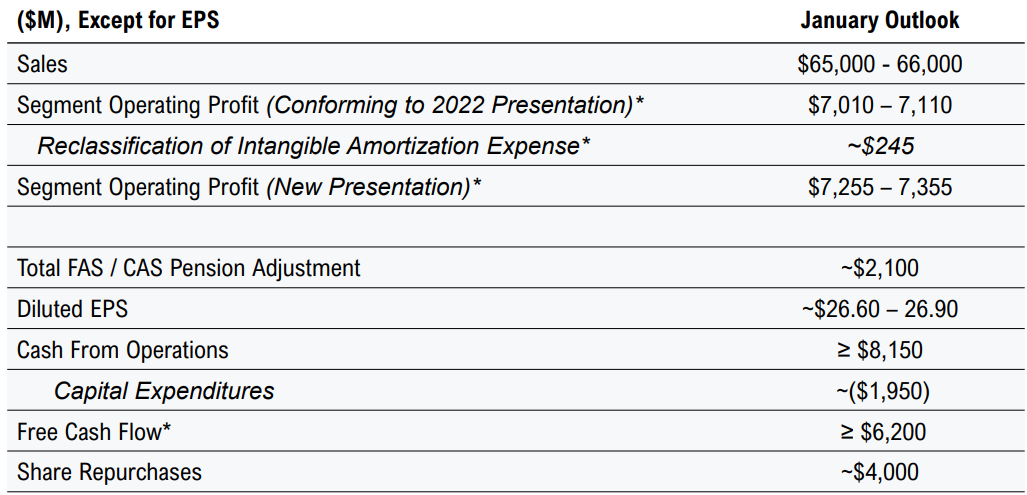

Figure 2: Lockheed Martin 2023 Outlook

Source: Lockheed Martin Q4 2022 Results Presentation

At first glance the outlook is disappointing, especially given the strong finish in Q4 of 2022. Sales are seen flat to down 1.5% relative to 2022. The outlook for operating profit is somewhat more encouraging, envisaging a flat to rising operating profit – albeit only to levels achieved in 2021 ($7.379 billion).

A distinction with regards to operating profit definition needs to be highlighted. Until 2022, LMT reported purchased intangible asset amortization expense as part of segment operating profit. Starting in 2023, the expense will be reported in unallocated corporate expense within operating income. In essence, the abovementioned flat to rising operating profit in 2023 excludes a non-cash expense when compared with 2022.

If we use the segment operating profit using the 2022 presentation method (7,010 – 7,110 in Figure 2 above), operating profit is seen down by about 2.2%.

Diluted EPS is also seen dropping from 2022 levels by some 1.5%. Thus the only true bright spot is the free cash flow guidance, which s seen at or above $6.2 billion ($6.1 billion achieved in 2022). The free cash flow target is even more impressive in light of the increased capital expenditure ($1.95 billion in 2023 relative to $1.67 billion in 2022). The capex in 2022 was 1.4 times depreciation.

Overall, while 2023 should be a trough year in terms of operating performance, the 16.8% increase in capital expenditure should position the company well for sales and earnings growth in 2024 and beyond:

"Speaking to the timing of sales this year, we expect the first quarter to be our lowest quarter of the year, ramping up quarter-over-quarter as we did in 2022."

Source: Lockheed Martin Q4 2022 Conference Call

Capital Structure

Despite generating only $6.1 billion in free cash flow in 2022, LMT returned a total of $10.9 billion to shareholders in 2022, of which $7.9 billion were share repurchases. In essence, the company made a conscious decision to shift its capital structure away from equity and to increase its debt.

At the end of Q4 2022, the company had $2.5 billion in cash and cash equivalents and $15.4 billion in long-term debt, taking its net debt position to about $12.9 billion. The market cap is around $115.5 billion hence despite the shift in 2022, the capital structure remains relatively debt-light and conservative.

Notwithstanding the current conservative stance, the company envisages 4 billion in share repurchases in 2023, which coupled with the circa 3 billion in dividends would surpass the internally-generated cashflow of about $6.2 billion. Thus, LMT is looking to further boost the portion of debt within its capital structure, albeit at a much slower pace than 2022 (money allocated to buybacks should be down about 50%).

Backlog

The backlog increased by 10.8% Y/Y to $150 billion, split by Aeronautics (37.8%), Rotary and Mission Systems (23.3%), Space (19.8%), and Missiles and Fire Control (19.2%).

The book-to-bill ratio stood at 1.2. As it stands, the backlog covers over 2 years of sales and should start to show up in the company's top line in 2024 and beyond, especially with the increased capex level:

"As we look ahead, demand for Lockheed Martin platforms and systems is strong in the United States and abroad. We continue to expect 2023 sales about the same level as we discussed back in October. We also continue to expect a return to sustained top line growth in 2024 and beyond as headwinds diminish in our program mix, the supply chain continues to recover and our signature programs grow."

Source: Lockheed Martin Q4 2022 Conference Call

Conclusion

Geopolitical uncertainty remains elevated, with military expenditure increasing around the world:

"In late December, Congress signed the FY '23 Omnibus spending bill into law, appropriating $858 billion for National Defense, including $817 billion for the DoD-based budget. This reflects approximately 10% growth year-over-year for both national defense and the DoD-based budget."

Source: Lockheed Martin Q4 2022 Conference Call

However due to limited production capacity, the increases are only visible in Lockheed's order book, while sales are stagnating in the near-term.

That said, increased capex in 2023 will lay the foundation of strong sales growth in 2024 and beyond. The company is also aggressive on the capital return front, which should help bridge the gap in terms of business performance.

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy Lockheed Martin or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.