Alternative data has been identified as “the deepest, least utilized alpha source in the world today”. Fund managers invest nearly USD 3 billion annually in alternative data sets and the annual spend growth varies between 20% and 30%.

The cited figures prove that alternative data is turning into a highly beneficial tool for hedge funds. Seemingly insignificant data on things like basic retail transactions supplies investors with loads of information and insight.

But hang on! What do we talk about when we talk about alternative data?

What is Alternative Data?

As the name suggests, alternative data differs from traditional data sources, i.e. from those that come directly from a company such as financial statements, SEC filings, press releases, and marketing presentations.

Instead, alternative data is gathered from external sources, which may include POS and credit card transactions, website usage, app usage, cell phone data, satellite images, social media posts, online browsing activity, and, increasingly public procurement data.

In an attempt to put various definitions as to what alternative data actually is, the Alternative Investment Management Association came up with the following definition: “alternative data comes from unconventional information, mostly in an unstructured form, is not broadly distributed within the industry and is being used to deliver both investment alpha and operational alpha.”

What Do The Experts Say?

Hedge funds are showing time and again that they value highly the possibility to extract real-time information from alternative data sources - a capability that is much welcome in the current times of uncertainty.

Quoted by the Financial Times in the summer of 2020, Hinesh Kalian, director of data science at hedge fund firm Man Group, which manages USD 104 billion in assets, confirmed that the demand for alternative data had skyrocketed in the past six months.

Michael Spellacy, global head of capital markets at consultancy Accenture, echoed this sentiment. Mr Spellacy said hedge funds had profited in 2020 from methods such as comparing social media posts in China with Chinese government statements to gauge the extent of the virus’s impact, as well as collecting data on the movement of Chinese container ships to monitor activity.

An Insight Into Hedge Funds’ Use of Alt Data

Shedding further light on how hedge funds are using alternative data, the Alternative Investment Management Association (AIMA) and the investment management software provider SS&C Technologies prepared and published a survey on the topic in the tumultuous 2020.

In it, 100 hedge fund managers, managing a total of about USD 720 billions in assets, responded. 53% of them were alt data users. The study then divided the users of alternative data among the participating hedge funds into ‘market leaders’ and ‘rest of the market’.

The former group consisted of the managers that have been using alternative data for more than five years, and the ‘rest of the market’ was made up of those who have been using it for less than half a decade.

When asked about the most used data sets, the ‘market leaders’ singled out the following:

- Data sourced from expert networks (bespoke research that may include data from unconventional sources)

- Web crawled data

- Consumer spending/lifestyle data

- Business performance metrics

Quite similarly, the hedge funds falling into the ‘rest of the market’ category cited web crawled data, consumer spending/lifestyle data and sentiment from social networks as their most widely adopted data sets.

Another of the study’s important findings is that a hedge fund classified as a market leader in the use of alternative data is likely using more data sets than its ‘late adopters’ counterparts. This is unsurprising, as these hedge funds have more experience within the alternative data landscape and have also established the necessary infrastructure that allows them to monitor the data from a larger number of data sets.

Main Applications of Alternative Data for Hedge Funds

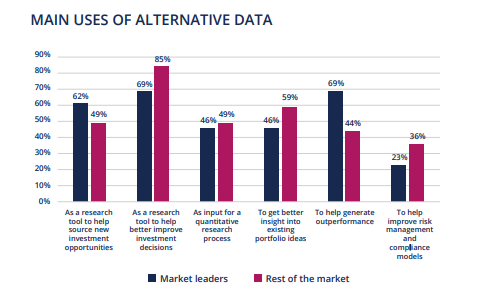

One of the most important questions that AIMA’s studies is trying to answer is what hedge funds are using alternative data for. As evident from the graph below, for between 60% and 70% of the ‘market leaders’ it is to help generate outperformance or as a research tool to help improve investment decisions and source new investment opportunities.

In comparison, 85% of the ‘rest of the market’ respondents stated that they use alternative data as a research tool to help improve their investment decisions. Nearly 60% harness it as a tool to get better insight into existing portfolio ideas, while just about half of them use it as a research tool to source new investment opportunities and as input for a quantitative research process.

Source: AIMA

Alternative Data as an Instrument to Deliver Outperformance

Alternative data is being used to deliver both investment alpha and operational alpha. However, Olga Kokareva from Quantstellation, a multi-asset multi-horizon quantitative investment firm, makes a clear distinction between the ways fundamental hedge funds and qualitative hedge funds approach this type of data.

“Fundamental hedge fund managers normally use alternative data to reinforce their investment thesis that they derived from their regular research process. Quantitative hedge funds derive their investment thesis by analyzing data, and they’ve been doing it for years. So that was a natural extension of the quantitative investment process – to start analyzing alternative data sets in exact same manner that they’ve been analyzing traditional financial data.”

Based on AIMA’s desk research, the main practical applications of alternative data in the search for alpha include:

- Dynamic stock screening

- Targeted security baskets

- Precise sector allocation

- Portfolio optimisation

- Strategy backtesting

- Market timing

Challenges

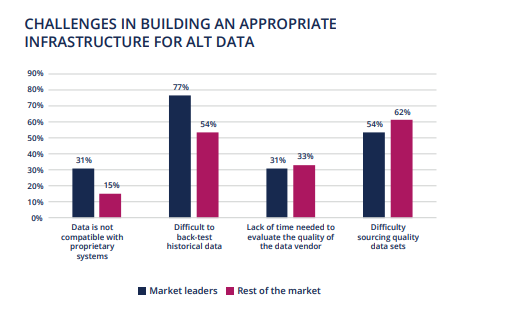

Building an appropriate infrastructure for alternative data does not come without its challenges. Both groups in AIMA’s study have cited the difficulties to backtest historical data and to source quality data sets as their main barriers. The lack of time needed to evaluate the quality of data vendor, as well as the data’s incompatibility with proprietary systems have also been listed as challenges, albeit to a lesser degree.

Source: AIMA

What Does the Future Hold?

The prevailing sense among both ‘market leaders’ (61%) and ‘the rest of the market’ (82%) is that alt data will become more widely adopted within the next five years. Nevertheless, members of both categories share the sentiment that certain criteria need to be satisfied beforehand.

For ‘market leaders’, having the required technological capacity to collect, store and assess this type of data is the most important factor. Meanwhile, for ‘the rest of the market’, the most relevant factor is the reliability and relevance of such data. This is an indicator that the newcomers are still finding their feet in the alt data world and probably need some more time to figure out which data sets would be most beneficial to them.

The Bottom Line

Given that 90% of the world’s data available today was only produced in the last two years, it is easy to perceive what immense role it can play in the near future.

The coronavirus crisis, in upending the world, highlighted the need for access to as up-to-date information as possible for investors to make decisions swiftly. The immediacy of alternative data sets in comparison to the information lag from working with traditional data is proving particularly helpful in moments like this, when markets no longer function normally.

Nevertheless, whilst hedge funds are clearly expected to increase their use of alternative data, there remain challenges as to setting the right infrastructure in place and selecting the most relevant data sets to work with. It will certainly take some time before the wheat is separated from the chaff in terms of which providers offer truly valuable alternative data.

Still, there are plenty of reasons to be optimistic. The use of advanced technologies have set the field for an exciting competition that can lead to the development of groundbreaking solutions. These may provide hedge fund managers with deep insights into the market, taking them closer to the Holy Grail of investing that is the alpha.

TenderAlpha's global public procurement database is sought-after alternative data by tens of hedge funds. Contact us now to learn more about our government contracting, trade flows, and supply chain datasets!

Did you find this article helpful? Check out some other publications to learn more about alternative data and its benefits to the investment community: