It has been well documented that companies maintaining continued success in public procurement, also enjoy more predictability in their cash flow, and are generally more financially stable in insecure times. As discovered in our 'Government Receivables as a Stock Market Signal' white paper, winning government contracts is also likely to have a positive impact on a company’s stock price.

Therefore, we thought it would benefit our readers if we offered them detailed analyses of the financial results these major government contractors achieve.

It is now time for us to look again at a company we covered previously in this series. Lockheed Martin recently reported its Q4 2023 results and below we will provide a brief analysis of the company’s performance recently and the expectations for 2024.

To read our analyses of Lockheed Martin's results in the previous two quarters, please follow the links below:

Part 1: Lockheed Martin: Soft 2023 Expected Before Growth Resumes in 2024

Part 26: Lockheed Martin: Strong Start to 2023 Driven by the Space Segment

Key points:

* Backlog growth consistently outpaced revenue growth in 2023 and 2022, reaching a record $160.6 billion;

* 92.5% of 2023 revenues came from government customers, with the U.S. government accounting for 73% of all sales;

* Revenue down 0.6% Y/Y in Q4 (2023: +2.4%). Sales are set to increase 2.5% in 2024;

* EPS of $27.82/share in 2023, +2.2% Y/Y. 2024 outlook set at $26/share, down 6.5%;

* Company working on several fronts to address supply chain issues.

Lockheed Martin Q4 2023 Results Overview

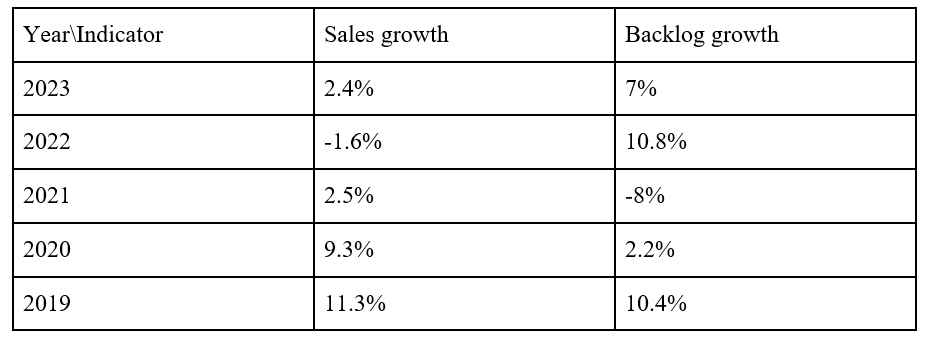

Lockheed Martin reports results in four key segments, namely Aeronautics at 40.3% of Q4 2023 net sales, Missiles and Fire Control at 16.8%, Rotary and Mission Systems at 25% and Space at 17.9% of Q4 2023 net sales:

Figure 1: Sales breakdown between segments

Source: Lockheed Martin Q4 2023 News Release

Operational Overview

Aeronautics saw sales decline by 0.3% Y/Y in Q4 (2023 +1.8%), driven by weakness in the F-35 program. The operating margin of 10% in Q4 was down both Y/Y and relative to the 10.3% full-year average, resulting in a 6.7% drop in operating profit. As usual, the main margin drivers were changes in net favourable profit adjustments.

Missiles and Fire Control was the weakest segment in Q4, with sales dropping 3.5% Y/Y (2023 -0.6%). The decrease was the result of supplier cost timing for air and missile defense programs. The margin picture was equally bleak as the operating profit margin of 12.5% came in below the 13.7% 2023 average, driven by losses on a classified program. All in all, Q4 operating profit was down 13.5% Y/Y.

Rotary and Mission Systems results were more nuanced, with a 1.9% Y/Y drop in Q4 sales (2023 +0.6%) offset by strong margin performance of 12.3% in the last quarter (2023:11.5%). As a result, operating profit was up 2.1% Y/Y in Q4.

Space was the only segment to grow revenues in Q4, with sales increasing 3.5% Y/Y (2023 +9.3%) thanks to growth in strategic and missile defense programs. The operating margin was 9.1% in Q4 (2023: 9.2%), resulting in a 31.2% increase in Q4 operating profit.

On a company level, revenues were down 0.6% Y/Y (2023 +2.4%). Adjusted EPS was $7.90/share in Q4, up 1.4% Y/Y (2023: $27.82/share, +2.2% Y/Y, in line with sales growth). Free cash flow was $1.7 billion in the quarter and $6.2 billion year-to-date (2022 $6.1 billion).

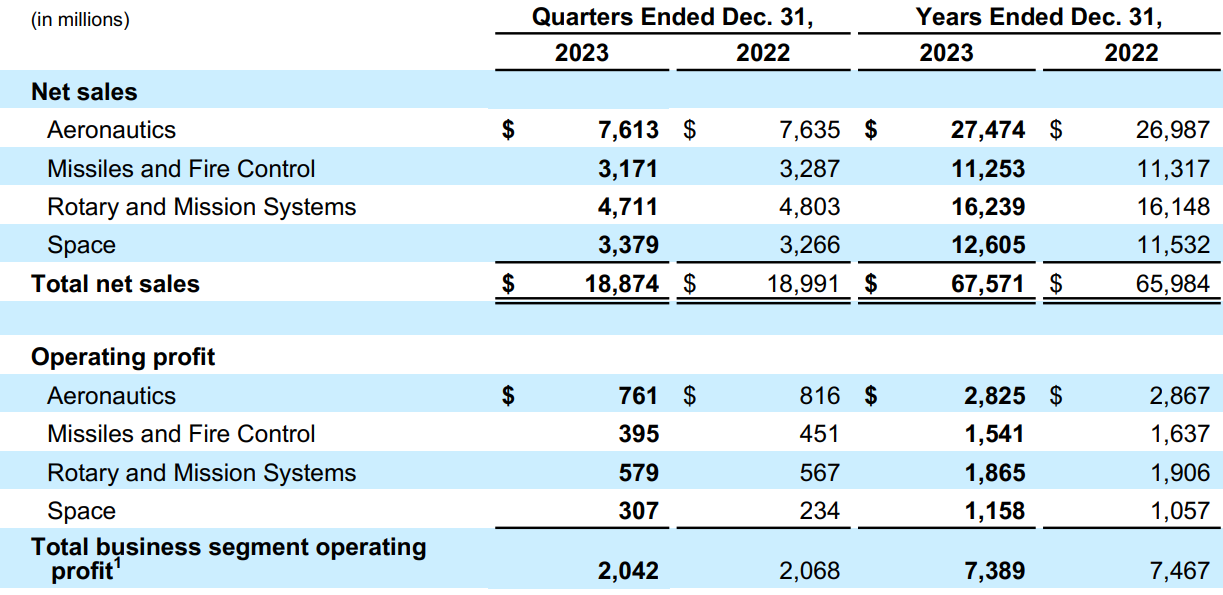

Record Backlog

Lockheed Martin’s backlog continues to hit new records, reaching $160.6 billion at the end of 2023:

Figure 2: Lockheed Martin Backlog

Source: Lockheed Martin Q4 2023 Earnings Release

Backlog growth in 2023 was broad-based across segments:

- Aeronautics +6.2%

- Missiles and Fire Control +12.2%

- Rotary and Mission Systems +7.9%

- Space +2.6%

On an absolute basis, Aeronautics still accounts for the largest share of the backlog, at 37.5%. The book-to-bill ratio was 1.15 in 2023, with the company expecting a book-to-bill above 1.00 in 2024 as well.

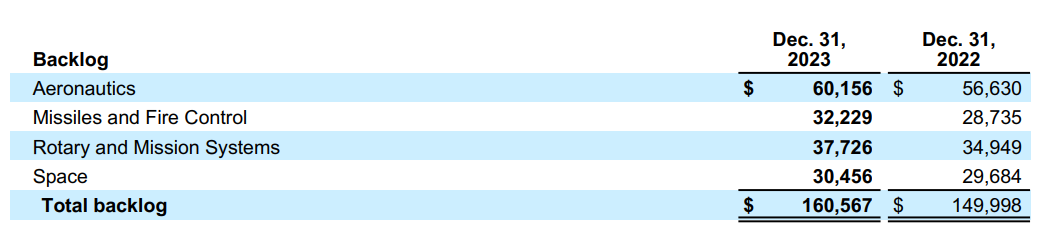

Relative to 2022, the backlog grew 7%, well above the 2.4% increase in sales. In fact, for the past two years, the company’s backlog has consistently outperformed sales growth, setting the stage for a significant uptick in sales:

Figure 3: Lockheed Martin backlog and sales evolution, 2019-2023

Source: Source: Lockheed Martin 2023 Annual report

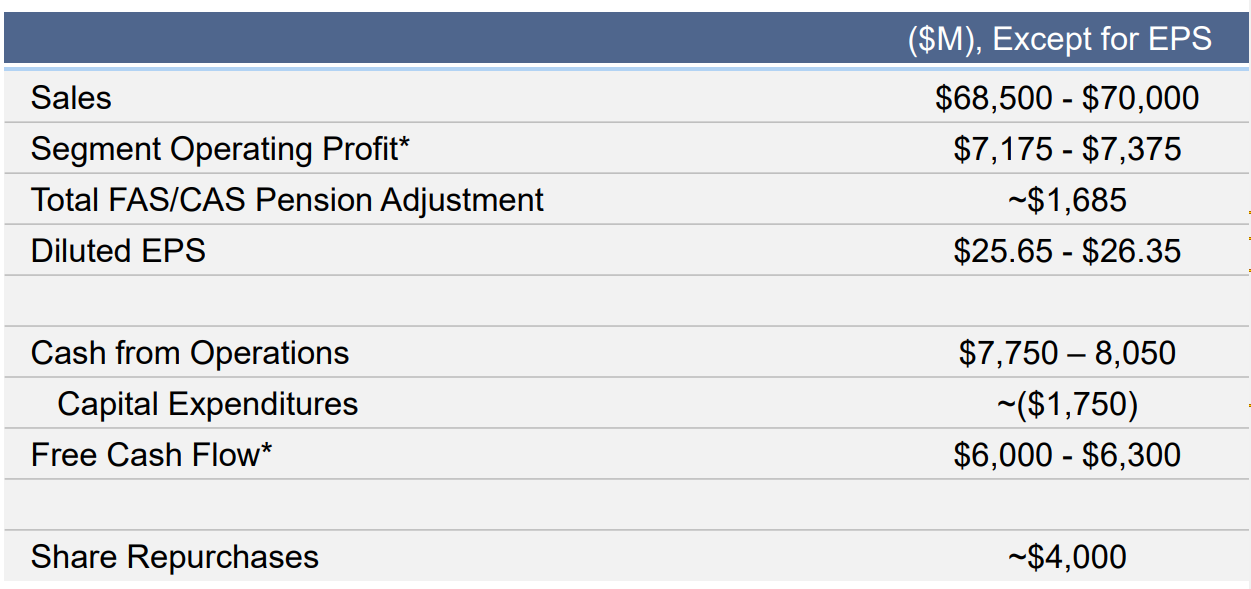

2024 Outlook

Following the weak final quarter of the year, Lockheed Martin expects mixed performance in 2024, as higher sales are offset by lower adjusted EPS and free cash flow:

Figure 4: Lockheed Martin 2024 Outlook

Source: Lockheed Martin Q4 2023 Earnings Presentation

- Sales are set to grow 2.5% in 2024.

- Segment profit is expected to be 1.5% higher (operating profit margin down 0.4% to 10.5%).

- Adjusted EPS is seen 6.5% lower in 2024.

- Free cash flow is forecast to be flat relative to 2023.

- The drop in adjusted EPS is largely the result of higher pension contributions, as well as elevated interest and tax rates.

Government Contracting Exposure

In 2023, government customers accounted for about 92.5% of Lockheed Martin’s revenue, including:

- 73% to the U.S. government

- 19.5% to international governments

International commercial customers made up 6.5% of total sales, while U.S. commercial customers accounted for just 1% of total company revenue.

Supply Chain Woes

Inflation and supply chain problems continue to impact Lockheed Martin’s profitability, particularly in the C-130 Hercules program. To address supply chain challenges, CEO Jim Taiclet highlighted several initiatives of the company during the Q4 conference call:

The steps that we're taking to take the fragility out of the missile production system are varied. One of them is -- and it's very specific, we are endeavoring to stand up a third solid rocket motor supplier in the United States that can be additive to the industry supply chain we have today, which hasn't been performing well, right? That's one piece. More broadly, we're using additive manufacturing, and we're bringing in more varied suppliers into the supply chain so that we can get the materials we need from a more diverse set of suppliers outside of solid rocket motors.

And also, we're looking at international opportunities to build this equipment including in Australia and in Poland, the U.K. and others are kind of on tap for co production or joint ventures with us to do these things, in Germany, I should mention as well. So these are some of the approaches we're taking. And it really comes down to these three areas, which is how can we on one hand take basic steps in antifragility to more suppliers, more diversity on the supply chain, different labour pools, better training, those kinds of things where it's just basic.

Getting deeper insights into Lockheed Martin's supply chain network is now possible through TenderAlpha's Corporate Supply Chain Transactions feed, showcasing the relationships between major government suppliers and their subcontractors and vendors. The feed helps you glimpse into potential supply chain disruptions and what might be the risks and opportunities existing within the supplier network of major government contractors such as Lockheed Martin.

Conclusion

Lockheed Martin experienced an operational slowdown into year-end which is set to continue affecting the company’s bottom line throughout 2024. That said, the company’s swelling backlog will eventually reach its reported sales, boosting profits and operating margins in the process.

Sales are expected to grow 2.5% in 2024, in line with the 2023 run rate, but well below the 10.8% and 7% backlog increase recorded in 2022 and 2023 respectively. We reckon a pickup in sales can be expected with the start of the first TR-3 configured F-35 aircraft, forecast for Q3 2024. The F-35 program is the biggest single program the company is working on, accounting for 26% of total 2023 consolidated sales.

In 2023, government customers accounted for about 92.5% of Lockheed Martin’s total revenue. In light of the fact that government contracts make up such a large portion of Lockheed Martin's revenue, monitoring the company’s public procurement activity appears to be a smart move that can provide key insights into its financial health.

To learn more about the ways in which TenderAlpha can provide you with insightful public procurement data, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy Lockheed Martin or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.