Raytheon is one of the most trusted and long-standing US government contractors. It has featured on multiple occasions in our Top Government Contractors series, where we discussed its financial performance in the last few quarters [Q4 2022] [Q1 2023] [Q2 2023] [Q1 2024].

Now we turn to examining the characteristics of Raytheon’s supply chain network. We will be doing so using data from our own Global Government Supply Chain Data Feed. To put things in perspective, below we present some telling figures about Raytheon's supply chain upon which we will build our analysis.

3 Key Figures for Raytheon’s Supply Chain:

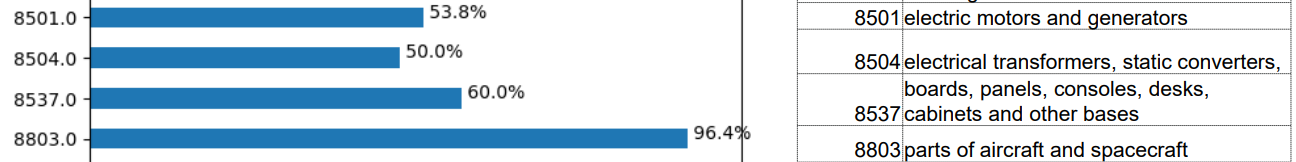

- 95% of the commodities related to aircraft and spacecraft parts come from Chinese suppliers

- 100% of tubes, pipes, hoses, and fittings are supplied by Chinese companies

- 54% of Raytheon’s electric motors and generators are supplied by Chinese suppliers

What Critical Parts do Chinese Suppliers Deliver to Raytheon?

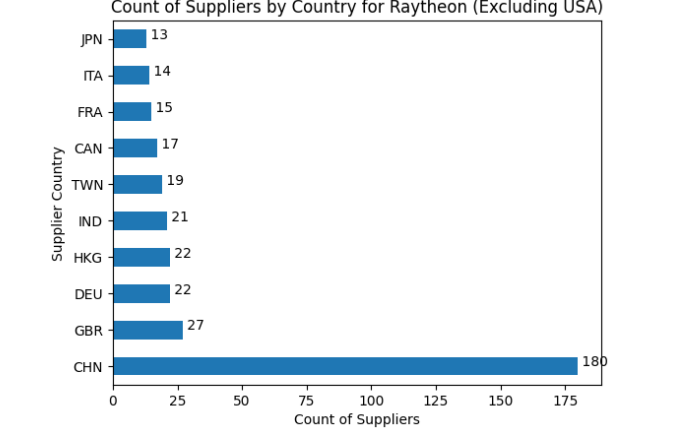

Looking at Raytheon’s international suppliers in particular, we discovered that the company has more direct Chinese suppliers than from all other countries combined. Notably, none of these Chinese suppliers were found to be direct government suppliers in our database.

What this means is that Chinese companies indirectly supply the US Government with goods and services required for some critical technologies used by the Department of Defense.

Zooming in on product level showed that more than 95% of the commodities related to aircraft and spacecraft parts are delivered by Chinese suppliers, with tubes, pipes, hoses and fittings supplied entirely by Chinese companies.

Another 54% of Raytheon’s electric motors and generators are supplied by Chinese entities. There is no doubt that all the aforementioned goods are essential for Raytheon’s work for the government and their timely delivery is critical for the company’s uninterrupted service.

Supply Chain Data as a Risk Mitigation Tool

These figures make the supply chain data a valuable tool that can be used to highlight the goods that are at potential risk of delay in delivery should they be imported from China.

Given that Rayheon’s Chinese suppliers deliver a number of critical parts needed for the production of military equipment, there is a real possibility that a more acute geopolitical tension between China and the US could affect Raytheon’s supply chain resulting in delays, cost increases or outright unavailability.

Such a development would also represent an opportunity for alternative suppliers that stand to benefit from Raytheon’s sizable US government business.

Government contract awards data is used as a basis to construct Raytheon’s supply chain network data. The rich database of contracts awarded to the company is instrumental as it allows you to extract and analyze the contracts that have suffered from supply chain disruptions.

Government contract awards data and supply chain transactions data complement each other to provide a detailed picture of major companies’ economic activity highlighting supply chain risks that may hamper their commitments as government contractors.

If you need this knowledge or have a different use case that our data can serve, let us know!