It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our Government Receivables as a Stock Market Signal white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

It is now time for us to look again at a company we covered previously in this series. Boeing recently reported its Q1 2024 results and below we will provide a brief analysis of the company’s recent performance

To read our previous analyses of Boeing's results, please follow the links below:

Part 4: Boeing: Improving Free Cash Flow Generation to Allow Debt Payback (Q4 2022)

Part 59: Boeing 2023 Q4 Report: Backlog Reaches a Record $520 Billion

Key points:

* Continued growth in government business coupled with a slump in Commercial Airplanes revenue resulted in circa 54% cumulative government exposure for Boeing in Q1 2024;

* U.S. government exposure at 47% of revenue in Q1 2024, with similar values recorded during the COVID-19 pandemic;

* Backlog further increased in the quarter, up 2% Q/Q, to a record $529 billion;

* Free cash flow was negative $3.9 billion in Q1 2024, with the company’s investment grade credit rating under threat;

* Defense, Space & Security segment margins were positive in Q1 2024, with further improvement in the Global Services segment margins.

Boeing Q1 2024 Results

We previously covered Boeing's Q4 2023 results in part 59 of our Top Government Contractors series here. Below we will highlight the progress achieved by the company in Q1 of 2024.

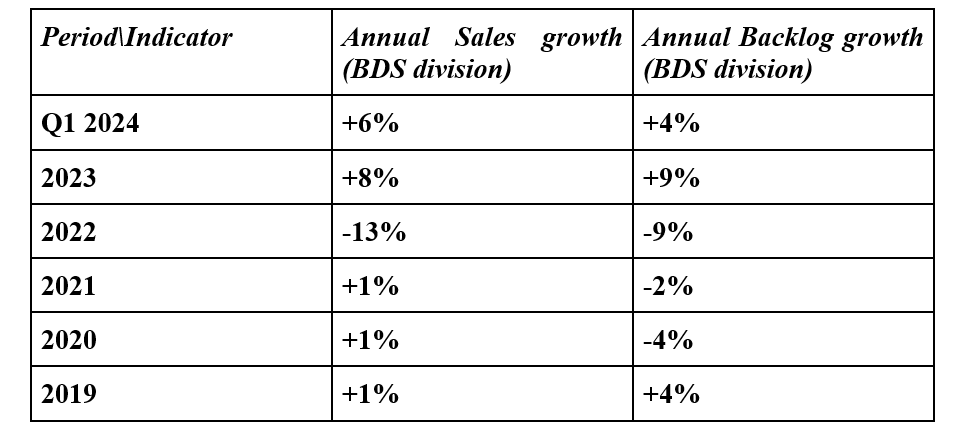

We will start with a Boeing revenue breakdown. The company reports results in three main segments, namely “Commercial Airplanes” (BCA) at 28% of Q1 2024 revenues, “Defense, Space & Security” (BDS) at 42%, and “Global Services” (BGS) at 30% of Q1 2024 revenues:

Figure 1: Boeing segment results

Source: Boeing Form 10-Q for Q1 2024

Operational Overview

Commercial Airplanes was the worst-performing segment in Q1, with revenues sliding 31% Y/Y (2023: +30%) due to a 36% Y/Y decline in aircraft deliveries, driven by the need to emphasize production quality following recent quality incidents. The operating margin was understandably negative at -24.6% (2023: negative 4.8%). As a result, the division recorded an operating loss of $1.1 billion, 86% greater than the prior-year period.

Defense, Space & Security delivered 6% Y/Y revenue growth in Q1 (2023: +8%). Despite continued losses on fixed-price contracts, improved performance and higher volumes drove the operating margin to a positive 2.2% (2023: -7.1%). As a result, the division delivered an operating profit of $151 million versus a loss in the prior-year quarter.

Key Boeing defense contracts awarded during the quarter include a contract for 17 P-8A Poseidon aircraft for the Royal Canadian Air Force and German Navy, the final new-build production contract from the U.S. Navy for 17 F/A-18 Super Hornets, and an MQ-25 cost-type contract modification from the U.S. Navy including two additional test aircraft.

Global Services was the best-performing segment in Q1 2024, increasing its topline by 7% Y/Y (2023: +9%). Margin performance was equally robust, with a further improvement in the operating margin to 18.2% (2023: 17.4%), driven by higher commercial volumes and a favourable mix. As a result, operating earnings grew 8% in Q1 (2023: +22%).

On a consolidated level, Q1 sales were 8% lower Y/Y (2023 +17%), Core loss per share was $1.13/share in Q1 (2023: $5.81/share), and free cash flow was negative $3.9 billion in the quarter (2023: positive $4.4 billion). The core operating margin was also negative at 2.3% (2023: -2.4%).

With the focus remaining on quality rather than financial performance, Boeing did not provide a full-year financial forecast in Q1 2024. This is understandable given the fact that CEO David Calhoun is set to step down by the end of the year.

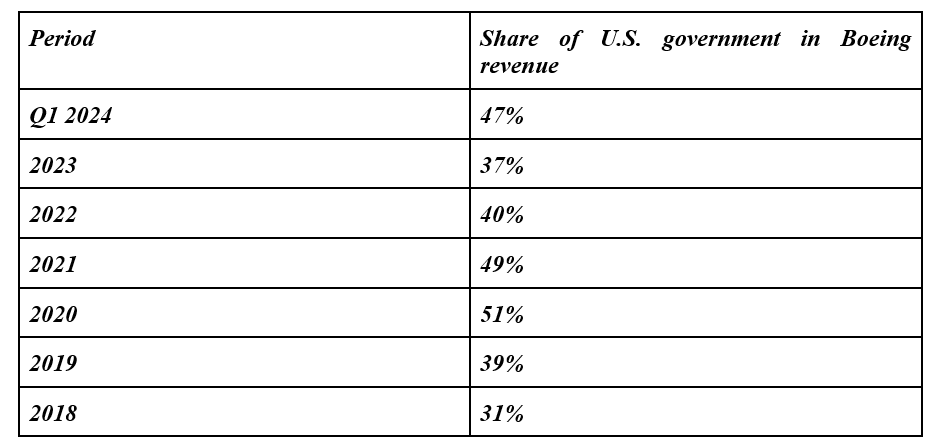

Backlog

Despite the slowdown in the BCA division, Boeing’s total backlog grew 2% Q/Q to $529 billion at the end of Q1 2024. The main driver, as in 2023, was the BCA segment, which accounts for 85% of the total backlog. Boeing defense contracts backlog, booked in the BDS division, increased 3% Q/Q and accounts for 11% of the total:

Figure 2: Boeing backlog evolution in Q1 2024

Source: Boeing Form 10-Q for Q1 2024

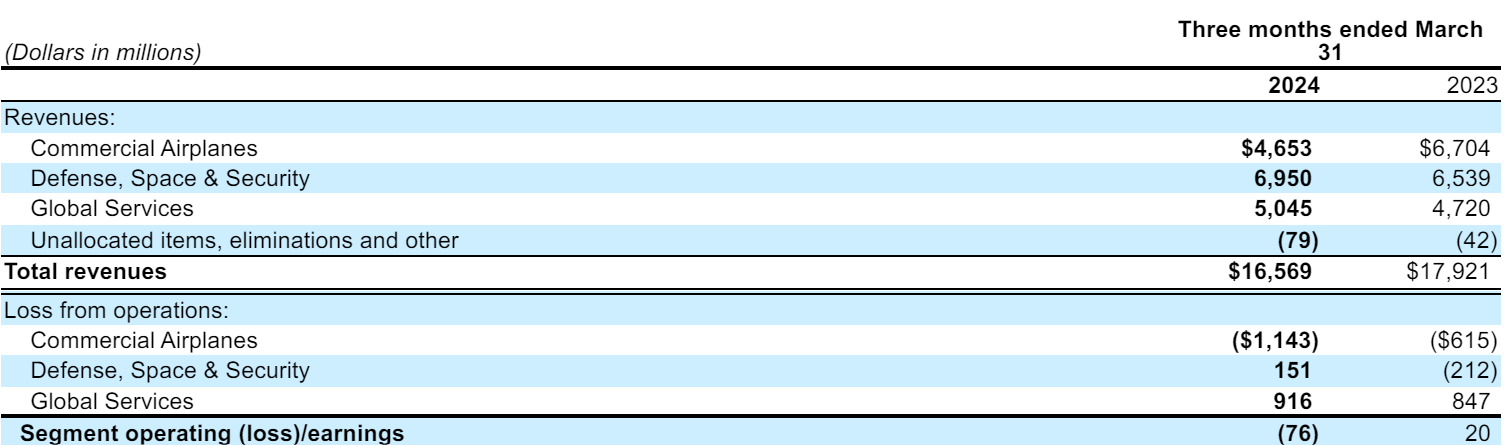

Looking at annual backlog developments, we can observe that sales in the BDS division (+6% Y/Y in Q1 2024) have largely kept up pace with the 4% Y/Y increase in Boeing government contracts backlog. This has largely been the trend since 2019, implying that the key to reducing Boeing’s swelling backlog lies exclusively in the BCA division:

Figure 3: Boeing Government Contracts: Revenue and Backlog Evolution

Source: Boeing Company Filings

The table above also shows that Q1 2024 continues the momentum in government orders observed in 2023, in contrast to the declining government order backlog over the 2020-2022 period.

To view all Boeing awards since 2010, request a free sample of TenderAlpha's government contracts data.

Capital Position

Boeing ended Q1 2024 with a net debt of about $40.4 billion. Against a market capitalization of $103 billion, Boeing remains one of the most levered companies in our Top Government Contractors series. As a result, monitoring Boeing's cash flow remains a top priority for both management and investors. Furthermore, following the Q1 2024 report, Fitch Ratings downgraded its outlook on Boeing debt to negative. Boeing’s rating stands at BBB-, meaning a downgrade would send the flagship U.S. plane maker into junk rating territory.

Boeing Government Contracts Exposure

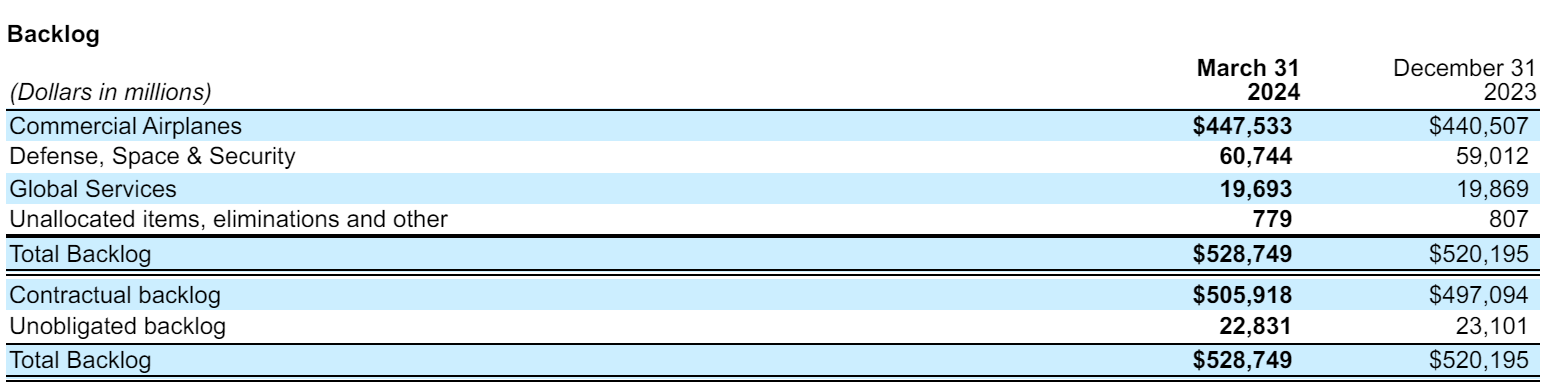

Boeing defense contracts account for a substantial amount of Boeing government contracts. Government orders are booked primarily through the BDS division, as well as the BGS services business to a lesser extent.

Following the slump in BCA revenue in Q1 2024, the relative importance of government contracts for Boeing increased dramatically.

In Q1 2024, a combined 47% of Boeing revenue came from the U.S. government alone. Quarterly company disclosures are not detailed enough to conclusively compute the exact government exposure to non-U.S. sources.

That said, our estimates show that an additional 7% of Q1 2024 revenue was derived from non-U.S. government sources. As a result, the cumulative government revenue exposure of Boeing was 54% in Q1 2024.

Figure 4: Boeing U.S. Government Contracts Evolution

Source: Boeing Company Filings

From the data above we see that government contracts provide a stable lifeline for Boeing in turbulent times, such as the ones during the COVID-19 pandemic or the recent quality control issues at BCA.

Conclusion

Boeing ended Q1 2024 with a record backlog of $529 billion, up 2% Q/Q, indicating the 8% Y/Y sales decline is only a temporary setback on the company’s growth runway.

That said, addressing quality issues remains a top concern for all stakeholders. It remains to be seen whether the new CEO will reconfirm the company’s $10 billion free cash flow target. The current lack of financial guidance indicates the extreme uncertainty for Boeing's cash flow.

The BDS division continued growing its backlog in Q1 2024, building on progress achieved in 2023. Despite the prevalence of fixed-price contracts in Boeing defense contracts, margins have already moved into positive territory, albeit only in the low single digits.

The services business represented by BGS was the fastest growing, and at the same time, most profitable division of the company in Q1 2024. As the company works through BCA and BDS backlogs, the BGS division is set to continue expanding for the foreseeable future.

According to our estimates, some 54% of Boeing's revenue came from government orders in Q1 2024. In light of the fact that government customers make up such a large portion of Boeing's revenue, monitoring the company’s public procurement activity appears to be a smart move that can provide key insights into its financial health.

To get a free sample of the government contracts awarded to Boeing and other established government suppliers, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy Boeing or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.