It is now time for the TenderAlpha team to look again at a company we covered previously in the Top Government Contractors series in our blog. Lockheed Martin recently reported its Q2 2024 results and below we will provide a brief analysis of the company’s recent performance.

Key points:

* Lockheed Martin grew Q2 2024 revenues by 8.6% Y/Y but the full-year outlook only envisages a 5% increase;

* The conservative forecast appears well-grounded as the company’s backlog registered a second quarterly decline;

* Operating profit was up 10.1% Y/Y but EPS growth lags at 5.6% Y/Y as the company continues to spend on shareholder remuneration in excess of free cash flow;

* All segments increased sales in Q2 2024 but backlog dynamics point to a weak footing of Aeronautics segment growth;

* The U.S. government accounted for 73.3% of the company’s Q2 2024 revenue.

Lockheed Martin Q2 2024 Results Overview

We previously covered Lockheed Martin's Q1 2024 results in part 60 of our Top Government Contractors series here. Below we will provide an update on how the company performed during the second quarter of 2024.

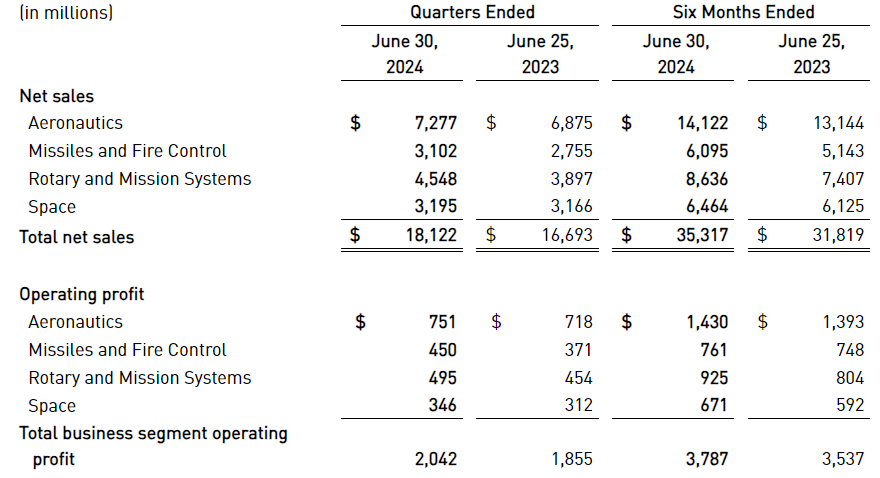

Lockheed Martin reports results in four key segments, namely Aeronautics at 40.2% of Q2 2024 net sales, Missiles and Fire Control at 17.1%, Rotary and Mission Systems at 25.1%, and Space at 17.6% of Q2 2024 net sales:

Figure 1: Sales breakdown between segments

Source: Lockheed Martin Q2 2024 Press Release

Operational Overview

Aeronautics saw sales increase by 5.8% Y/Y in Q2 (2023 +1.8%), driven by increased production volumes in the F-35 & F-16 programs. The operating margin of 10.3% in Q2 was marginally down Y/Y but in line with the 10.3% 2023 full-year average, resulting in a 4.6% higher operating profit. Margins were driven by higher production volumes partially offset by a loss on a classified program.

Missiles and Fire Control was the second-best segment in Q2 as sales grew 12.6% Y/Y (2023 -0.6%). The increase was the result of higher sales in the Guided Multiple Launch Rocket Systems and Long Range Anti-Ship Missile programs. Margin performance was equally robust - the 14.5% operating margin was up both Y/Y and versus the 13.7% 2023 average, driven by volumes, as well as favourable net profit adjustments. All in all, Q1 operating profit was up 21.3% Y/Y.

Rotary and Mission Systems was the best-performing segment in Q2 as revenue soared 16.7% Y/Y (2023 +0.6%) on strength in integrated warfare systems and sensors programs. Margin performance was less robust, at 10.9% in the quarter, weaker Y/Y and relative to the 2023 average of 11.5%. This was due to lower profit booking rate adjustments. As a result, operating profit only grew 9% Y/Y in Q2.

Space was the weakest segment in Q2 as sales only increased by 1% Y/Y (2023 +9.3%) thanks to growth in strategic and missile defense programs. On a brighter note, the operating margin was 10.8% in Q2, up Y/Y and better than the 2023 9.2% average, driven by a favourable mix and higher profit booking rate adjustments. This pushed operating profit 10.9% higher Y/Y.

On a company level, revenues increased 8.6% Y/Y (2023 +2.4%) while operating profit was 10.1% higher in Q2. Adjusted EPS was $7.11/share, up 5.6% Y/Y, impacted by higher interest expenses (2023: $27.82/share, +2.2% Y/Y). Free cash flow was $2.7 billion year-to-date (2023: $6.2 billion).

Increased 2024 Outlook

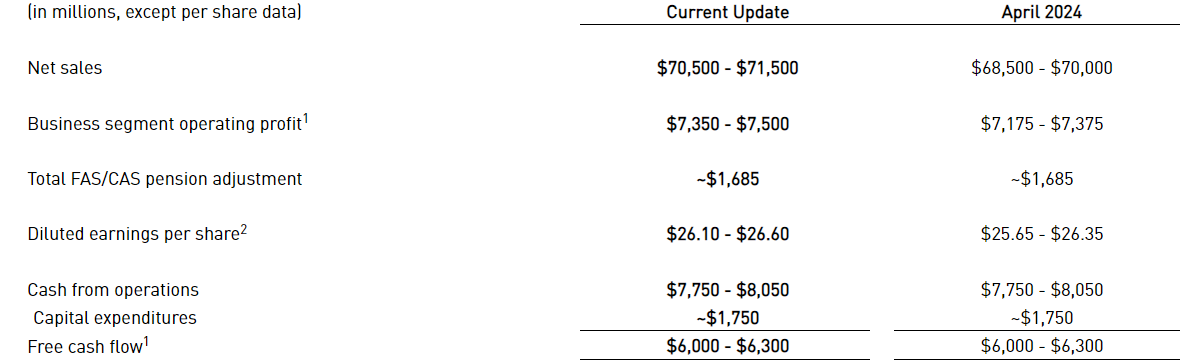

As the strong Q1 performance carried into the second quarter of 2024, Lockheed Martin boosted its sales, operating profit, and Adjusted EPS outlook, but kept its free cash flow outlook unchanged:

Figure 2: Lockheed Martin Updated 2024 Outlook

Source: Lockheed Martin Q2 2024 Earnings Press Release

- Sales are set to grow 5% in 2024.

- Segment profit is expected to be 3.5% higher.

- Adjusted EPS is seen 5.3% lower in 2024.

- Free cash flow is forecast to be flat relative to 2023.

Capital Structure

The company is sticking to its policy of returning over 100% of free cash flow to shareholders, with Q2 2024 shareholder payouts running at about 106% of free cash flow. Nevertheless, net debt accounts for only 12.6% of enterprise value - among the lowest in our Top Government Contractors series.

Declining Backlog

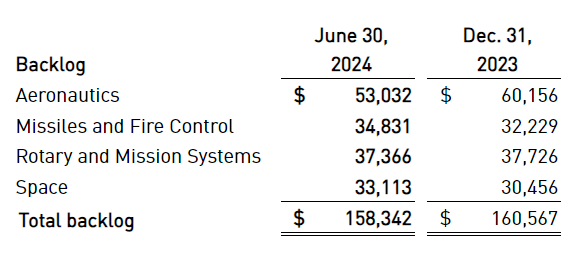

In Q2 2024 Lockheed Martin recorded a book-to-bill ratio of 0.97. As a result, the company’s backlog suffered a second quarterly drop and is now 1.4% lower than the 2023 year-end value:

Figure 3: Lockheed Martin Backlog

Source: Lockheed Martin Q2 2024 Earnings Release

We observe the backlog weakness in concentrated in Aeronautics (-11.8% in H1 2024) and Rotary and Mission Systems (-0.9%), while Missiles and Fire Control and Space segments registered increases of 8.1% and 8.7% respectively.

On an absolute basis, Aeronautics still accounts for the largest share of the backlog, at 33.5%.

The backlog decline observed in H1 2024, coupled with rising sales of about 11% Y/Y over the same period, is in contrast to the trend observed in 2022-2023, and more in line with the 2020-21 period. Nevertheless, on a year-over-year basis, the $158.3 billion H1 2024 backlog is still higher, albeit by only 0.2%:

Figure 4: Lockheed Martin sales and backlog year-over-year evolution, 2019-2024

| Period/Indicator | Sales growth | Backlog growth |

| H1 2024 | 11% | 0.2% |

| 2023 | 2.4% | 7% |

| 2022 | -1.6% | 10.8% |

| 2021 | 2.5% | -8% |

| 2020 | 9.3$% | 2.2% |

| 2019 | 11.3% | 10.4% |

Source: Lockheed Martin Investor Materials

We will continue to monitor Lockheed Martin’s backlog in a bid to evaluate whether the trend set in H1 2024 is due to government awards timing, or rather the result of a structural shift in demand for the company’s products. The former appears to be the case, as the company noted on its conference call that the total backlog should grow in H2 2024.

Government Revenue Exposure

In Q2 2024, the U.S. government accounted for 73.3% of Lockheed Martin’s revenue. No concrete update on foreign military sales was provided with the Q2 2024 results. That said, based on the company’s 2023 annual report, we can conclude that they accounted for about 19.5% of the company’s revenue. As a result, we can conclude that the cumulative government exposure of Lockheed Martin stands at about 92.8% of the company’s revenue.

To view all Lockheed Martin awards since 2010, request a sample of TenderAlpha's government contracts data now.

Conclusion

Lockheed Martin delivered a stellar operational performance in H1 2024, prompting the company to boost its full-year outlook. Even so, the outlook points to more muted growth in the remainder of the year, which is also evident from the declining backlog.

Going forward, growth should be concentrated in the Missiles and Fire Control and Space segments due to their rising backlogs, while the outlook for the Aeronautics segment looks precarious in light of declining orders.

The U.S. government remains the company’s largest customer at 73.3% of its Q2 2024 revenue. With a cumulative government exposure of about 92.8%, Lockheed Martin is one of the most government-dependent companies in our Top Government Contractors series, therefore, monitoring its public procurement activity appears to be a smart move that can provide key insights into its financial health.

To get a free sample of the government contracts awarded to Lockheed Martin and other established government suppliers, get in touch now!

This article was written by members of TenderAlpha's team and does not serve as a recommendation to buy Lockheed Martin or any other stock. TenderAlpha is not receiving compensation for it and we have no business relationship with any company whose stock is mentioned in this article.

Check out our previous analyses of Lockheed Martin's results:

Part 1: Lockheed Martin: Soft 2023 Expected Before Growth Resumes in 2024

Part 26: Lockheed Martin: Strong Start to 2023 Driven by the Space Segment

Part 60: Lockheed Martin: Sales Soar as Backlog Records a Rare Decline